Yuletide Forecast: Cash-strapped holiday shoppers adjust to inflation, higher prices

November 28 - December 4, 2022

By The Daily Record Staff

Holiday spending is expected to be healthy heading into Black Friday, but inflationary challenges could mean fewer pricey gifts, less decorations, and more celebrations closer to home.

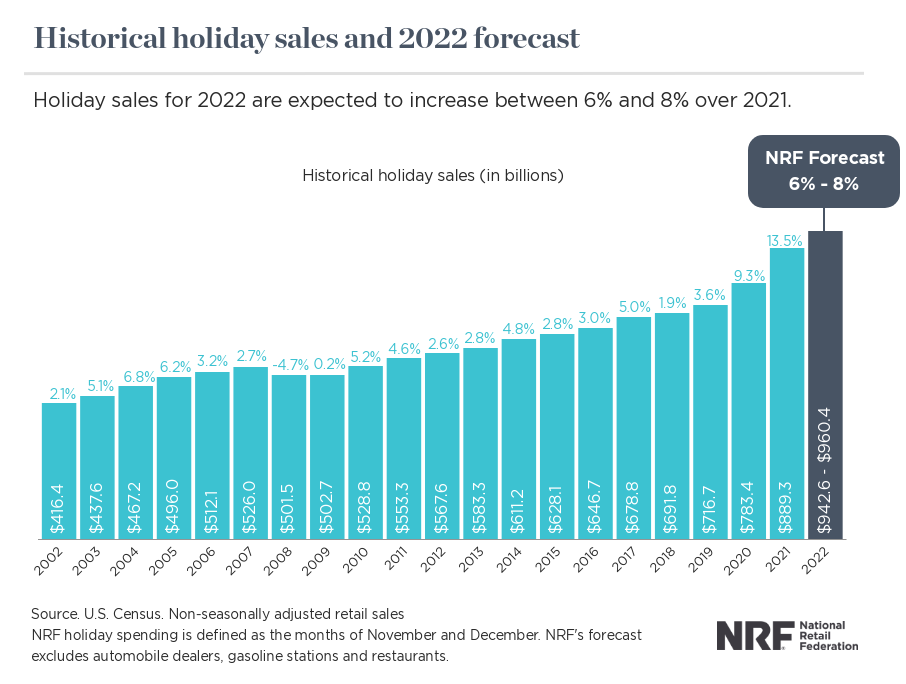

The National Retail Federation (NRF)on Nov. 3 forecasted that holiday retail sales during November and December will grow between 6% and 8% over 2021 to between $942.6 billion and $960.4 billion. Last year’s holiday sales grew 13.5% over 2020 and totaled $889.3 billion, shattering previous records. Holiday retail sales have averaged an increase of 4.9% over the past 10 years, with pandemic spending in recent years accounting for considerable gains.

“While consumers are feeling the pressure of inflation and higher prices, and while there is continued stratification with consumer spending and behavior among households at different income levels, consumers remain resilient and continue to engage in commerce,” NRF President and CEO Matthew Shay said. “In the face of these challenges, many households will supplement spending with savings and credit to provide a cushion and result in a positive holiday season.”

NRF expects online and other non-store sales, which are included in the total, to increase between 10% and 12% to between $262.8 billion and $267.6 billion. This figure is up from $238.9 billion last year, which saw extraordinary growth in digital channels as consumers turned to online shopping to meet their holiday needs during the pandemic. While ecommerce will remain important, households are also expected to shift back to in-store shopping and a more traditional holiday shopping experience.

“This holiday season cycle is anything but typical,” NRF Chief Economist Jack Kleinhenz said. “NRF’s holiday forecast takes a number of factors into consideration, but the overall outlook is generally positive as consumer fundamentals continue to support economic activity. Despite record levels of inflation, rising interest rates and low levels of confidence, consumers have been steadfast in their spending and remain in the driver’s seat.”

“The holiday shopping season kicked off earlier this year – a growing trend in recent years – as shoppers are concerned about inflation and availability of products,” Kleinhenz said. “Retailers are responding to that demand, as we saw several major scheduled buying events in October. While this may result in some sales being pulled forward, we expect to see continued deals and promotions throughout the remaining months.”

Kleinhenz’ comments mirror NRF’s consumer data, which shows that consumers have been kicking off their holiday shopping early over the last decade in order to spread out their budgets and avoid the stress of holiday shopping. This year, given concerns around inflation, 46% of holiday shoppers said they planned to browse or buy before November, according to NRF’s annual survey conducted by Prosper Insights & Analytics. Still, consumers plan to spend $832.84 on average on gifts and holiday items such as decorations and food, in line with the average for the last 10 years.

