BUDGET BUSTER: INFLATION WEIGHS ON FAMILY SPENDING

August 8-14, 2022

By Wesley Brown

As Arkansas kicks off its back-to-school shopping season, retailers are hoping that rising inflation does not hurt one of their busiest and most profitable periods.

Heading into Arkansas’ annual sales tax holiday on Aug. 6-7, the state director for the Arkansas chapter of the National Federation of Independent Business (NFIB) said he hopes consumers would continue to support small businesses rocked by the series of economic setbacks that began with the COVID-19 pandemic in 2020.

“These two days could have a big impact on local businesses,” Smith said. “Main Street is having a rough time because of things like supply chain breakdowns, high gas prices and rising prices.” Small business owners surveyed for NFIB’s latest Small Business Economic Trends report ranked inflation as the No. 1 issue affecting their business.

Despite those concerns, an Aug. 3 Debt.com poll shows 45% of parents are spending at least $200 per child this year — compared to only 29% in 2021. And 27% will spend more than $300 per child. Debt.com’s 2022 parent survey also reports that 8 in 10 said inflation will translate into higher spending.

Debt.com President Don Silvestri says there are two reasons for that.

“While inflation means you’ll spend more for the same back-to-school items you purchased last year, there’s also a psychological component,” Silvestri explains. “Consumers tend to actually buy more during inflationary periods — if they believe inflation will continue to climb. They figure they’ll actually save money by stocking up on nonperishable goods.”

Silvestri says Debt.com will conduct further research to see if parents are stocking up on back-to-school items for next year. Other results from the poll indicate parents aren’t scared by the economy, but they are taking it into consideration.

“Like holiday shopping, back-to-school shopping is nearly impervious to what’s going on around us — whether it’s inflation, recession or pandemic,” Silvestri says. “Both happen once a year, and they’re about our children. It’s very hard for us to apply the same financial scrutiny we do in our normal lives, but it is still important to budget for back to school.”

According to the Federation of Tax Administrators, 20 states have planned at least one sales tax holiday in 2022, three more than a year ago. In some states, sales tax holidays are set in statute to occur on an annual basis, while other states pass legislation each year a sales tax holiday is desired.

In Arkansas, Act 757 of 2011 established the state’s sales tax holiday on the first weekend in August. Under the decade-old law, Arkansas shoppers can purchase school supplies, instructional materials, and clothing free of state and local sales or use tax. In the 2021 session, certain electronic items and computer equipment were also added to the legally exempt list.

All retailers in Arkansas are required to participate and may not charge tax on items that are legally tax-exempt during the two-day holiday.

Consumer spending survey

Despite those tax-free deals in Arkansas and other states, one-third of consumers (38%) said they are cutting back in other spending areas to cover the cost of items for the upcoming school year, according to the annual survey released on July 14 by the National Retail Federation (NRF) and Prosper Insights & Analytics.

“Families consider back-to-school and college items as an essential category, and they are taking whatever steps they can, including cutting back on discretionary spending, shopping sales and buying store- or off-brand items, in order to purchase what they need for the upcoming school year,” NRF President and CEO Matthew Shay said. “The back-to-school season is among the most significant shopping events for consumers and retailers alike, second only to the winter holiday season.”

