Targeted eviction ban extended through October Delta variant causes CDC to change course

August 9-15, 2021

By Wesley Brown

Despite the U.S. Supreme Court decision that struck down the Centers for Disease Control and Prevention’s (CDC) nationwide eviction moratorium that was prolonged through July 31, the Biden administration changed course and issued a targeted extension through early October.

CDC Director Dr. Rochelle Walensky on Aug. 3 signed an order determining the evictions of tenants for failure to make rent or housing payments could be detrimental to public health control measures to slow the spread of SARS-CoV-2, the virus that causes COVID-19. This order will expire on Oct. 3 and applies to all U.S. counties experiencing substantial and elevated levels of COVID-19 transmission.

Walensky’s order comes a week after President Joe Biden asked all federal agencies to extend their respective bans through the end of September. CDC officials said the new eviction moratorium allows additional time for rent relief to reach renters and further increase vaccination rates.

“The emergence of the Delta variant has led to a rapid acceleration of community transmission in the United States, putting more Americans at increased risk, especially if they are unvaccinated. This moratorium is the right thing to do to keep people in their homes and out of congregate settings where COVID-19 spreads,” Walensky said in a statement. “It is imperative that public health authorities act quickly to mitigate such an increase of evictions, which could increase the likelihood of new spikes in SARS-CoV-2 transmission. Such mass evictions and the attendant public health consequences would be very difficult to reverse.”

Although Congress last week did not respond to Biden’s call to extend the federal moratorium for a sixth time, the Democratic president ordered the U.S. Departments of Housing and Urban Development, Agriculture, and Veterans Affairs to also extend their respective eviction bans through the end of September. That executive order will provide continued protection for households living in federally insured, single-family properties, the White House said.

Biden also urged Arkansas and other states and local governments, which have received billions of dollars in federal Emergency Rental Assistance through the $2.2 trillion American Rescue Plan, to accelerate their efforts to disburse funds before the CDC eviction moratorium ends.

“With some cities and states demonstrating their ability to release these funds efficiently to tenants and landlords in need, there can be no excuse for any state or locality not to promptly deploy the resources that Congress appropriated to meet this critical need of so many Americans,” Biden said.

The Biden administration’s targeted eviction ban is a reversal of an earlier stance last week that a U.S. Supreme Court decision prevented the CDC from extending the policy. On June 29, the U.S. Supreme Court issued a ruling stating that a “clear and specific congressional authorization” through new legislation would be necessary for the CDC to extend the eviction ban any further.

Earlier on March 15, 2021, the U.S. District Court for the Western District of Tennessee, entered a judgment favoring property owners and managers backed by the National Realtors Association who brought a lawsuit against the CDC and the Trump administration’s Department of Justice (DOJ), Health and Human Services (HHS, and Department of Housing and Urban Development (HUD). That ruling was appealed to the high court where it was struck down in a 5-4 ruling where landlords told the justices they were losing over $13 billion in unpaid rent each month because of the moratorium.

Despite the earlier ruling, the U.S. Supreme has refused to halt the CDC moratoriums. President Biden said during a White House briefing on Tuesday that any call for a full moratorium would face legal challenges, but he urged the CDC and other federal agencies to seek other alternatives.

Catastrophic ‘eviction cliff” ahead for millions of past-due tenants, experts say

Meanwhile, recent data from the U.S. Census Household Pulse Survey shows that more than 7.4 million U.S. households were behind on rent ahead of the scheduled expiration of the federal moratorium last month. In a new report, Zillow estimates there will be about 481,630 eviction filings after the moratorium ends, with a projected 261,945 likely to be evicted.

“There is no historical precedent to the current moment, and very little relevant data to precisely map out the path forward. Additionally, because there is a limited historical baseline between (census) data (which only begins at the start of the pandemic) and eviction filings, any forecast must reflect the very uncertain nature of the situation,” said the Seattle-based data analytics group.

As housing experts are predicting a looming “eviction cliff” now that the CDC’s full moratorium has extended, California and some other states are taking steps to protect their own residents. On Monday (Aug. 2), California officials emphasized that the end to the federal eviction protections on July 31 would have no effect on California renters.

Earlier on June 28, Gov. Gavin Newsom signed AB832 into law, which extends California’s critical eviction protections through Sept. 30. The also provided $5.2 billion to help struggling California renters remain housed by covering rent and utilities that date back to April 2020. Housing officials there were also strongly encouraging both tenants and landlords with unpaid rent to apply as soon as possible to the CA COVID-19 Rent Relief program. Under AB 832, the program now covers up to 100% of unpaid or future rent and may also help low-income renters pay part or all their unpaid utility bills, including gas, electric, water and internet services.

