Bubble Trouble Fight brewing over nation’s student loan debt of $1.6 trillion

May 30 - June 5, 2022

As the nation’s student loan bubble nears $1.6 trillion, a big fight is brewing over whether the federal government should be responsible for paying overpriced, interest-laden educational debt.

On April 6, President Joe Biden and Vice President Kamala announced at the White House that the administration was extending federal student loan relief through Aug. 31, marking the sixth extension during the pandemic. That debt relief that started at the beginning of the pandemic in March 2020 includes the suspension of student loan payments, a waiver of interest, and the stopping of collections activity on defaulted loans. The suspension of student loan payments was expected to help 41 million borrowers save an estimated $5 billion per month.

In speaking about the extension, Harris shared a personal anecdote on how her own student loan debt affected her as a former student and the attorney general of the largest state in the union.

“This is personal for me. I had student loans. Each month, I would sit at the kitchen table, fill out paperwork, and send a check to pay down my balance,” Harris said. “Later, as California Attorney General, I took on predatory for-profit colleges and won $1 billion for defrauded veterans and students. President Biden and I understand that student loan debt adds stress for borrowers and their families.”

Harris continued: “We have made strong progress as a country in the face of a global pandemic and an economic downturn, but there is still work to do. [This] announcement will make a meaningful difference as we continue moving forward,” said Harris.

In making the case for the sixth student loan extension, including two under former President Donald Trump, Biden said the additional five months were needed as the nation continues to recover from the pandemic and the unprecedented economic disruption it caused. According to some calculations, the repayment extension has canceled more than $90 billion in interest payments over the past two years.

“If loan payments were to resume on schedule in May, analysis of recent data from the Federal Reserve suggests that millions of student loan borrowers would face significant economic hardship, and delinquencies and defaults could threaten Americans’ financial stability,” said Biden.

“Accordingly, to enable Americans to continue to get back on their feet after two of the hardest years this nation has ever faced, my Administration is extending the pause on federal student loan repayments through Aug. 13,” the Democratic president continued. “That additional time will assist borrowers in achieving greater financial security and support the Department of Education’s efforts to continue improving student loan programs. As part of this transition, the Department of Education will offer additional flexibilities and support for all borrowers.”

In the days after his April 6 announcement, Biden has hinted he may go one step further and seek legislation to cancel student loan debt altogether for some borrowers. However, the White House has not offered any policy details, leaving Republicans, financial institutions, and the debt collection lobby to seek to block new legislation.

In the U.S. Senate, former 2012 GOP presidential candidate, Sen. Mitt Romney, R-Utah, and several other Republican senators introduced the Student Loan Accountability Act on May 18. Romney said his bill would halt the Biden administration’s effort to cancel student loan debt at the expense of millions of Americans who chose not to go to college or worked diligently to pay off any student debt.

“It makes no sense for the Biden Administration to cancel nearly $2 trillion in student loan debt. This decision would not only be unfair to those who already repaid their loans or decided to pursue alternative education paths, but it would be wildly inflationary at a time of already historic inflation,” Romney said. “Democrats and Republicans alike have called on the President to not take this unwise step and pile more onto our $30 trillion national debt. And while the President’s legal authority in forgiving this debt is dubious at best, our bill would ensure that he would be prevented from taking action.”

On May 10, the Federal Reserve Bank of New York’s Center for Microeconomic Data issued its Quarterly Report on Household Debt and Credit. The first quarter report shows a solid increase in total household debt in the first quarter of 2022, increasing by $266 billion, or 1.7% to a whopping $15.84 trillion. Total balances now stand $1.7 trillion higher than at the end of 2019, months before the COVID-19 pandemic began.

Of that total U.S. household debt, the nation’s student loan bubble stood at $1.59 trillion in the first quarter, a $14 billion increase from the fourth quarter of 2021. According to the influential New York Fed, about 5% of aggregate student debt was 90 days delinquent or in default in the first quarter, which amounts to nearly $80 billion. The lower level of student debt delinquency reflects a Department of Education decision to report the current status on loans eligible for CARES Act forbearances, the report said.

