U.S. housing sales continue to retreat as buyers and sellers wait for mortgage prices to deflate

November 28 - December 4, 2022

By The Daily Record Staff

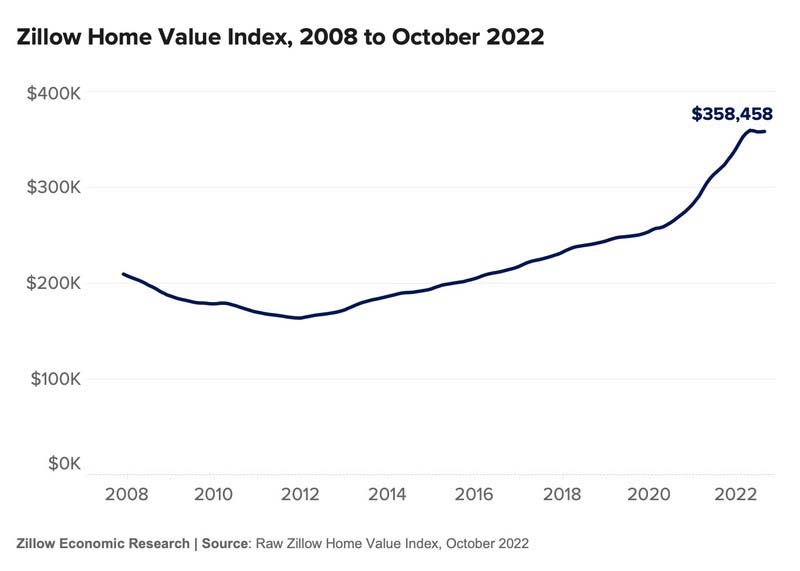

Housing prices continue to decline through the end of the third quarter as buyers and sellers are pausing potential deals to see which way the market turns, according to monthly housing reports by the National Association of Realtors (NAR) and Zillow Inc.

Total existing-home sales — completed transactions that include single-family homes, townhomes, condominiums and co-ops — decreased 5.9% from September to a seasonally adjusted annual rate of 4.43 million in October. Year-over-year, sales dropped by 28.4%, down from 6.19 million in October 2021.

According to the NAR's highly watched monthly analysis of the nation’s housing market, existing-home sales retreated for the ninth straight month as four major U.S. regions saw month-over-month and year-over-year declines.

“More potential homebuyers were squeezed out from qualifying for a mortgage in October as mortgage rates climbed higher,” said NAR Chief Economist Lawrence Yun. “The impact is greater in expensive areas of the country and in markets that witnessed significant home price gains in recent years.”

Total housing inventory registered at the end of October was 1.22 million units, which was down 0.8% from both September and one year ago (1.23 million). Unsold inventory sits at a 3.3-month supply at the current sales pace, up from 3.1 months in September and 2.4 months in October 2021.

“Inventory levels are still tight, which is why some homes for sale are still receiving multiple offers,” Yun added. “In October, 24% of homes received over the asking price. Conversely, homes sitting on the market for more than 120 days saw prices reduced by an average of 15.8%.”

According to Zillow’s Real Estate Market Report, a monthly overview of the national and local real estate markets, buyers and sellers are both stepping away as skyrocketing mortgage rates have settled the housing market into a more balanced state. Home values remained nearly flat in October as new inventory waned and sales continued to fall from the pandemic frenzy, noted the Seattle-based real estate analytics giant.

“Home prices in October remained in suspended animation as more buyers, but especially sellers, took a wait-and-see approach to market conditions,” said Skylar Olsen, chief economist at Zillow. “Fewer home sales is the hallmark of a housing market lull, but right now potential sellers sensitive to losing their historically low mortgage rates have as much, if not more, of a reason to wait for a robust spring season and hope for mortgage rate relief. With some renewed competition, buyers hoping for aggressive price declines may be disappointed in all but the frothiest pandemic-era markets.”

Rapidly rising mortgage rates coupled with stubbornly high home prices are driving drastic drops in affordability. The share of income spent on monthly mortgage payments has risen from 27.7% in February to 37.3% in October — well above a previous peak of 35% in 2006. Housing payments are considered to be a financial burden when they exceed 30% of a household’s income.

Average U.S. home price in October jumped to nearly $380,000

The median existing-home price for all housing types in October was $379,100, a gain of 6.6% from $355,700 a year ago as prices rose in all regions. This marks 128 consecutive months of year-over-year increases, the longest-running streak on record.

