BANKING HEADWINDS

June 13-19, 2022

By Wesley Brown

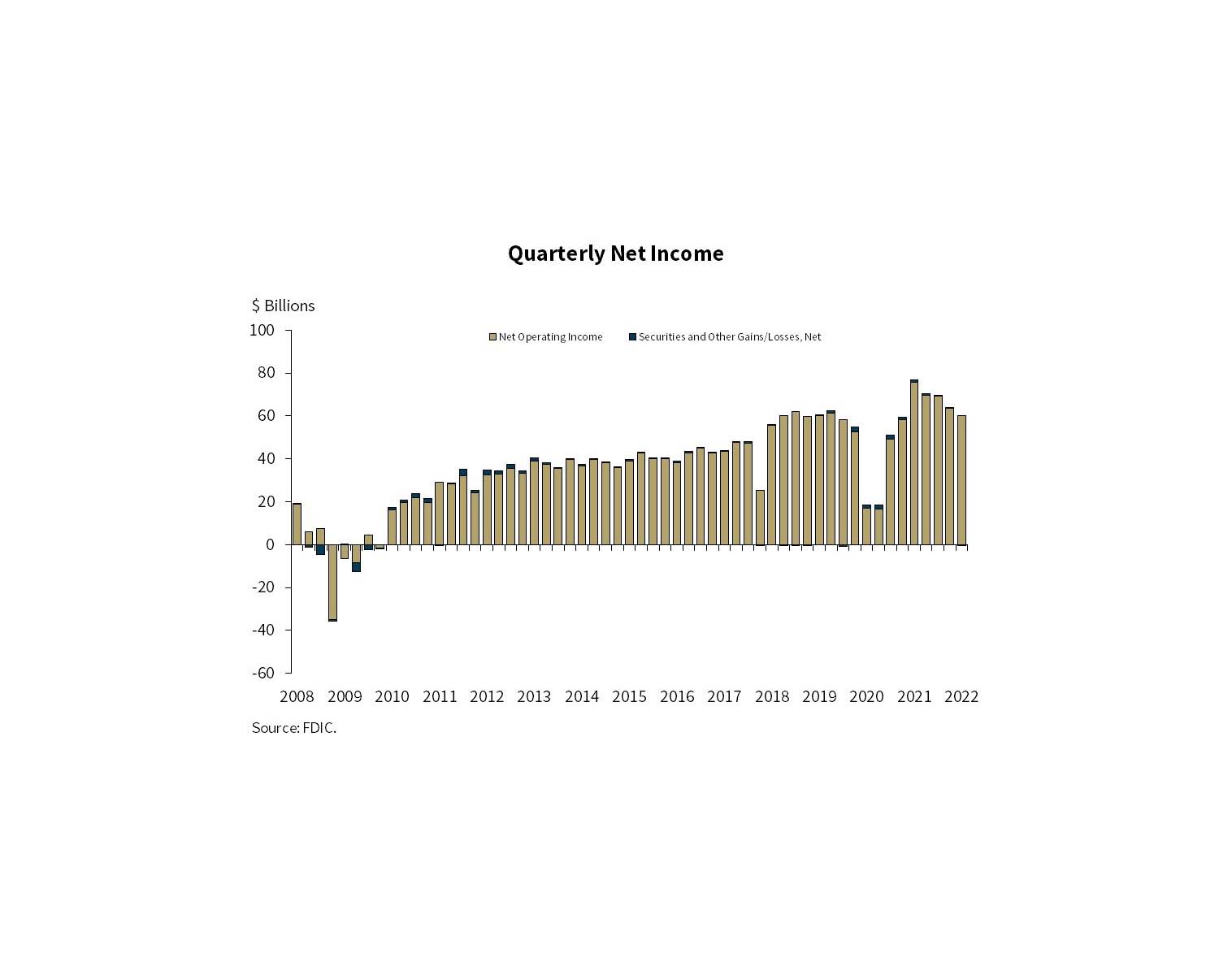

Rising inflation and interest rates, along with the continued effects of the pandemic and global instability, resulted in 63% of U.S. banks reporting a year-over-year decline in quarterly net income, according to the highly watched first quarter banking profile from the U.S. Federal Deposit Insurance Corporation (FDIC).

First-quarter reports from 4,796 commercial banks and savings institutions insured by the FDIC, including 84 Arkansas financial groups, reflect aggregate net income of $59.7 billion in the first quarter of 2022, a decline of $17 billion or 22.2% from a year ago. An increase in provision expense drove the annual reduction in net income, FDIC officials said of the dire financial results for the first quarter of 2022 included in the FDIC’s latest Quarterly Banking Profile released on May 24.

Quarterly net income totaled $59.7 billion, the key metric for banking profitability, saw a decline of $17 billion or 22.2% from the same quarter a year ago, primarily due to an increase in provision expense. Provision expenses increased $19.7 billion from the year-ago quarter, from negative $14.5 billion during the same period a year ago to positive $5.2 billion this quarter. A majority of banks, 62.8% of the 4,796 institutions, reported an annual decline in quarterly net income. The increase in provision expense also drove a decline of $4.1 billion (6.5%) in quarterly net income.

