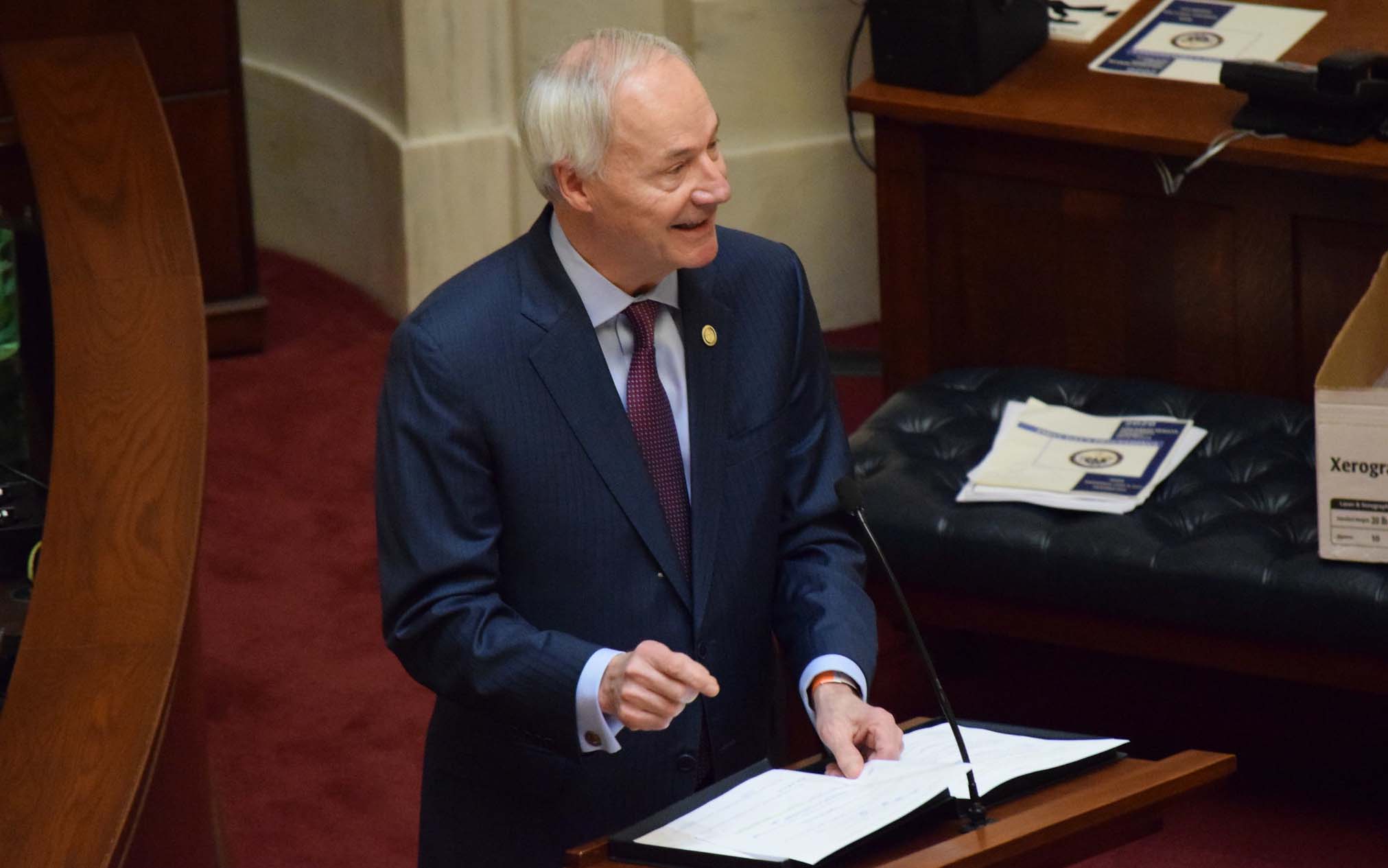

Gov. Hutchinson outlines $5.84 billion, 2021 budget ahead of upcoming legislation session

November 16-22, 2020

In a moment that capsulized the past nine months for the state’s chief executive officer, Gov. Asa Hutchinson on Nov. 10 offered the framework for his Fiscal Year 2022 budget during a Zoom call rather than the normal committee hearing at the State Capitol.

