Chief Job Creator: Gov. Hutchinson continues legacy as global job hunter with U.S. Steel deal

January 31 - February 6, 2022

By Wesley Brown

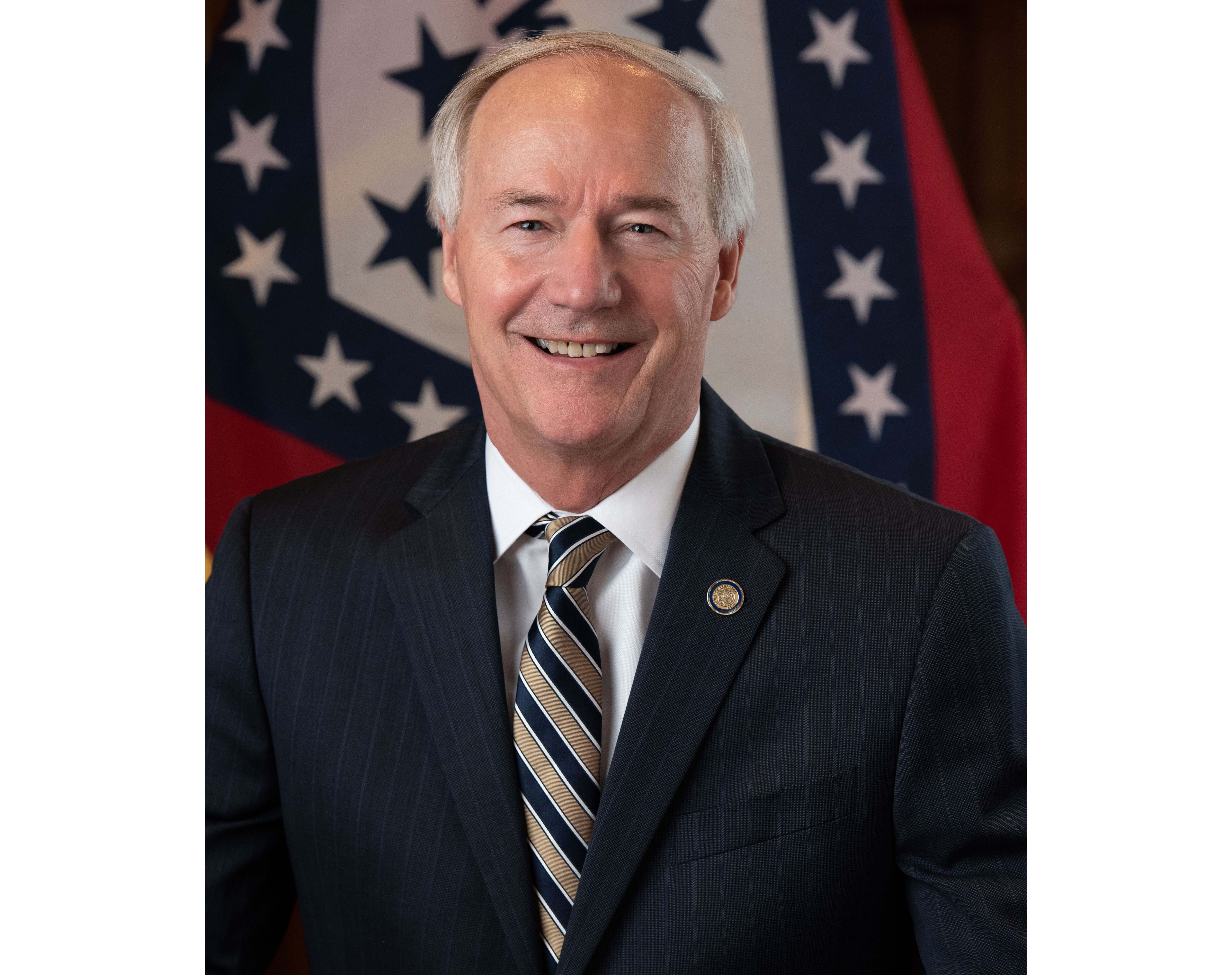

In the final year of his role as the state’s chief job recruiter, Gov. Asa Hutchinson and state Department of Commerce Secretary Mike Preston continue their quest to bring the holy grail of economic development projects to Arkansas – a game-changing automotive plant.

On Jan. 11, Pittsburgh-based steel conglomerate U.S. Steel Corp. announced that its next-generation highly sustainable and technologically advanced steel mill will be located in Osceola, Ark., close to U. S. Steel’s cutting-edge Big River Steel plant. The facility is engineered to bring together the most advanced technology to create the steel mill of the future that delivers profitable solutions for customers.