“The banking industry reported a decline in net income driven by an increase in provision expense. Capital and liquidity levels remain strong. In addition, loan growth and credit quality metrics remain generally favorable,” said FDIC Acting Chairman Martin Gruenberg. “Looking forward, inflationary pressures, rising interest rates, and continued pandemic and geopolitical uncertainty will likely be headwinds for bank profitability, credit quality, and loan growth.”

In other key metrics, the banking industry reported an aggregate return on average assets (ROAA) ratio of 1%, down 38 basis points (bps) from the ROAA ratio reported in the first quarter of 2021 and down 9 bps from the ROAA ratio reported in fourth quarter 2021.

The net interest margin (NIM) declined by one basis point from the prior quarter to 2.54%. NIM was 4 bps higher than the record low set in the second quarter of 2021 but 2 bps lower than the level reported in the year-ago quarter. While more than half of banks (57.2%) reported higher net interest income compared with a year ago, NIM expansion was limited by earning asset growth, which continued to outpace net interest income growth.

The yield on earning assets declined to 2.7%, or down 1 bps from a quarter ago and down 7 bps from a year ago, as the growth rate in average earning assets continued to outpace the growth rate in interest income. Average funding costs were unchanged over the quarter at the record low set in the fourth quarter of 2021 of 0.16% but were down 4 bps from the year-ago quarter.

Community banks, which have assets of $10 billion or less and reflect the economic sentiment on Main Street, reported a decline in net income of $1.1 billion from the year-ago quarter, driven by a weakening in revenue from loan sales. An increase in interest income on securities ($655.5 million, or 34.2%) and a decline in interest expense ($630.3 million, or 28.9%) drove a slight improvement in net interest income ($792.7 million, or 4.2%) from the year-ago quarter.

However, net interest income declined slightly ($225.9 million, or 1.1%) from the fourth quarter of 2021. Provision expenses declined by $129.7 million, or 31% from a year ago and $64.4 million, or 18.3% from the previous three-month period. Most of the 4,353 FDIC-insured community banks, or 63.2% of all U.S. banks, reported lower quarterly net income compared with the year-ago quarter. The net interest margin for community banks also narrowed 15 bps from the year-ago quarter to 3.11% as growth in earning assets outpaced growth in net interest income.

Arkansas “Big Four” hold serve

In Arkansas, the state’s gaggle of community and regional banks and savings institutions together posted net income of $458 million for the three-month period ended Sept. 30, down 23.8% from $567 million a year ago. The dip in year-over-year profits corresponds with the national decline in earnings before the Federal Reserve’s Open Market Commission (FOMC) boosted the federal fund’s interest rate that banks pay to each other twice in 2022.

The first rate hike came in March when the FOMC agreed to a 25 bps rate increase — its first increase since late 2018 since former President Donald Trump was in office. Earlier this month, the influential Fed panel quietly raised the nation’s target interest by 50 bps to the range of 0.75% to 1% in a failed effort to quell runaway inflation. The last time the Federal Reserve raised interest rates at back-to-back meetings was in 2006.

As of March 31, Bank OZK, along with Arkansas’ other Big Four regional banks, hold more than 65% or $81.1 billion of the state’s total banking assets. The other three banks with assets topping federal banking regulator’s $10 billion threshold between community and regional banks include privately held Arvest Bank of Bentonville, Pine Bluff-based Simmons First National, and Home Bancshares of Conway.

The state’s largest bank by assets at the end of 2021, Bank OZK, reported a first-quarter profit of $128 million, a 13.7% decrease from $148.4 million for the first quarter of 2021. During the three-month period that ended March 31, the Little Rock-based banking group reported that total deposits fell by 4.5% from $21.3 billion and total assets declined by 2.6% to $27.2 billion.

Bank OZK also sold off its banking location in Magnolia in south Arkansas and several local branches in South Carolina, posting quarterly asset sales of $6.2 million. Headquartered at its new office complex in west Little Rock, Bank OZK has over 240 offices in eight states including Arkansas, Georgia, Florida, North Carolina, Texas, California, New York and Mississippi.

“We are pleased to report our excellent results for the first quarter of 2022. Our results were highlighted by our second consecutive quarter of record RESG loan originations, reflecting the importance of organic growth in our long-term strategy,” said longtime Bank OZK Chairman and CEO George Gleason. “Our strong capital and liquidity, disciplined credit culture and outstanding team have us well positioned for the future.”

Bank OZK’s three other regional banking rivals in Arkansas, including privately-held Arvest Bank which does not release its quarterly financial statements publicly, also saw a decline in earnings from a year ago. According to Arvest’s own internal communications, the Bentonville-based bank founded and entirely owned by the Walmart family has assets exceeding $26 billion with operations in more than 110 communities across Arkansas, Kansas, Missouri and Oklahoma.