Due to rising inflation and rising household expenses across the board, Americans are racking up more debt on everything they do not pay off in cash. In other areas, the highly watched quarterlyFed reports show mortgage balances rose by $250 billion in the first quarter of 2022 and stood at $11.18 trillion at the end of March.

In line with seasonal trends typically seen at the start of the year, credit card balances declined by $15 billion. Credit card balances are still $71 billion higher than a year ago and represent a substantial year-over-year increase. Auto loan balances increased by $11 billion in the first quarter, while total, non-housing balances grew by $17 billion.

“The first quarter of 2022 saw an increase in mortgage and auto loan balances coupled with a typical seasonal decrease in credit card balances,” said Andrew Haughwout, director of the Household and Public Policy Research division at the New York Fed. “However, mortgage originations declined from the historically high volumes seen in 2021, reflecting an unwinding in the demand for refinances.”

In another New Fed report on April 21, central bank economists raised the question of how the discontinuation of student debt relief might affect U.S. households, although the Biden administration has not been quiet about details.

In the report, Rajashri Chakrabarti, a senior economist in the New York Fed’s Research and Statistics Group, noted that the scheduled discontinuation of student debt forbearance on Aug. 31 will likely increase financial hardship and delinquency rates.

In Chakrabarti’s calculations, she said borrowers currently availing themselves of student debt forbearance will have a 16% chance of delinquency once the extension is discontinued. Assuming a zero-delinquency rate among those not currently receiving student debt relief, overall borrower delinquency would fall to 10%, which is two-thirds of the pre-pandemic student loan delinquency rate of 15.6% of borrowers.

“Our 10% estimate is clearly a lower bound as we have assumed that those that are not currently in forbearance have a zero percent expected delinquency rate, thus implying that we cannot rule out that the delinquency rate at relief withdrawal could reach or even surpass the pre-pandemic rate,” she said.

“We also find that this hardship in repayments will not affect all borrowers evenly. Rather, we find that lower-income, less educated, non-white, female and middle-aged borrowers will struggle more in making minimum payments and in remaining current,” warned Chakrabarti.

The senior Fed economist added that borrowers who do not have an income-driven repayment (IDR) plan to pay off their student loan debt are expected to be relatively worse off, likely because such plans allow payments to be more manageable amid income fluctuations.

“Finally, our analysis suggests likely consequences for repayment of debts other than student loans, with student loan borrowers reporting high average risks of delinquency on other debts even while their student loan payments were paused,” Chakrabarti concluded.

Arkansas' student loan debt decline

According to Federal Reserve datasets, the average student debt balance among borrowers across the U.S. is $36,200. In Arkansas, there are 373,900 student loan borrowers with an average debt of $32,400 at the end of 2021, up $100 from the previous year. There were 369,700 Arkansans with student loan debt at the end of 2019 before the pandemic began with an average balance owed of $30,900.

Because of President Biden and Trump’s extension of the federal forbearance program, the delinquency rate nationally and in Arkansas has declined during the COVID-19 health crisis. At the end of 2019, the delinquency rate in Arkansas was 17%. It fell to 12% during the height of the virus spread in 2020 and has since declined to only 9% at the end of 2021. The national delinquency rate is now at only 8%, down pre-COVID-19 levels of 15%.

