LABOR DAY PAINS: Inflation, housing market slowdown has Arkansas consumers worried about the “R WORD”

September 5-11, 2022

By Wesley Brown

For many consumers and retailers, Labor Day is associated with shopping for tax-free back-to-school supplies or purchasing a big-ticket item such as new furniture or a brand-new car.

As the summer vacation season ends over the Labor Day holiday, many households are keeping a tight grip on their household budgets in hopes that inflation and the slowing housing market doesn’t push the U.S. economy in a recession or prolonged downturn in late 2022 and early 2023.

In the nation’s most recent bellwether economic report from the U.S. Bureau of Economic Analysis (BEA), real gross domestic product (GDP) backtracked at an annual rate of 0.6% in the second quarter of 2022, according to the “second” estimate released by U.S. Department of Commerce’s economic research group.

The BEA’s second GDP reading is based on more complete source data than were available for the first and “advance” estimate issued last month. In the advance estimate, the decrease in real GDP was 0.9%. The third and final GDP reading, which is based on more complete economic data, will be released on Sept. 29.

Many believe that two consecutive quarters of negative GDP growth indicates that the economy is in a recession. However, whether or not a recession has begun is determined by the National Bureau of Economic Research (NBER), which considers a variety of indicators, not just GDP.

National Retail Federation (NRF) Chief Economist Jack Kleinhenz said heading into the Labor Day holiday that U.S. economic growth has slowed, but it still isn’t clear if the nation is in a recession. Kleinhenz’s remarks came in the September issue of NRF’s Monthly Economic Review, which cited conflicting data on whether the U.S. economy grew or shrank during the first half of the year.

“As we come to the end of the summer, economic indicators are signaling an unsteady U.S. expansion in the face of several headwinds,” Kleinhenz said, noting ongoing inflation, Federal Reserve interest rate hikes, the volatile stock market and other issues. “These factors are all contributing to the debate on whether the economy is already in a recession, but key indicators disagree on whether we are there yet.”

“All eyes remain on the consumer and what is happening in retail is very important,” Kleinhenz added. “While consumers have become more cautious and cooled their spending in the first half of 2022, households continue to spend and are contending with inflation by using credit cards more, saving less and drawing on savings built up during the pandemic. Consumer stamina will be the big question going forward.”

President Joe Biden and his administration have also downplayed any talk of a possible recession amid the disappointing GDP reports for the first half of 2022, which has reversed the 5.7% expansion in 2021 following the COVID-19 shutdown two years ago.

In light of some top economic reports predicting a recession in late 2022 and early 2023, the Biden administration has been touting Aug. 16 passage of the Inflation Reduction Act, which aims to curb inflation by reducing the deficit, lowering prescription drug prices, and investing into domestic energy production.

“Coming off of last year’s historic economic growth — and regaining all the private sector jobs lost during the pandemic crisis — it’s no surprise that the economy is slowing down as the Federal Reserve acts to bring down inflation,” said President Biden following the release of the GDP report. “But even as we face historic global challenges, we are on the right path, and we will come through this transition stronger and more secure. Our job market remains historically strong, with unemployment at 3.6% and more than 1 million jobs created in the second quarter alone. Consumer spending is continuing to grow.”

Biden added that his economic plan is focused on bringing inflation down, without giving up all the economic gains we have made. Despite the Democratic president’s upbeat assessment of the economy, a recent speech by Federal Reserve Chairman Jerome Powell at the highly anticipated Jackson Hole (Wy.) Economic Conference roiled U.S. financial markets last week.

At the highly anticipated economic policy symposium sponsored by the Federal Reserve Bank of Kansas City, Powell shared his views on the Fed’s Federal Open Market Committee’s (FOMC) overarching focus to bring inflation back down to our 2% goal. In the Bureau of Labor Statistics’ most recent Consumer Price Index report, inflation increased 8.5% over the past 12 months.

However, month-over-month, inflation was flat in July, compared to a 1.3% gain in June. The 12-month reading was also down from the near 50-year inflation high of 9.1% in June. In his speech, Powell called “price stability” is the responsibility of the Federal Reserve and “serves as the bedrock of our economy.”

“Without price stability, the economy does not work for anyone. In particular, without price stability, we will not achieve a sustained period of strong labor market conditions that benefit all. The burdens of high inflation fall heaviest on those who are least able to bear them,” said Powell. “Restoring price stability will take some time and requires using our tools forcefully to bring demand and supply into better balance. Reducing inflation is likely to require a sustained period of below-trend growth.”

Powell also noted there will likely be some softening of labor market conditions and further pain in the housing market after the FOMC hike interest rates for the fourth time in 2022. On June 15, the influential FOMC announced that it decided to raise the target range for the federal funds rate from 1.5% to 1.75% in order to achieve maximum employment and inflation at the rate of 2% over the longer run.

