Inflation Nation

June 27 - July 3, 2022

By Wesley Brown

As gas prices and inflation continue to soar, President Joe Biden on Wednesday, June 22, called on Congress to suspend the federal gas tax through September, the traditional end of the nation’s vacation season.

Since 1993, the federal government has charged an 18-cent tax per gallon of gasoline and a 24.4 cent tax per gallon of diesel through the Highway Trust Fund — the major source of federal road and bridge funding. The Highway Trust Fund is an accounting mechanism in the federal budget with two accounts — one for highways and the other for mass transit — to which certain fuel and other vehicle-related excise tax collections are credited.

According to the Congressional Budget Office (CBO), federal spending on highways totaled $46 billion in 2019. Most of those outlays were for grants to state and local governments to support their spending on capital projects. Those governments typically spend roughly three times as much of their own funds on highways each year, not only on capital projects but also to operate and maintain roads.

That $46 billion also includes spending for federal programs that subsidize state and local governments’ borrowing for highway projects; other subsidies for state and local borrowing are provided through the tax code.

In the president’s appeal to Congress, Biden administration officials said any new legislation should make sure that a gas tax holiday has no negative effect on the Highway Trust Fund.

“With our deficit already down by a historic $1.6 trillion this year, the President believes that we can afford to suspend the gas tax to help consumers while using other revenues to make the Highway Trust Fund whole for the roughly $10 billion cost,” the White House said in a statement. “This is consistent with legislation proposed in the Senate and the House to advance a responsible gas tax holiday.”

Whether or not Biden has enough support in the House and Senate to gain approval for his three-month moratorium, the national average for a gallon of gas is $4.96, a nickel less than a week ago. The primary cause of the modest decline is the tumbling cost of oil, which fell from $122 to around $110 per barrel due to fears of a global recession and its associated economic slowdown.

“The recent high prices may have led to a small drop in domestic gasoline demand as fewer drivers fueled up last week,” said Andrew Gross, AAA spokesperson. “This dip, coupled with less costly oil, has taken some steam out of surging pump prices. And this is happening right before drivers gas up for what AAA forecasts will be a busy July 4th travel weekend.”

According to new data from the Energy Information Administration (EIA), total domestic gasoline stocks fell by 700,000 billion barrels (bbl) to 217.5 million bbl last week. Meanwhile, gasoline demand declined slightly from 9.2 million barrels per day (b/d) to 9.09 million b/d. The slight drop in gas demand has helped to limit pump price increases. However, as crude oil prices remain volatile, the price per gallon for gasoline will likely remain elevated.

As of June 21, the national average of $4.96 is 37 cents more than a month ago, and $1.89 more than a year ago. At $4.50 per gallon to fill up a tank with regular unleaded, Arkansas is among the nation’s top 10 least expensive markets, behind Georgia and Mississippi at $4.46 and $4.47. The other top states well below the $5 per gallon mark include Louisiana ($4.51), South Carolina ($4.52), Alabama ($4.57), Tennessee ($4.58), North Carolina ($4.60), Oklahoma ($4.62) and Texas ($4.63).

On the other end of the scale, California continues to lead the nation with pump prices at a whopping $6.37 per gallon for regular unleaded, followed by Nevada and Alaska at $5.62 and $5.60 per gallon, respectively. Other states above the $5 mark include Hawaii ($5.55), Washington and Oregon ($5.52), Illinois ($5.52), Arizona ($5.35), Idaho ($5.20) and Utah ($5.19).

Across the state, pump prices in the state’s key metropolitan service areas (MSA) range from a low of $4.42 and $4.43 in Hot Springs and the Little Rock-North Little Rock areas, respectively, to the highest recorded average of $4.55 and $4.60 per gallon at opposite ends of the state at the Arkansas/Tennessee state line in West Memphis and the Arkansas/Texas stateline in Texarkana.

In between, drivers in Pine Bluff and Jonesboro are paying on average about $4.48 and $4.49 per gallon to fill up their tanks. Pump prices in Fayetteville-Rogers-Springdale MSA and Fort Smith are averaging $4.53 per gallon for regular unleaded.