In Arkansas, Gov. Asa Hutchinson announced in May that the state Department of Human Service (DHS) distributed $173 million in assistance through the Arkansas Rent Relief Program. Those funds, part of billions allocated through the American Rescue Act, will remain available through the end of this year or until all funds are exhausted. As of Aug. 1, only $3.2 million of those funds have been allocated for rent assistance to 1,171 households across the state as of Aug. 1, according to DHS spokesperson Amy Webb.

“We still have time to allocate them,” Webb said of the remaining $169 million in rental assistance funds still available.

To qualify, a renter must be a resident of Arkansas and a U.S. citizen or legal resident with a current residential lease or rental agreement. Renters also must meet one of these three criteria to qualify for aid, including someone in their home qualifies for unemployment benefits; their household income decreased because of the pandemic; or someone in their home has incurred significant financial hardship because of the pandemic. In addition, the renter’s income must qualify for assistance under federal poverty rules.

Under the program, payments will go to landlords, but a tenant and a landlord each must apply. The payments will cover 15 months of rent and utilities not paid from April 1, 2020, through Dec. 31. Residents of Pulaski, Benton and Washington counties, the state’s largest metropolitan service areas, must apply through their local county government.

Walker Hawkins, staff attorney with the Center for Arkansas Legal Services (CALS), said despite the CDC moratorium on July 31 some evictions have still moved forward during the pandemic. In many cases, he said, Arkansas judges have forestalled evictions until the end of the moratorium.

“Right now, you have a lot of these cases that may have been filed --- six, eight, ten or even 12 months ago that have been just kind of sitting there, and the tenants are more or less staying in those properties,” said Hawkins. “Some of them have tried to move, but in the financial situation that a lot of them are in after having been laid off, having their hours cut, or even contracting the coronavirus and having medical complications from that … (they) have been just staying at the property.

“And now I feel like what we are going to see is these judges are going to come back to these cases and say, ‘I told you six months ago and times up now.’ And that is really the kind of thing that we are worried about,” Hawkins continued. “We are not just worried about the new (eviction) cases that are inevitably going to be filed, but all these cases that have been sitting there over the last year. And that is going to contribute to this cascade of evictions.”

Hawkins added that Arkansas is not the only state to see American Rescue Act rental assistance funds go unused. He said nationally only six percent of the $25 billion set aside for emergency COVID-19 rental relief has been distributed to landlords and low-income tenants at risk of eviction and homelessness.

“I think 94% of the funds allocated for this are just sitting there, and I think part of the problem is that this is something that our political infrastructure has to deal with on a regular basis. And I think it has just caused an overload of the system,” said Hawkins. “I think the people over at DHS are working as fast as they can to process these applications, but what has happened is that there are so many (applications) that are coming in that they can’t process them quick enough.”

The staff attorney for the nonprofit law firm founded in 1965 that provides free civil legal services to low-income Arkansans said the current DHS backlog for federal COVID-19 rental assistance goes back as far as early June. Hawkins also said some landlords are hesitant to accept government aid and were awaiting the expiration of CDC moratorium to move forward with evictions.

“Another problem is the hesitancy of some landlords to accept rental assistance. A lot of them would just like to get the property back as soon as possible,” he said. “At the end of the day, it is a two-way street for that money to be distributed. It requires the landlord’s participation as well and if they want the people out, that is their prerogative, and they have the right to feel that way.”

Besides renters, those who have fallen behind at least three months on their mortgage increased 250% to over two million households in 2020 and is now at a level not seen since the height of the Great Recession in 2010, according to an April report by the federal Consumer Financial Protection Bureau. Collectively, these households owe nearly $90 billion in deferred principal, interest, taxes and insurance payments, the report said.

Following President Biden’s recent announcement, the FHA has also extended its moratorium on evictions for foreclosed borrowers and their occupants through September 30. Under federal housing protection, FHA and HUD will provide continued protection for households living in federally insured, single-family properties.

“We must continue to do everything within our authority to make sure that foreclosed borrowers who are impacted by the pandemic have the time and resources to secure safe and stable housing, whether it’s in their current homes, or by obtaining alternative housing options,” said Lopa Kolluri, FHA’s deputy Assistant Secretary for Housing. “We don’t want to see any individuals or families displaced unnecessarily while trying to recover from the pandemic.”

U.S. foreclosures create huge loan delinquency backlog

Under the FHA extension, mortgage servicers must continue to halt evictions for FHA Single Family Title II forward and Home Equity Conversion Mortgage (HECM) foreclosed properties, except for those that are vacant or abandoned. Mortgage servicers, however, may initiate or continue foreclosures in accordance with FHA requirements under the July 31 moratorium, but may not yet evict a foreclosed borrower or other occupant.