The monthly mortgage payment on the purchase of a typical house in the U.S., even when putting 20% down, was $1,910 in October. That’s a 77% jump year over year and a 107% increase — nearly $1,000 — from 2019. Monthly payment figures are even higher when including taxes and insurance and when putting less than 20% down, as more than half of borrowers do.

Affordability challenges are weighing heavily on sales. Sales counts, nowcast for the most recent month due to latency, show significant slowing in recent months and standing 16% to 17% below pre-pandemic October norms.

While it’s tempting to focus on buyers, mortgage-rate-driven affordability changes are highly impactful on seller behavior, keeping more existing homes out of the market. While first-time buyers have experienced continued pressure on rent as well, homeowners who bought or refinanced when rates were near record lows in 2020 and 2021 are sitting on substantial home value gains and have little incentive to take out a new home loan, deciding instead to enjoy their current monthly payment.

To that point, the number of new for-sale listings dropped by more than 12% month over month, bringing the flow of listings to the market 24% lower than in 2021 and 21% below 2019. The steepest drops in new listings from September came in Seattle (-28.5%), Denver (-26%) and Washington, D.C. (-24.2%). New inventory increased month over month in two major metros — Jacksonville (3.1%) and Tampa (1.3%) — while the smallest declines took place in other Florida cities and across relatively affordable metros in the Midwest.

The drastic pullback of new listings has stalled the recovery in total inventory that began in March. There are slightly more (1.8%) for-sale listings on Zillow than a year ago, but still far fewer (-36.1%) than in October 2019.

According to NAR, properties typically remained on the market for 21 days in October, up from 19 days in September and 18 days in October 2021. Sixty-four percent of homes sold in October 2022 were on the market for less than a month.

First-time buyers were responsible for 28% of sales in October, down from 29% in both September 2022 and October 2021. NAR’s 2022 Profile of Home Buyers and Sellers — released earlier this month — found that the annual share of first-time buyers was 26%, the lowest since NAR began tracking the data. All-cash sales accounted for 26% of transactions in October, up from 22% in September and 24% in October 2021.

Individual investors or second-home buyers, who make up many cash sales, purchased 16% of homes in October, up from 15% in September, but down from 17% in October 2021. Distressed sales — foreclosures and short sales — represented 1% of sales in October, down from 2% in September and identical to October 2021.

According to Freddie Mac, the average commitment rate for a 30-year, conventional, fixed-rate mortgage was 6.90% in October, up from 6.11% in September. The average commitment rate across all of 2021 was 2.96%.

“Mortgage rates have come down since peaking in mid-November, so home sales may be close to reaching the bottom in the current housing cycle,” Yun said.

Realtor.com’s Market Trends Report in October shows that the largest year-over-year median list price growth occurred in Milwaukee (+34.5%), Miami (+25.1%) and Kansas City (+21.4%). Phoenix reported the highest increase in the share of homes that had prices reduced compared to last year (+35.9 percentage points), followed by Austin (+31.2 percentage points) and Las Vegas (+24.4 percentage points).

Single-family home sales declined to a seasonally adjusted annual rate of 3.95 million in October, down 6.4% from 4.22 million in September and 28.2% from one year ago. The median existing single-family home price was $384,900 in October, up 6.2% from October 2021.

By region, existing-home sales in the Northeast trailed off 6.6% from September to an annual rate of 570,000 in October, a decline of 23.0% from October 2021. The median price in the Northeast was $408,700, an increase of 8.0% from the previous year.

Existing-home sales in the Midwest retracted 5.3% from the previous month to an annual rate of 1,080,000 in October, falling 25.5% from the prior year. The median price in the Midwest was $274,500, up 5.9% from October 2021.

In the South region, which includes Arkansas, existing-home sales declined 4.8% in October from September to an annual rate of 1,980,000, a 27.2% decrease from this time last year. The median price in the South was $346,300, an increase of 8.0% from one year ago.

Existing-home sales in the West waned 9.1% from September to an annual rate of 800,000 in October, down 37.5% from one year ago. The median price in the West was $588,400, a 5.3% increase from October 2021. The National Association of Realtors® is America’s largest trade association, representing more than 1.5 million members involved in all aspects of the residential and commercial real estate industries.