“While higher interest rates, slower growth, and softer labor market conditions will bring down inflation, they will also bring some pain to households and businesses,” Powell said of the Fed’s monetary policy. “These are the unfortunate costs of reducing inflation. But a failure to restore price stability would mean far greater pain."

In response to recession concerns, Powell said the U.S. economy is clearly slowing from the historically high growth rates of 2021, which reflected the reopening of the economy following the pandemic recession.

“While the latest economic data have been mixed, in my view our economy continues to show strong underlying momentum. The labor market is particularly strong, but it is clearly out of balance, with demand for workers substantially exceeding the supply of available workers,” said Powell. “Inflation is running well above 2%, and high inflation has continued to spread through the economy. While the lower inflation readings for July are welcome, a single month’s improvement falls far short of what the Committee will need to see before we are confident that inflation is moving down.”

Since Powell’s speech in Wyoming, U.S. financial markets have lost trillion of dollars heading into the long Labor Day holiday after the Fed chairman indicated there are more interest rate hikes in the future. On Wall Street, the S&P 500 declined three straight days after Powell’s speech, while the tech-heavy Nasdaq, which is more sensitive to Fed policy, dropped nearly 7% over the same period.

That stock market slide and the slowing housing market has some economist already predicting a recession. According to the National Association of Realtors (NAR), existing-home sales sagged for the sixth straight month in July. All four major U.S. regions recorded month-over-month and year-over-year sales declines.

Total existing-home sales, or completed transactions that include single-family homes, townhomes, condominiums and co-ops, slipped 5.9% from June to a seasonally adjusted annual rate of 4.81 million in July. Year-over-year, sales fell 20.2% from 6.03 million in July 2021.

“The ongoing sales decline reflects the impact of the mortgage rate peak of 6% in early June,” said NAR Chief Economist Lawrence Yun. “Home sales may soon stabilize since mortgage rates have fallen to near 5%, thereby giving an additional boost of purchasing power to home buyers.”

Total housing inventory registered at the end of July was 1,310,000 units, an increase of 4.8% from June and unchanged from the previous year. Unsold inventory sits at a 3.3-month supply at the current sales pace, up from 2.9 months in June and 2.6 months in July 2021.

The median existing-home price for all housing types in June was $403,800, up 10.8% from July 2021 ($364,600), as prices increased in all regions. This marks 125 consecutive months of year-over-year increases, the longest-running streak on record.

“We’re witnessing a housing recession in terms of declining home sales and home building,” Yun added. “However, it’s not a recession in home prices. Inventory remains tight and prices continue to rise nationally with nearly 40% of homes still commanding the full list price.”

Properties typically remained on the market for 14 days in July, the same as in June and down from 17 days in July 2021. The 14 days on market are the fewest since NAR began tracking it in May 2011. Eighty-two percent of homes sold in July 2022 were on the market for less than a month.

On the positive side, St. Louis Fed economist Kevin Kliesen is forecasting that GDP growth will return to positive territory in the second half of 2022 despite the recent downtown. A business economist and research officer at the Federal Reserve’s Eighth District in St. Louis that serves the majority and several other Midwest states, Kliesen forecasts GDP growth to average about 1.25% over the second half of 2022 and into the first half of 2023.

“Gross domestic product data for the first half of 2022 appeared to suggest that the U.S. economy was either in or on the cusp of a recession. However, the demand for labor remained very strong over the first seven months of 2022, and consumer outlays continued to register positive growth over the first half of the year,” Kliesen wrote in an Aug. 31 research report. “But with inflation running at levels last seen in the early 1980s, the FOMC has signaled that it will continue to raise its federal funds rate target and reduce the size of its balance sheet, despite negative real GDP growth.

“In response, the interest rate-sensitive housing sector continued to weaken, and equity prices declined sharply through late August. Although there remains considerable uncertainty about the macroeconomy and inflation over the second half of the year, the consensus of private forecasters is that real GDP growth will return to positive territory and the inflation rate will continue to decelerate,” concluded the St. Louis Fed economist.

In past years, Kleisen has participated at the annual economic forecasting event at the Clinton Presidential Library sponsored by the Little Rock branch of the Federal Reserve Bank of St. Louis and the Institute for Economic Advancement at the University of Arkansas at Little Rock (UA Little Rock). The conference is held each year to help local business leaders and policymakers analyze the current state of the Arkansas economy through discussions with our region’s economic experts from the St. Louis Fed and the Arkansas Economic Development Institute, which is led by UA Little Rock economic Michael Pakko.

After being held virtually during the pandemic, the breakfast conference will again be held at the Clinton Library on Nov. 16. There is no charge to attend the breakfast event, but registration is required by Nov. 3.