According to Irvine, Calif.-based RealtyTrac’s midyear U.S. Foreclosure Market Report, there are a total of 65,082 U.S. properties with foreclosure filings — default notices, scheduled auctions or bank repossessions — in the first six months of 2021. That figure is down 61% from the same period a year ago and down 78% from two years ago.

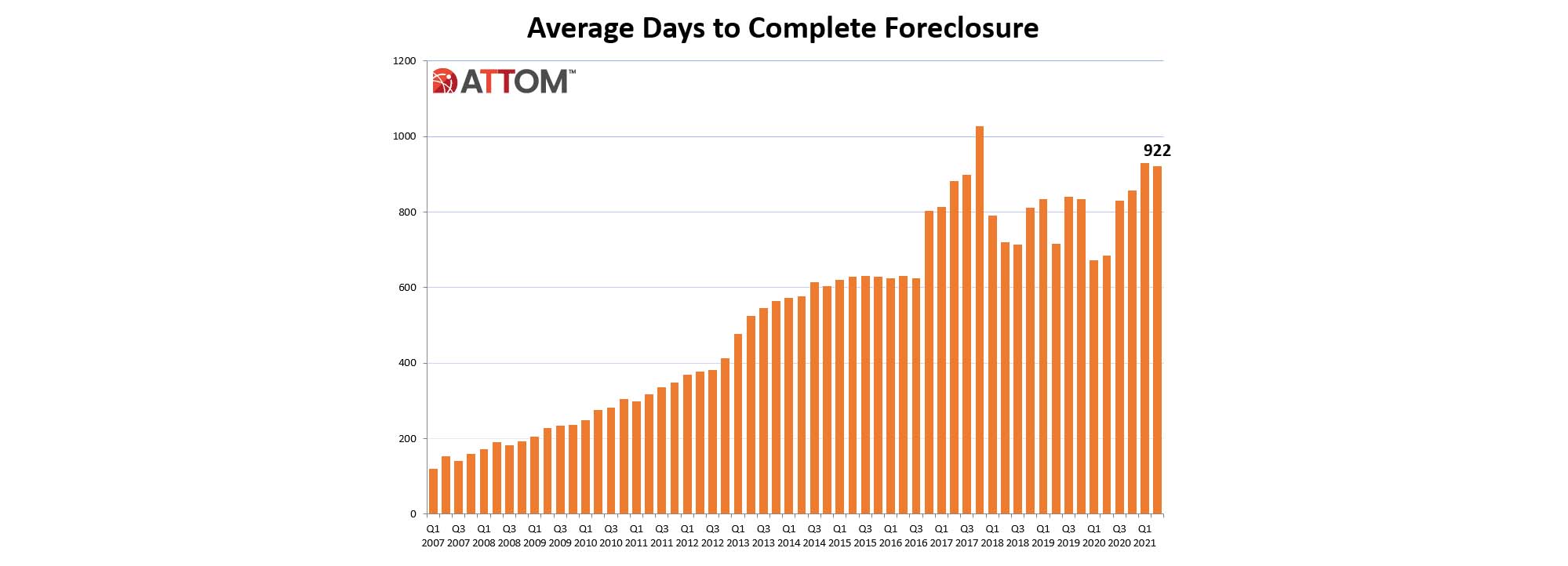

“The government’s foreclosure moratorium and mortgage forbearance program have created an unprecedented situation - historically high numbers of seriously delinquent loans and historically low levels of foreclosure activity,” said Rick Sharga, executive Vice President of RealtyTrac. “With the moratorium scheduled to end on July 31, and half of the remaining borrowers in forbearance scheduled to exit that program over the next six months, we should start to get a more accurate read on the level of financial distress the pandemic has caused for homeowners across the country.”

RealtyTrac’s data show states with the longest average foreclosure timelines in the second quarter of 2021 were Hawaii (3,068 days), New York (1,822 days), Indiana (1,617 days), Wisconsin (1,587 days), and New Jersey (1,471 days). States with the shortest average foreclosure timelines included Wyoming (173 days), Arkansas (253 days), Tennessee (270 days), Virginia (280 days), and Mississippi (292 days).

PHOTO CAPTIONS: (Photos by The Daily Record Staff)

Little Rock rental market is seeing construction boom despite COVID-19 complications and eviction bans. The Heights at Shackleford and the Bowman Pointe mixed-use developments under construction in West Little Rock. For the sixth time since the COVID-19 pandemic began in March 2020, the U.S. Centers for Disease and Control has extended the federal eviction moratorium to aid working-class renters.