Speaking to House and Senate leaders and other state policymakers for about 12 minutes, Hutchinson set out his biennial budget priorities for the upcoming 93rd General Assembly that begins Jan. 11 2021, noting that his $5.84 billion balanced budget will maintain the robust surplus amid the COVID-19 pandemic

“Today, I am presenting my balanced budget recommendation for state revenue for the 2022-2023 biennium. This budget funds the priorities of the state, including the largest increase in education in more than a decade,” Hutchinson said in his virtual Zoom presentation. “It funds our crisis stabilization units that have proven effective in dealing with those in mental health crisis, and the budget allows rooms for another round of tax cuts.”

Highlighting the final two years of his tenure as Arkansas governor, Hutchinson said he would continue building on his legacy of tax cuts with a commitment to not only absorb cuts from previous years but also set aside another $50 million in tax relief for workers in low- and middle-income brackets.

With an expected $240 million surplus after Arkansas legislators approved a revised budget in April due to COVID-19 concerns, Hutchinson’s proposed financial plan for state government operations will also increase the balance in the Long-Term Reserve from $185 million to $285 million by the end of the biennium. Hutchinson noted that when he took office in 2015, the state’s “rainy day” fund’s balance was zero.

As governor, Hutchinson has led the state’s response to COVID-19 after the World Health Organization declared the SARS-CoV-2 coronavirus a global pandemic in early March. Shortly after, Hutchinson issued an executive order declaring COVID-19 a public health emergency due to the spreading virus that has taken more than 2,100 lives in Arkansas. By late March, the popular Republican governor had advised Arkansans to practice social distancing and shelter-in-place orders statewide, thus effectively shutting down the state’s economy for several months.

In early April, Hutchinson and the Arkansas General Assembly adjusted the state budget during the 2020 fiscal session held virtually at the Arkansas State Capitol and at the Jack Stephens Center. During the brief session, Department of Finance Administration Director Larry Walther and state budget officials projected a budget shortfall of $353.1 million by the end of the 2020 fiscal year that ended June 30, and then cut the 2021 forecast by $205 million.

However, unlike many states facing deep deficits during the pandemic, Arkansas will enter the 2021 legislative session with at least a $240 million surplus with two months of accounting still left in the calendar year. According to recent analysis by the Urban Institute’s State and Local Finance Initiative, COVID-19’s impact on state budgets across the U.S. could lead to more than $200 billion in combined deficits, causing states like California, Maryland, Florida, Michigan, New York and Illinois to request federal help to fill coronavirus-related budget holes.

“During the pandemic we have worked together to tighten the belt of state government. We have reduced spending in the past year and we have focused on the core critical areas of education, public safety, and our health care that was essential during this pandemic,” Hutchinson said to lawmakers during the conference call. “As a result, we are entering the next year in sound financial condition.”

Hutchinson also noted the work of the state’s CARES Act Steering Committee, a 15-person task force created by the governor to make recommendations for $1.25 billion in funding from the Coronavirus Aid, Relief and Economic Security (CARES) Act approved by Congress in late March. As of Nov. 10, the Arkansas Legislative Council had approved all but $70 million of those CARES Act funds that must be spent by Dec. 31 and cannot be mixed with other state revenues.

“I appreciate the General Assembly’s work to increase the safety net for Arkansans who are struggling because of layoffs and financial challenges,” the governor said. “This includes rental assistance, enhanced unemployment compensation and food assistance all delivered and approved for use from the CARES Act funding as approved by the Legislative Council.”

Hutchinson’s legacy of tax cuts

To pay for the proposed tax cuts, Hutchinson said Arkansas’ conservative fiscal discipline will allow the state to absorb earlier tax cuts approved by the legislature during his six-year tenure as governor. In the 2019 session, Hutchinson signed legislation that reduced the top marginal tax rate from 6.9% to 5.9%. Phase one of that three-phase plan, which ultimately will benefit from nearly $250 million in reduced taxes, went into effect on Jan. 1, 2020.

In 2017, Hutchinson signed the second largest cut to the income tax rate in Arkansas history, a $50 million windfall aimed at lessening the tax burden for low income Arkansans. The governor’s tax package during that biennium also eliminated the income tax on military retirement pay, known as the Retired Military Tax Cut.