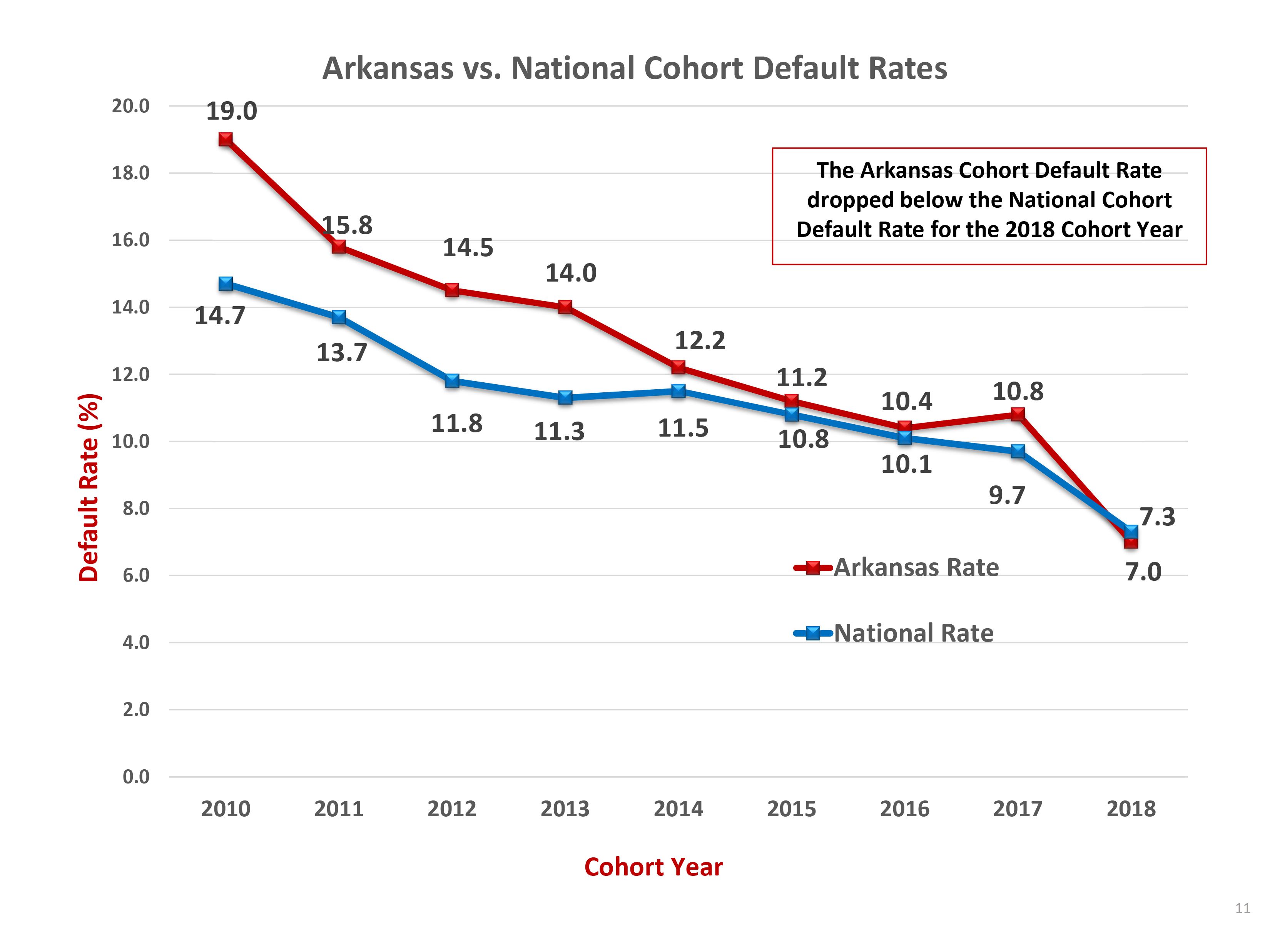

According to Arkansas Student Loan Authority (ASLA) Executive Director Tony Williams, the federal student loan default rate for Arkansas has declined from a level of 19% nearly a decade ago in 2013 to only 7% in 2019 2020, a decline of 63.2%. The national average for federal student loan defaults is 7.3%.