As noted, drivers choosing to fill up the tanks with a higher grade of gasoline should expect to pay well over $5 per gallon. Big rig drivers and other diesel fuel users will see pump prices at a whopping $5.40 gallon, up nearly $2.35 from a year ago, according to AAA.

Food prices see largest spike in 43 years

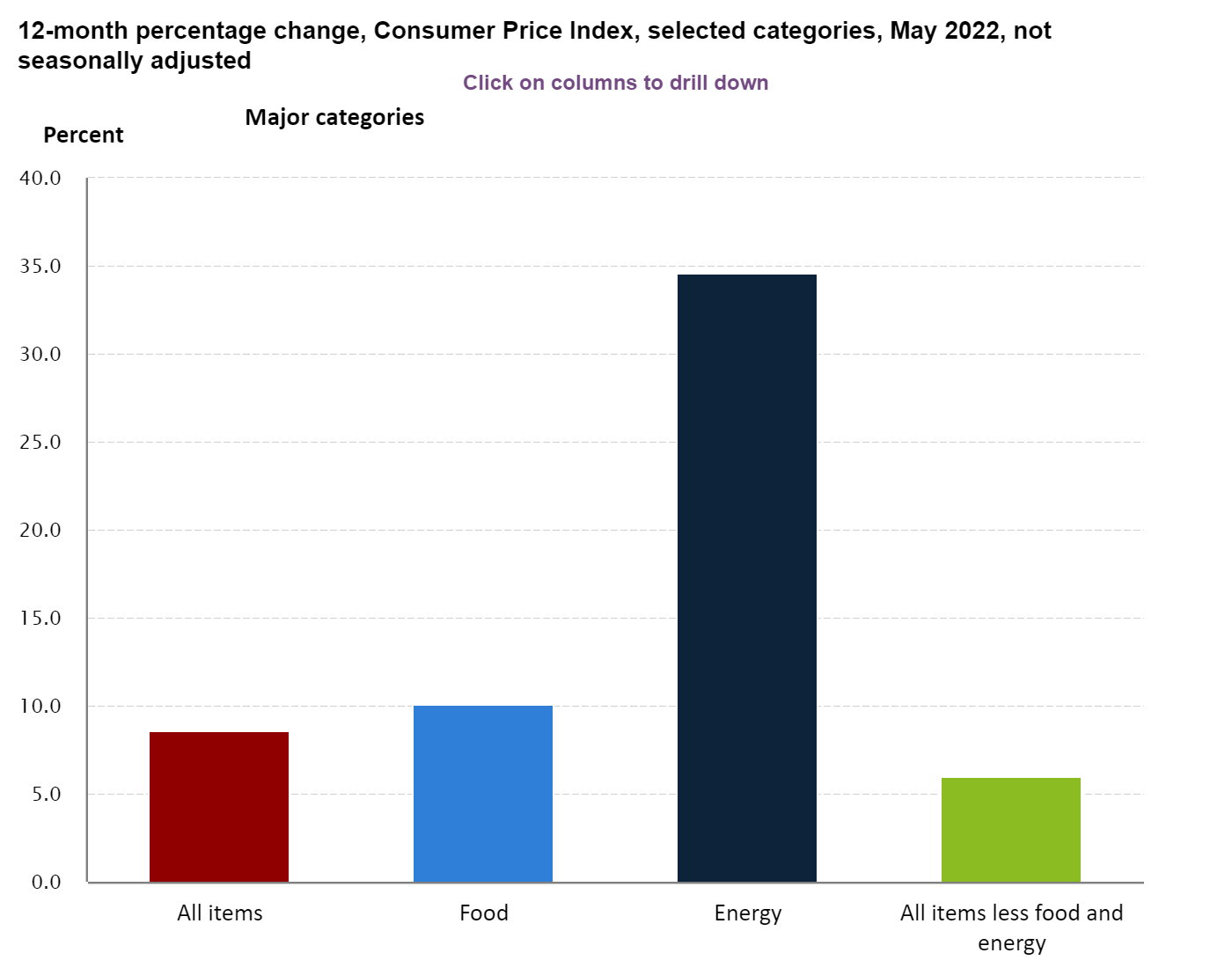

Besides the rising pump prices, the Consumer Price Index for All Urban Consumers (CPI-U) increased 1% in May on a seasonally adjusted basis after rising 0.3%in April, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the “all items” index increased 8.6%, the largest 12-month increase since the period ending December 1981.