After taking office in 2015, Hutchinson fulfilled his top campaign promise by signing his so-called “middle-income” tax proposal of $102 million, touted by GOP officials as the largest income tax rate cut in state history. That legislation, according to state Department of Finance and Administration (DFA) officials, has returned as much as $540 annually to nearly 500,000 taxpayers.

“In terms of the future, we are in a position to absorb the tax cuts that are already scheduled for next year,” Hutchinson told lawmakers as he shared a copy of his 2021 budget. “As you know, we have reduced the individual income tax rate to 5.9% beginning next January. This reduction is already included in the forecast that you see before you.”

Besides those fiscal priorities, Hutchinson’s other key budget recommendations for the upcoming fiscal year that begins July 1, 2021, include reducing the sales tax on used cars that sell for less than $10,000, allocating $30 million in surplus funding to continue expansion of broadband, and reduce spending by $26.5 million through the governor’s earlier initiative to transform and reorganize state government.

In April 2019, state lawmakers approved Hutchinson’s omnibus legislation to downsize state government from 42 to 15 agencies led by cabinet secretaries that report directly to the governor. For example, former Arkansas Economic Development Commissioner (AEDC) Director Mike Preston now leads the newly created Department of Commerce that includes AEDC, the Arkansas Minority Commission and other related quasi-agencies, boards and departments.

Overall, Hutchinson’s $5.84 billion budget for the fiscal year is a 2.8% increase in general revenues over the revised budget of $5.68 billion approved by lawmaker’s in the fiscal session earlier this spring. If all budget scenarios play out as forecasted, Hutchinson’s recommendations would then jump 2.9% to $6.01 million in fiscal 2023.

Unlike other states, Arkansas’ Constitution requires a balanced budget that prioritizes spending for the operation of state government under the Revenue Stabilization Act (RSA). Under that complex budget-balancing forecasting model, legislators must prioritize all state agency spending requests during both the fiscal and regular legislative session. The legislature usually divides state general revenues into “A”, “B”, and “C” categories under the RSA. Allocations in the “A” category have top priority and normally are 100% funded. If there is money left over after funding the “A” category, the “B” category is also funded, and eventually the “C” category is funded if revenues allow.

If the economy is healthy and general revenue is collected at projected levels, state agencies receive what they are budgeted to receive. However, if there is a downturn and revenues decline and tax collections fall below estimates, state agencies must then cut back on spending in the low-priority categories under the state’s unique balanced budget law.

After releasing his highly anticipated biennial budget, Hutchinson’s proposal was generally well received by lawmakers, policymakers and economic forecasters across the state. Lt. Gov. Tim Griffin, who is mounting a run for the governor’s office in 2024, released the following statement regarding Hutchinson’s budget for the 2021 legislation session.

“I am excited about Governor Hutchinson’s commitment to lowering Arkansas’s income tax burden further for the hardworking families of our state,” said Griffin, also a Republican. “Reducing the income tax will incentivize work, job creation, and economic productivity and will make Arkansas more competitive with other states. I also support reducing the sales tax burden on used automobiles, a Clinton-era tax that disproportionately harms lower-income Arkansans.”

Commenting on Hutchinson’s tax-friendly budget cuts, University of Central Arkansas (UCA) Professor Jeremy Horpedahl said the governor’s plan to eventually reduce the top income tax rate to 4.9% “will make Arkansas more competitive with neighboring states and provide tax relief to many Arkansans.”

“This tax reduction has been a long-standing goal of Gov. Hutchinson, and it should be feasible to do so once we are past the COVID recession,” continued Horpedahl, an assistant professor of economics at UCA. “The governor’s immediate plan to reduce the rate only for new residents could have some benefits of attracting new workers, but it will also be unnecessarily costly, since it will likely have to be given to the roughly 30,000 new workers that move to Arkansas each year anyway, according to the latest IRS Statistics of Income Migration Data.”

PHOTO CAPTION: (Photo courtesy of Gov. Asa Hutchinson’s press office)

COVID-19 pandemic looms over 93rd General Assembly as Gov. Hutchinson submits 2021 budget priorities, including education, tax cuts, and Rainy Day fund.