Williams said for the first time since we began tracking default rates, Arkansas’ rate is below the national average. The U.S. Department of Education (USDE) stopped publishing the rates for every state after the 2016 cohort year that was released in 2019 before the pandemic began.

Under USDE rules, a student loan is delinquent if any payments are past due. Delinquent loans may result in additional fees and damage to the borrower’s credit. If the borrower does not get up to date on their payments, the student loan eventually is placed in default. Once in default, the unpaid balance and interest are due immediately, and the borrower is subject to a host of negative consequences.

In the past, Williams said the ASLA’s general advice was similar to advice on any other debt, “pay it off as quickly as possible.”

“Today, our advice depends on each borrower’s specific situation and the type of loans they have,” said Williams. “This is my advice in very general terms; if you have Federal Direct Loans, wait and see if the President and Congress grant forgiveness. And while you wait, save the money you would have used for monthly payments in case loan forgiveness doesn’t occur or only partial forgiveness occurs.

If you have a Federal Family Education Loan (FFEL), Williams said to consider an IDR to make payments while waiting to see if loan forgiveness occurs. For students with private loans with interest rates higher than 7, they can contact ASLA about refinancing options, he said.

Besides extending the federal Department of Education forbearance program, Congress has allotted over $76.3 billion in COVID-19 emergency relief funds to U.S. higher education institutions since the pandemic began. The $2.2 trillion CARES Act signed into law by President Trump on March 11, 2002, created the Higher Education Emergency Relief Fund (HEERF) and provided $14 billion nationally for universities and colleges in all 50 States.

At the end of 2020, Trump also signed the federal Coronavirus Response and Relief Supplemental Appropriations Act (CRRSAA) in December 2020, providing an additional $22.7 billion nationally for HEERF funds.

The $2.2 trillion American Rescue Act plan provides $39.6 billion nationally for HEERF — slightly more than the amounts provided in the first two rounds combined. It was signed into law in March 2021. Arkansas received over $406 million for 76 colleges and universities including $116 million for community colleges from the Biden administration.