Photo Captions:

1. Inflation, housing market slowdown has Arkansas consumers worried about the “R WORD”

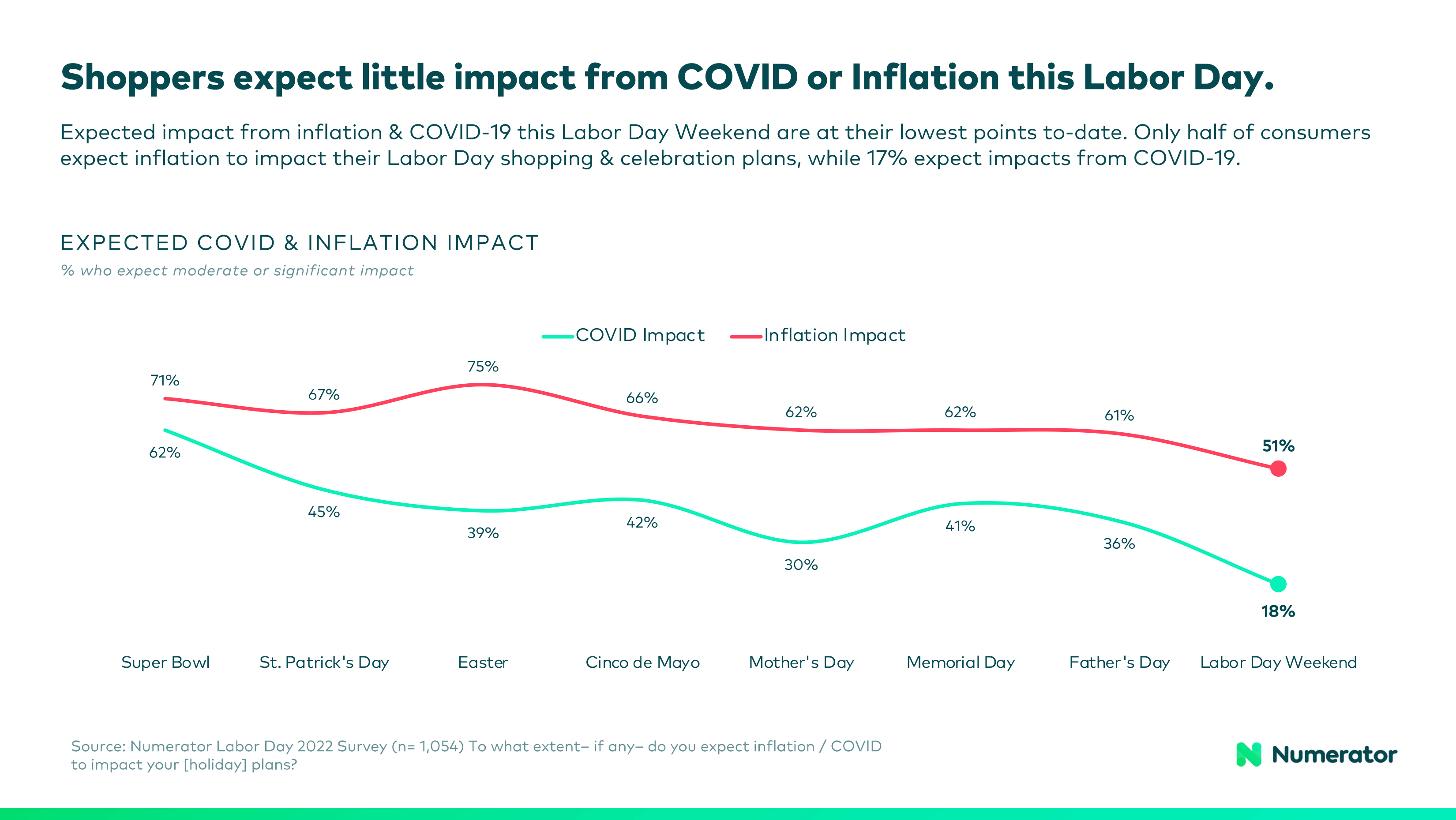

2. Inflation is expected to interfere with Labor Day travel plans, according to Numerator's Labor Day Consumer Survey Report. A third of shoppers say rising gas prices will push them to travel less this year, while a fifth say they won’t travel at all. The Labor Day holiday is the traditional end of the summer travel season.

3. According to Numerator, over half of consumers may shop at Labor Day sales events (See graphic.) Inflation will impact many shoppers’ decisions; a third say they will stock up on sale items or pass up good deals on non-necessities.

4/5. Several retailers at the Outlets of Little Rock (top right and bottom left) are holding clearance sales during the long Labor Day holiday on Sept. 1-5. The federal holiday on the first Monday of September is meant to honor American labor workers. It is now a tradition for most e-commerce and brick-and-mortar retailers to hold Labor Day sales to attract customers on the annual day of respite.