The new mill is designed to extend U. S. Steel’s customer advantages as the company maps a bold path toward a more sustainable future. The new optimized steel production facility is expected to feature two electric arc furnaces (EAFs) with 3 million tons per year of advanced steelmaking capability, a state-of-the-art endless casting and rolling line, and advanced finishing capabilities. This first use of endless casting and rolling technology in the United States brings significant energy, efficiency, and capability enhancements to the company’s operations.

Upon completion, U.S. Steel said it will apply to become LEED certified. The site selection is subject to several factors, including final agreements with key partners. Permitting for the project is underway and the company expects to break ground in the first quarter of 2022, with project completion and full operation anticipated in 2024.

“With this location selected and shovels ready, we are reshaping the future of steelmaking,” said U.S. Steel President and CEO David B. Burritt. “We had numerous competitive site options, but Osceola offers our customers incomparable advantages.”

When completed, the sophisticated new steelmaking facility in combination with Big River Steel will form a 6.3-million-ton mega mill capable of providing many of the most advanced and sustainable steels in North America, company officials said. The new non-grain oriented electrical steel and galvalume/galvanizing lines currently under construction at Big River Steel will further advance U. S. Steel’s ability to respond to customers’ pressing supply chain needs to satisfy their own domestic manufacturing expansion. The location affords abundant, increasingly renewable and clean power from Entergy, superior Class 1 rail service from BNSF Railway with connections to other railroads, Mississippi River docks and interstate trucking access.

“Our nation and our customers need a robust and resilient supply chain to meet consumers’ needs, and that starts with U.S. Steel’s advanced, sustainable steels. Steel is critical to so much of what the world builds, so how we make our products contributes directly to a better, more sustainable world for all. This new facility will build that future,” continued Burnett. “Stay tuned. As we add this to our world-class Big River Steel facility, you’re going to be seeing great things as we advance the Best for All future of steel.”

The expansion of the U.S. Steel’s Big River Steel facility in Mississippi County comes more than three years after publicly-traded Pittsburgh steel first acquired Big River Steel in October 2018 through the purchase of a 49.9% ownership stake for $700 million in cash, with a call option to acquire the remaining 50.1% over the next four years.

On Jan. 15, U.S. Steel officials said the company had finally closed its acquisition of the remaining equity of Big River Steel for approximately $774 million from cash on hand. The transaction met customary closing conditions, including antitrust approval from the U.S. Department of Justice.

Big River Steel first broke ground on its $1.2 billion facility in September 2014. The company received $125 million in general obligation bonds under the state’s Amendment 82 provision that allows for so-called “super projects.”

It also received a $50 million loan, that was paid back 17 years early, and another $50 million for site preparation, according to the Arkansas Economic Development Commission (AEDC). The largest industrial project in Arkansas history has also received a package of tax credits and incentives to build its plant in the state. Under its incentive deal with the AEDC, Big River Steel is obligated to employ 525 workers making on average between $75,000 and $100,000 per year.

In late June 2018, Big River Steel made the surprise announcement that its planned Phase II-A expansion would double its hot-rolled steel production capacity to 3.3 million tons annually and nearly double the company’s employee payroll to well over 1,000 workers. Following that expansion, Big River Steel now offers high-quality products and services to discerning customers in the automotive, energy, construction, and agricultural industries. The Phase II-A expansion was completed in November 2020, ahead of schedule and below budget.

During the recent special session in early December, the 93rd Arkansas General Assembly approved legislation to allow for the use of these credits by a qualified growth project that must have common ownership with and is located on the site of or adjacent to an existing qualified steel manufacturer. At a press briefing with local reporters, Hutchinson said an auto manufacturer would potentially locate anywhere in Arkansas because it would want to have access to steel production, markets in Texas and both coasts, and have access to a super project industrial site of more than 1,000 acres.

From Toyota Tundra to Steel County USA

Since losing out to Texas to win the Toyota Tundra plant in 2003 under former Gov. Mike Huckabee, Arkansas has been on a losing quest to remove the distinction of being the lone southern state without an auto production plant, the most prized economic development project in the U.S.

In a press brief where he touted Mississippi County as the “number one steel-producing county” in the nation, Hutchinson said AEDC and Mississippi County’s economic development team prepared a first-rate package for U.S. Steel.

“The 93rd General Assembly supported the effort with legislation that offers an income-tax credit to steel manufacturers that invest in equipment to reduce waste, and reuse or recycle materials. U.S. Steel plans to be carbon neutral by 2050,” said Hutchinson. “The process moved quickly, and our nimble economic development team had the savvy and the resources to keep pace. U.S. Steel announced in September last year that it was looking for a place to build a state-of-the-art minimill. Only three months later, the company announced it would build in Arkansas.”