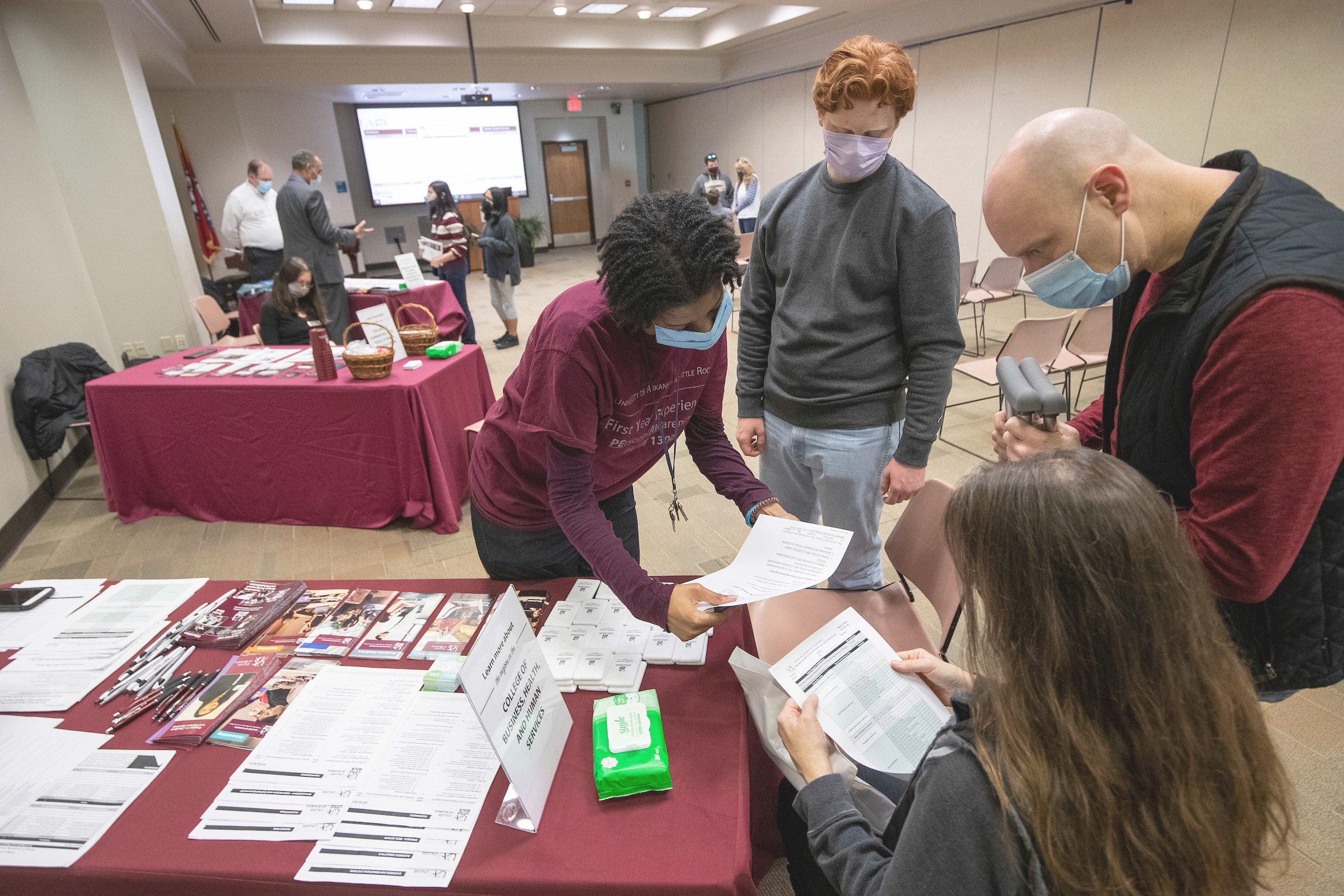

Some colleges in Arkansas and across the U.S. that received those COVID-19 emergency funds developed programs to assist students with tuition and other costs. For example, UA Little Rock received approximately $10 million in federal funds for students through ARP. In the fall, a portion of those federal dollars were used to provide direct relief for students, while the second tranche provided emergency grants for students in need.

According to UA Little Rock officials, undergraduate students received direct aid through a formula-based approach. Full-time students were expected to receive between $420 and $720 through the university’s own metrics.

Under the CARES Act funding, Arkansas Baptist College in Little Rock also used $831,020 in HEERF and other targeted funding for Historically Black Colleges and Universities (HBCUs) to offer cash grants to students most in need of financial relief during the pandemic. Grants were awarded according to the availability of funds and documentation of financial impact. ABC officials estimated that 287 students received on average about $1,350 due to the disruption of campus operations caused by the pandemic.

In October 2020, Arkansas Baptist College said it had processed funds for reimbursement to students for tuition, housing, room and board from the USDE Institutional and Student fund in the amount of $387,480 in emergency financial aid grants to students and $250,632 in reimbursements. Other USDE funds were allocated for computer supplies and software for distance learning in the amount of $109,348, and $832,450 from the HBCU grant portion to provide additional emergency financial aid grants to students.

Photo Captions:

1. After extending student loan forbearance for sixth time during pandemic, President Joe Biden is considering a plan to wipe out nation’s higher education debt.

2. UA Little Rock students prepare for fall enrollment amid the pandemic. (Photos by page 12 and 13 by Ben Krain.)

3. According to Arkansas Student Loan Authority (ASLA), the federal student loan default rate for Arkansas has declined from a level of 19% nearly a decade ago in 2013 to only 7% in 2021, a decline of 63.2%.

4. Through the end of 2021, Arkansas colleges and universities had a total student loan volume of $570 million, down --- from $619 million in 2020, according to ASLA data.

5. Tony Williams, director of the Arkansas Student Loan Authority.