For the month, the increase was broad-based, with the indexes for shelter, gasoline and food being the largest contributors. After declining in April, the energy index rose 3.9% over the month with the gasoline index rising 4.1% and the other major component indexes also increasing. The food index increased 1.2% in May following a 0.9% gain in the prior month. The index for food at home rose 1.4% in May, the fifth consecutive increase of at least 1% with all six major grocery store food group indexes rising in May.

The food away from home index rose 0.7% in May after rising 0.6% in April. The index for full-service meals rose 0.8% over the month. The index for limited-service meals increased 0.7% in May after rising 0.3% in April. The food at home index rose 11.9% over the last 12 months, the largest 12-month increase since April 1979. All six major grocery store food group indexes increased over the span, with five of the six rising more than 10%.

The index for all items less food and energy rose 0.6% in May, the same increase as in April. While almost all major components increased over the month, the largest contributors were the indexes for shelter, airline fares, used cars and trucks, and new vehicles. The indexes for medical care, household furnishings and operations, recreation and apparel also increased in May.

IRS reconfigures mileage rate

Meanwhile, as pump prices continue to rise in Arkansas and nationally, the Internal Revenue Service (IRS) on June 9 announced a rare mid-year increase in the optional standard mileage rate for the final six months of 2022. Taxpayers may use the optional standard mileage rates to calculate the deductible costs of operating an automobile for business and certain other purposes.

For the final six months of 2022, the standard mileage rate for business travel will be 62.5 cents per mile, up 4 cents from the rate effective at the start of the year. Also, the new rate for deductible medical or moving expenses for active-duty members of the military will be 22 cents for the remainder of 2022, up 4 cents from the rate effective at the start of 2022. These new rates went into effect on Friday, July 1.

In recognition of recent gasoline price increases, the IRS made this special adjustment for the final months of 2022. The IRS normally updates the mileage rates once a year in the fall for the next calendar year. For travel from Jan. 1 through June 30, 2022, taxpayers should use the rates set forth in Notice 2022-03 here: https://www.irs.gov/pub/irs-drop/n-22-03.pdf.

“The IRS is adjusting the standard mileage rates to better reflect the recent increase in fuel prices,” said IRS Commissioner Chuck Rettig. “We are aware a number of unusual factors have come into play involving fuel costs, and we are taking this special step to help taxpayers, businesses and others who use this rate.”

While fuel costs are a significant factor in the mileage figure, other items enter into the calculation of mileage rates, such as depreciation and insurance and other fixed and variable costs.

The optional business standard mileage rate is used to compute the deductible costs of operating an automobile for business use in lieu of tracking actual costs. This rate is also used as a benchmark by the federal government and many businesses to reimburse their employees for mileage.

Taxpayers always have the option of calculating the actual costs of using their vehicle rather than using the standard mileage rates. The 14 cents per mile rate for charitable organizations remains unchanged as it is set by statute.

As noted, midyear increases in the optional mileage rates are rare, the last time the IRS made such an increase was in 2011.

Photo Captions:

1. President Biden calls for gas tax holiday as gas and food prices soar

2. Soaring energy, housing and food costs pushing consumers to the brink

3. As of June 23, motorists in Arkansas are paying $4.49 per gallon for regular unleaded, 46 cents below the national average, according to AAA.

4. The U.S. Bureau of Labor Statistics reported on June 10 that the Consumer Price Index jumped 8.6% in May, the largest 12-month increase since December 1981. The food at home index rose 11.9% over the last 12 months, the largest yearly gain since April 1979.