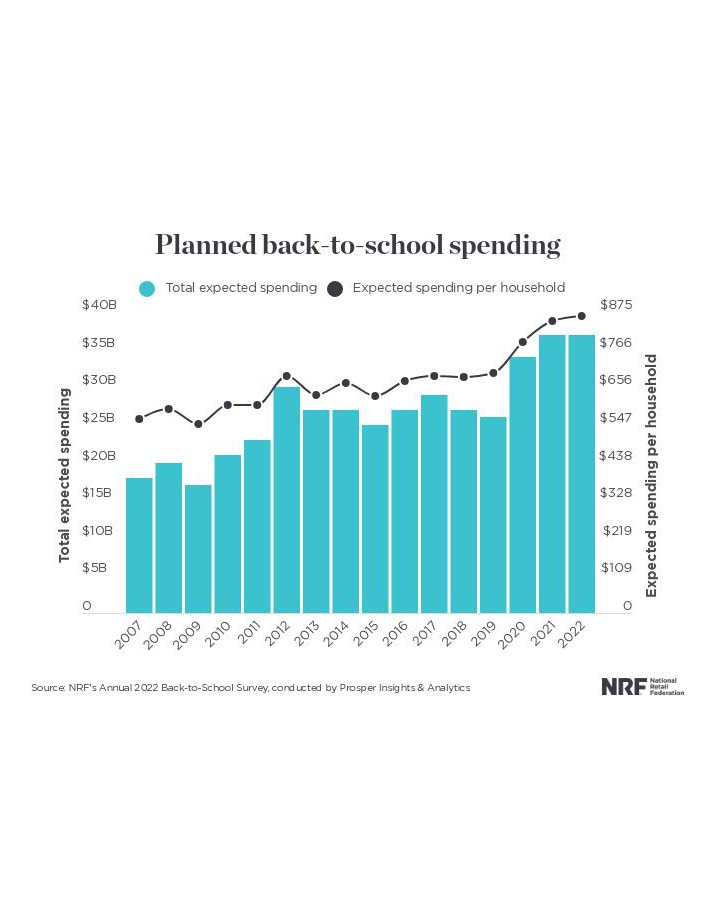

Total back-to-school spending is expected to match 2021’s record high of $37 billion. Families with children in elementary through high school plan to spend an average of $864 on school items, approximately $15 more than last year. Back-to-school spending has increased dramatically since the onset of the pandemic, as families adjusted to changes from virtual and hybrid learning. Compared to 2019, back-to-school shoppers are expected to spend $168 more on average, and total spending is up $11 billion.

Total back-to-college spending is expected to reach nearly $74 billion, up from last year’s record of $71 billion and the highest in the survey’s history. More college students and their families plan to shop this year compared to last and anticipate spending an average of $1,199 on college or university items, consistent with last year’s record of $1,200. Since 2019, total expected spending on back-to-college has grown by $19 billion and consumers are spending $223 more on average than they were prior to the pandemic. Nearly half of this increase comes from spending on electronics and dorm or apartment furnishings.

Like other recent holidays, shoppers are starting early to find the best deals and help spread out their budgets. As of early July, more than half (56%) of shoppers had started shopping for school and college supplies.

Consumers may be even more motivated to get a jump start on their back-to-class shopping this year given the impact of inflation and higher prices. A majority (68%) of survey respondents said they have seen higher prices on school items. Clothing and accessories and school supplies were among the top areas where consumers have noticed higher prices.

There is still plenty of outstanding shopping, with the vast majority (85%) of back-to-school and college families indicating they have at least half of their shopping remaining. The top reasons consumers have not checked items off their list are because they do not know what is needed yet and are waiting for the best deals.

Given this year’s inflationary pressure, traditional sales events may play an even larger role for back-to-school and college shoppers. Most (81%) said they planned to use retailer deals during the week of July 11 to shop specifically for school and college items. Approximately three out of five (62%) said they plan to shop Prime Day deals on Amazon, 31% will shop online deals at other retailers and 20% will shop in-store deals at other retailers.

“We are seeing real shifts in the way people are shopping and spending on back-to-class items since before the pandemic. As a result, retailers are also shifting by bringing in inventory earlier and extending back-to-class offerings,” Prosper Insights Executive Vice President of Strategy Phil Rist said.

Compared with their pre-pandemic habits, back-to-school and college shoppers plan to concentrate their shopping rather than spreading it out across multiple destinations. The top five back-to-school shopping destinations are online (50%), department stores (45%), discount retailers (40%), clothing stores (37%) and electronics stores (28%). Top back-to-college shopping destinations are online (43%), followed by department stores (36%), discount stores (29%), office supply stores (27%) and college bookstores (26%).

The survey of 7,830 consumers, the most comprehensive back-to-class annual survey, was conducted June 30-July 7 and has a margin of error of plus or minus 1.1 percentage points.

Better Beginnings program

Meanwhile, not all parents’ concerns center around purchasing back-to-school supplies and clothing. Better Beginnings, a program of the Arkansas Department of Human Services Division of Child Care and Early Childhood Education, is encouraging families to take advantage of resources meant to assist families and children adjusting back to school from summer.

Officials said that children thrive best when keeping up with familiar routines as they aren’t yet equipped with the skills needed to cope with new situations. Any disruption to established routines can cause stress on the whole family as children sometimes struggle going back to childcare or going to childcare for the first time.

“It is normal for children to be upset at drop-off,” said Kelli Hilburn, Better Beginnings program administrator. “If this is the case for your child, I want to encourage parents to hang in there because this reaction is usually temporary. With consistency and patience, children eventually adjust to their new routine and environment.”

This resource includes tips on how to:

Talk to your child about going to childcare.

Be cheerful and reassuring.

Make drop-off quick.

Avoid drop-off mistakes like going back to your child once you’ve said goodbye.

Hilburn said parents are key to helping children develop the skills necessary to adjust to changes in their routines and environments. Children learn how to adapt by watching their parents adjust to new situations in a healthy way.

“Parents are a child’s first teacher,” Hilburn said. “Children imitate what they see in those closest to them. When the adults in their lives display healthy coping skills to changes in routines and environments, children will develop those skills, too.”

For similar resources or to learn more, visit arbetterbeginnings.com.

Photo Captions:

1. Budget Buster: Inflation Weighs On Family Spending

2. As Arkansas kicks off its back-to-school shopping season, retailers are hoping that rising inflation does not hurt one of their busiest and most profitable periods.

3 .According to the National Retail Federation, families with children in elementary and high school plan to spend an average of $864 on school items, about $15 more than last year.