NRF expects retailers will hire between 450,000 and 600,000 seasonal workers. That compares with 669,800 seasonal hires in 2021. Some of this hiring may have been pulled into October as many retailers are eager to supplement their workforces to meet increased consumer demand.

While retailers face a multitude of challenges, one is totally out of their hands. Weather, as always, plays a role in holiday retail sales. The National Oceanic and Atmospheric Administration is forecasting warmer-than-average temperatures for the Southwest, Gulf Coast and Eastern Seaboard, which cover a large swath of the U.S. population, but wetter and snowier conditions are expected for parts of the northern tier.

NRF’s holiday forecast is in line with the organization’s full year forecast for retail sales, which predicted retail sales will grow between 6% and 8% to more than $4.86 trillion in 2022.

NRF’s holiday forecast is based on economic modeling that considers a variety of indicators including employment, wages, consumer confidence, disposable income, consumer credit, previous retail sales and weather. NRF’s calculation excludes automobile dealers, gasoline stations and restaurants to focus on core retail. NRF defines the holiday season as November 1 through December 31.

*The methodology used to calculate holiday retail employment in 2020 was changed to accommodate the sizeable impact of COVID-19 on overall industry employment. In 2021, NRF returned to a traditional employment buildup method.

NRF balanced high inflation and rising interest rates against strong consumer fundamentals as it developed its 2022 holiday spending forecast, said Kleinhenz.

“There are many factors impacting our holiday forecast, but business conditions are generally positive as consumer fundamentals continue to support economic activity,” Kleinhenz said. “Despite record levels of inflation, rising interest rates and low levels of confidence, consumers have been steadfast in their spending and remain in the driver’s seat. The latest figures show the economy is holding together better than may have been expected.”

Kleinhenz’s remarks came in the November issue of NRF’s Monthly Economic Review, which noted that gross domestic product rose by 2.6% in the third quarter. The NRF economist called that “a healthy increase that should override any remaining fears that the economy is in a recession.”

Consumers’ willingness to spend has been “clearly impacted by inflation” but their ability to spend has been supported by job growth, rising wages and tapping into savings accumulated during the pandemic,” the report said. September consumer spending rose 0.6% from August, which underscored that “demand remains strong and can be expected to continue.”

Jolly high-income consumers vs. Grinch-impacted middle-wage earners

Although not as cheery as the NRF’s annual yuletide report, the highly watched holiday spending forecast by Price Waterhouse Coopers (PwC) notes that most consumers plan to spend the same or more this holiday season as they did last year. Despite citing fears of inflation and the rising costs of transportation and utilities as deterrents to holiday spending, some consumers aware they might have to stretch holiday spending started to cut back in the earlier months on splurging on discretionary items such as dining out, apparel and streaming services.

Still, PwC predicts 35% of shoppers plan to spend more than they did last year. High-earning young shoppers, these big spenders skew male and live in metropolitan areas. In addition to spending on their families, they will also spend more on themselves than the average holiday shopper.

Overall, consumers plan to spend an average of $1,430 on gifts, travel and entertainment this year, including $754 on gifts, $452 on travel, and $224 on entertainment. That is similar to the $1,447 in 2021, and up 20% over pandemic-ravaged 2020 and more than 10% over 2019.

Higher income households — whose purchasing power has increased in recent months as their personal incomes have grown — will spend considerably more this holiday than they did last year, the PwC survey notes. Unlike middle- and lower-income households, their spending patterns over the last several months have remained unchanged, despite inflation.

In fact, while holiday budgets for consumers at large remain essentially the same as last year, those with household incomes of $120,000 and above will increase holiday spending by 15%. They will spend $2,759 on gifts, entertainment and travel — close to double the $1,430 average.

As in previous years, millennials (ages 26-40) are primed to spend, with an average budget of $1,823 — 27% higher than consumers overall. In fact, almost half (48%) expect to spend more this holiday season than they did in 2021, compared to 35% for all age groups.

They are also more likely to travel this holiday (63% v 47% for all consumers). Often residing in large metropolitan areas, they are less likely to have to deal with the price of gas, given much shorter commutes, often via public transportation. And in the wake of the pandemic job reshuffling, many have traded up for higher paying roles in a job-seeker’s market.

Six in 10 millennials belong to a customer loyalty program and 66% have a brand or retailer credit card, which influences online browsing (77%) and in-store shopping (79%) — higher than any other age group.