According to the details of HB 1007, the U.S. Steel-Big River super project would need a total investment of at least $2 billion and create 700 new direct positions with an average annual wage of $120,000 and 200 new independent direct positions with an average annual wage of $60,000. In association with that bill, the legislature also voted in favor of a transfer of up to $50 million from the general revenue allotment reserve fund to the Quick Action Closing Fund for specific economic development incentives.

The recycling tax credits and the transfer to the Quick Action Closing Fund, now Act 1 of the Second Extraordinary Session of 2021, were specifically aimed at creating an incentive package for a U.S. Steel-Big River project in Northeast Arkansas.

“Arkansas has created an ideal business environment for the growth of the steel industry in our state,” Hutchinson said. “The investment and high paying jobs that will result from this announcement will make a real difference in the lives of many families in Northeast Arkansas. I am grateful for the support of the legislature which was critical in winning this expansion. Now, U.S. Steel is an important part of our future and we look forward to continued success in the coming years.”

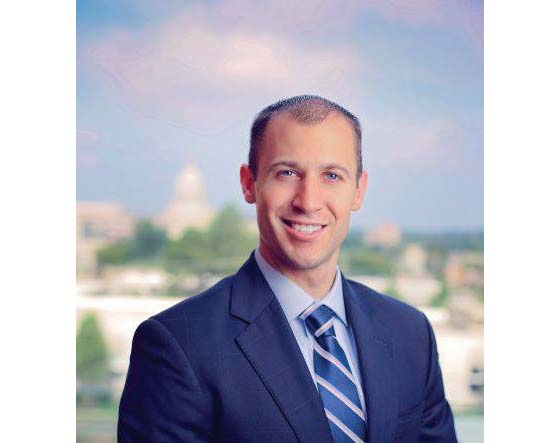

According to Preston, who also serves double duty as executive director of AEDC, Arkansas was in competition with Mississippi and other states to land the U.S. Steel project.

“Mississippi County has become a national leader in steel production, and U.S. Steel’s decision to create ‘the steel mill of the future’ in this community continues to underscore why,” Arkansas Secretary of Commerce Mike Preston said. “Not only does Arkansas have a trained workforce, a reliable electrical grid, and easy access to river, rail, and highways, but it also has a governor, a General Assembly, and numerous community partners and stakeholders who recognize the importance of broadening economic opportunities for Arkansans and who will go the extra mile to compete for those opportunities.”

Hutchinson also noted that the state-of-the-art mill will produce high-end steel used to build cars and appliances, and AEDC can build on its success by recruiting even more industries, such as automakers.

“The benefits of this steel mill extend beyond the economy and will improve the quality of life in Northeast Arkansas in intangible ways we haven’t imagined. As Secretary of Commerce Mike Preston said, with the expansion of our steel industry, the sky’s the limit,” said the term-limited Republican governor.

Separately, while the partnership with the nation’s second largest steel producer is moving the northeast corner of Arkansas closer to the claim of being the new steel-producing capital of the South, the Natural State will also lose another homegrown company with a strong blue-collar reputation to a larger publicly traded industrial giant.

On Jan. 14, publicly traded outdoor equipment giant Toro Company acquired Intimidator Group of Batesville for $400 million. Founded by Becky and Robert Foster of Batesville, the former owners of Bad Boy Mowers, the Intimidator Group designs and manufactures Spartan Mowers, a professional line of zero-turn mowers known for exceptional performance, durability and distinctive styling.

Sold through an established dealer network, Spartan Mowers has strong brand recognition in southern regions of the United States, appealing to rural markets and large acreage customers. Intimidator Group also designs and manufactures an attractive line of powerful and versatile side-by-side utility vehicles that perform well in the toughest terrains.

“The addition of Spartan Mowers to our portfolio strategically positions us to be an even stronger player in the large and rapidly growing zero-turn mower market,” said Toro Chairman and CEO Richard Olson. “Spartan’s product lineup complements our innovative Exmark and Toro branded equipment and provides unique opportunities to further leverage technology and design, procurement and manufacturing efficiencies.”

“We are confident the combined efforts of our teams will help advance our strategic priorities while providing unparalleled products, technologies and service to our customers,” continued Olson. “This move also reinforces our commitment to disciplined capital deployment, including prudent investments in our business, strategic acquisitions, dividend growth and share repurchases, all of which position us to deliver compelling shareholder returns long-term.”