Simmons First, which is seeking to eclipse Bank OZK and Arvest as the state’s largest bank by assets, reported net income of $65.1 million for the first quarter of 2022, down 3.4% compared to $67.4 million in the first quarter of 2021. Simmons also completed the acquisition of Spirit of Texas Bancshares Inc. in Conroe, Texas, on April 8 in a cash-and-stock deal valued at $581 million.

That deal pushed Simmons’ total assets value to $28 billion at the end of the first quarter, leapfrogging the Pine Bluff bank just ahead of Bank OZK and Arvest. Still, following the first-quarter earnings report, Simmons’ Chairman and CEO George Makris noted possible challenges ahead for the fast-growing Pine Bluff regional bank group with more than 200 bank locations in Arkansas, Missouri, Tennessee, Texas, and Oklahoma and Kansas.

“Simmons posted solid results in the quarter driven by accelerating loan demand across our footprint and continued growth of low-cost deposits. We also delivered another quarter of exceptional credit performance, with nonperforming assets dropping to historically low levels,” said Makris. “While we are encouraged by our results to start the year, we also recognize the challenges ahead given expectations that interest rates are most likely to increase further during the remainder of 2022, the impact elevated inflation levels have on the cost of everyday goods and services, and the global unrest that adds uncertainty to the financial markets and potentially future economic growth.”

Conway-based Home Bancshares (HOMB), which operates mainly through its Centennial Bank subsidiary, also reported a first-quarter earnings decline of $64.9 million, down 29.1% compared to $91.6 million in the first quarter of 2021.

“The first quarter brought about record-high wholesale prices, rising interest rates, future recession fears and global unrest, thus creating one of the most volatile quarters on record during my business career,” said Home Bancshares Chairman John Allison. “During this time, HOMB has stayed true to our discipline and still delivered solid performance during the quarter. We like how we have positioned ourselves in the market with over $3.5 billion in excess cash, and with rising interest rates, it seems as though we have played the chess game very well so far.

“We believe the Fed will be forced to continue raising rates at a faster pace in the near term. As a result, we could be poised to start deploying some of the cash in the remainder of the year,” stated Allison.

Like Simmons, Home Bancshares recently completed an acquisition in Texas that increased the Conway regional banking group’s breadth and size. In September 2021, Home Bancshares acquired Happy State Bank in Amarillo for more than $900 million. The publicly traded Arkansas bank currently has 76 branches in Arkansas, 78 branches in Florida, 62 branches in Texas, 5 branches in Alabama, and one branch in New York City. At the end of the first quarter, the Centennial branded Arkansas bank had assets of more than $18 billion.

Altogether, Arkansas banks and savings institutions have total assets of nearly $146.6 billion, a 5.3% gain from $139.3 billion a year ago, FDIC data shows. The 73 Arkansas larger community banks with assets of more than $100 million held the lion’s share of those third-quarter profits at $456 billion compared to only $2 million for the 11 smaller local banks below the $100 million asset threshold.

In other key metrics, deposits at Arkansas banks were well ahead of the total amount of loans and leases. Loans held at the end of the quarter totaled $85.5 billion, up slightly from $84.6 million a year ago. Total deposits rose 7% to $121.5 billion in the three-month period amid higher consumer savings rates and individuals, families, and businesses.

Like most industries seeking desperately to find new workers, Arkansas banks are posting hiring signs across the state but closing underperforming branches as consumers depend more on virtual and online banks. Altogether, there were 23,929 full-time employees on payroll at Arkansas banks at the end of the first quarter, up 401 from the previous year.

Nationally, the FDIC’s Deposit Insurance Fund (DIF) balance was $123 billion as of March 31, down approximately $100 million from the end of the fourth quarter. The increase in unrealized losses on available-for-sale securities in the DIF portfolio, driven by the rising rate environment, was the primary reason for the decline, officials said.

During the first quarter, 44 institutions merged, and no banks failed in the first quarter of 2022, the FDIC stated. During the Great Recession in 2008, more than 400 U.S. community banks were acquired, failed or went bankrupt.

Photo Captions:

1. Arkansas banks see yearly profit decline amid rising interest rates, inflation and loan losses.

2. Most of the 4,353 FDIC-insured community banks (63.2 percent) reported lower quarterly net income compared with the year-ago quarter. The FDIC's Deposit Insurance Fund (DIF) balance was $123 billion in the first quarter, down approximately $100 million from the previous three-month period

3. Simmons First, which is seeking to eclipse Bank OZK and Arvest as Arkansas' largest bank by assets, reported net income of $65.1 million for the first quarter of 2022. (top photo)

4. In the first quarter of 2022, net income for the 4,796 commercial banks and savings institutions FDIC-insured declined 22% from the year-ago quarter as the banking industry raised provision expenses to reflect loan growth as well as economic and geopolitical uncertainty. (bottom photo)