Meanwhile, another holiday survey by Dallas-based credit monitor Scoresense says nearly 50% of consumers plan to use cash to finance their holiday spending. The Nov. 15 report forecast that 41% of survey respondents also plan to spend less than last year on holiday gifts, décor, and travel this year.

Another 15% of respondents believe holiday spending will somewhat or significantly affect their current debt. 29% are unsure how it will affect them. Nineteen percent plan to reduce holiday travel to better manage their budgets this year.

As note, almost half of respondents (49%) said they plan to use cash to finance their holiday spending. Scoresense’ post-holiday spending survey a year ago found that 49% of respondents also said they used cash and had no credit cards to pay off. Another 25% of respondents plan to pay off credit cards immediately.

“Inflation is the Grinch that is stealing from a lot of families this holiday season,” said Carlos Medina, senior vice president at One Technologies LLC., parent company of ScoreSense. “While many respondents in our survey said they intend to pay cash and pay off credit charges immediately, we still see that a lot of families are struggling.”

Black Friday bonanza

Despite concerns about spending, an estimated 166.3 million people still plan to shop from Thanksgiving Day through Cyber Monday this year, according to NRF’s released Nov. 17 with Prosper Insights & Analytics. This figure is almost 8 million more people than last year and is the highest estimate since NRF began tracking this data in 2017.

“While there is much speculation about inflation’s impact on consumer behavior, our data tells us that this Thanksgiving holiday weekend will see robust store traffic with a record number of shoppers taking advantage of value pricing,” said Shay. “We are optimistic that retail sales will remain strong in the weeks ahead, and retailers are ready to meet consumers however they want to shop with great products at prices they want to pay.”

According to the survey, more than two-thirds (69%) of holiday shoppers plan to shop during Thanksgiving weekend this year. The top reasons consumers plan to shop are because the deals are too good to pass up (59%), because of tradition (27%) or because it is something to do (22%) over the holiday.

Black Friday continues to be the most popular day to shop, with 69% (114.9 million) planning to shop then, followed by 38% (63.9 million) on Cyber Monday. Among the 114.9 million Black Friday shoppers, 67% say they expect to head to stores, up from 64% in 2021.

Similar to 2020 and 2021, this year, 60% of holiday shoppers had started browsing and buying for the season as of early November. This consumer trend of earlier shopping was accelerated by the pandemic. In 2019, 56% of holiday shoppers had started their shopping around this time.

“While consumers continue to save the bulk of their holiday shopping for later in November and December, some of that spending has shifted into October,” Prosper Executive Vice President of Strategy Phil Rist said. “This year, 18% of holiday shoppers have completed at least half of their holiday shopping. While this is on par with last year, it is up from only 11% a decade ago.”

Online search (43%) remains the most popular source of gift inspiration, followed by friends and family (35%) and within a retail store (31%). The top five gift categories consumers plan to give are clothing (55%), followed by gift cards at 45%, toys at 37%, books/music/movies/video games at 33% and food/candy at 31%.

Gift cards remain a favorite gift item, with total spending expected to reach $28.6 billion, compared with $28.1 billion in 2021. Similar to last year, holiday shoppers plan to purchase between three to four gift cards and spend an average of $51.47 per card ($165.87 per person). Consumers are most likely to purchase a gift card for a restaurant (27%), department store (26%) or bank-issued gift card (25%). Another 10% plan to purchase a food delivery service gift card such as Door Dash or Uber Eats.

For those buying for children, the top toys for boys this year include Lego, Hot Wheels, cars and trucks, PlayStation, video games, Pokémon, Nerf, 8. electric/remote control cars, dinosaurs, and Xbox. For girls, the top toys are Barbie, dolls, L.O.L. dolls, Lego, makeup, Squishmallows, American Girl and apparel (tied), Disney-related items, cell phone and Magic Mixies.

The survey of 7,719 adult consumers was conducted November 1-8 and has a margin of error of plus or minus 1.1 percentage points.

Photo Captions:

1. Cash-strapped holiday shoppers adjust to inflation, higher prices

2. An estimated 166.3 million people still plan to shop from Thanksgiving Day through Cyber Monday this year, according to the National Retail Federation.

3. U.S. retail sales for the holiday are forecast to top $960 million. Bentonville-based Walmart, the nation's largest brick-and-mortar retailer is expecting yuletide sales to rise only 3% this year.

4. Above: Amazon will also be operating five staffed pop-up stores at Whole Foods in Illinois, Michigan, Florida, California and Colorado, focused on “ holiday sales and entertaining,"