“Our success and growth is the result of our dedicated team of employees, dealers and supply partners for which we are truly thankful and excited to be taking this next step in our journey together,” added Robert and Becky Foster, owners of Intimidator Group. “The Toro Company has a rich history and proven track record of growing brands with the resources to fuel our future growth. With a shared commitment to furthering innovation, serving customers and supporting our people and communities, we look forward to joining The Toro Company and continuing to provide best-in-class products and service to our customers.”

The pros and cons of corporate incentives

For calendar year 2021, Intimidator Group net sales were approximately $200 million, said company officials. Bloomington, Minn.-based Toro, which had annual sales exceeding $4 billion in fiscal 2021, said it expects to provide updated full-year guidance that includes the acquisition of Intimidator Group when it reports its fiscal 2022 first quarter results.

The transaction has already received customary regulatory approvals. Toro said the $400 million purchase price for the Arkansas-based lawn mower manufacturer was paid with a combination of cash on hand and short-term borrowings under the company’s existing revolving credit facility. The Toro Company expects this acquisition to be modestly accretive to fiscal 2022 adjusted earnings excluding transaction and integration expenses.

Toro and Intimidator officials did not say if the acquisition would impact the Arkansas company’s workforce. Under Gov. Asa Hutchinson, Intimidator has been a big winner of recipient corporate tax credits and incentives to remain in Arkansas. In September 2016, Intimidator Inc. first announced plans to invest $12 million and expand a second facility in Batesville by adding 400 full-time workers to its then 80-person payroll through 2020.

At the time, the state gave Intimidator a $1.5 million Community Development block grant, according to the Arkansas Economic Development Commission. The company also received other state incentives including 4.25% of their payroll cash rebate from the state during the first five years of operation. Intimidator also qualified for state tax back considerations on its building materials, machinery, and other equipment bought as a part of the expansion.

Based on Toro’s latest quarterly filing with the federal Securities and Exchange Commission, the Minnesota outdoor equipment manufacturer had just over 9,500 employees on payroll at the end of fiscal 2021, down 4.6% from the previous year.

Jeremy Horpedahl, an economist with the University of Central Arkansas’ Center for Research in Economics (ACRE), said what really jumped out to him about the incentive package was that the sponsor, Sen. Dave Wallace, R-Leachville, openly admitted the Republican-controlled legislature was passing a law to benefit one entity – US Steel’s Big River facility.

“I say all this not to necessarily criticize Sen. Wallace. He’s just doing his job to represent his district. But the openness with which the legislature seems fine with passing laws that everyone acknowledges will benefit just one firm seems like a huge change to me,” said Horpedahl. “In my opinion, this is something which we should be very worried about going forward, as more firms may now feel that they can come to the legislature, tell them that other states are offering them deals, and the legislature will amend state laws with no debate. Usually, there’s at least the appearance that these incentives are available to many firms, but perhaps they are just getting more honest.”

The UCA economist also noted that the large incentives package given to U.S. Steel also claimed to create 700 high-paying jobs in Arkansas. He said although this was touted as one of the big benefits of the state’s economic development approach, “it’s just not really an impressive number to me as an economist.”

“Prior to the pandemic, under the Hutchinson administration the average number of jobs created was 1,400 every single month. I would submit that very little of this had to do with any sort of economic development incentives. It’s just the normal job creation of a growing economy. And it happens every month,” said Horpedahl.

Concerning Hutchinson’s legacy on job creation and economic policy, Horpedahl said the governor’s efforts to lower income taxes for all Arkansans and businesses, and his restructuring of the state’s onerous corporate tax code had more impact than incentive to lure jobs to the Natural State.

“But I’m much more skeptical that the policy of targeted incentives has benefitted the state, and in my view it detracts from the possibility of further broad-based tax cuts that would benefit all businesses, not just politically favored ones,” he said.

PHOTO CAPTIONS:

1. Since January 2015, the Arkansas Economic Development Commission has signed incentive agreements with 555 new and expanding companies that have resulted in approximately 25,700 new jobs for Arkansans under Gov. Hutchinson.

2. U.S. Steel Corp. on Jan. 11 announced that its new $3 billion state-of-the-art steel mill will be built in Osceola, close to the company's Big River Steel LEED-certified rolled steel plant in Mississippi County.

3. Gov. Asa Hutchinson attends the August 2020 grand opening Koppers, a global provider of treated wood products in North Little Rock. At the event,

Koppers announced that it plans to invest a minimum of $23 million and increase its 80-person workforce through 2023.

4. Governor Asa Hutchinson

5. Department of Commerce Secretary Mike Preston