As PPP era ends, SBA shifts to community-based programs for businesses still struggling from side-effects of COVID-19

May 31 - June 6, 2021

As the U.S. Small Business Administration’s centerpiece Paycheck Protection Program (PPP) quietly sunsets during the Memorial Day weekend, the Biden administration is now shifting operations to focus on small business owners still struggling from the affects of the pandemic as the economy fully reopens.

On Tuesday (May 25), the SBA began accepting applications for its new Community Navigator Pilot Program. This new initiative, established by the Biden administration’s $2.2 trillion American Rescue Plan on March 11, will leverage a community navigator approach with a priority focus on those owned by “socially and economically disadvantaged individuals,” as well as women and veterans, agency officials said.

SBA will accept applications through July 12 and anticipates making award decisions by August. The new Democratic administration under President Joe Biden and Vice President Kamala Harris has made delivering COVID-19 relief to hard-hit small businesses a top priority as SBA officials said they will continue to take steps to ensure that model continues.

“The Community Navigator Pilot Program is a crucial addition to our SBA programs because it helps us to connect with small businesses that have historically been underserved or left behind. These businesses – the smallest of the small in rural and urban America, and those owned by women, people of color, or veterans – have suffered the greatest economic loss from this pandemic,” said SBA Administrator Isabella Casillas Guzman. “We’ll be using a hub and spoke model in local regions across the nation to bridge the gap between local entrepreneurs and SBA’s resources and programs. If we’re going to build back better, we need to ensure that all entrepreneurs have the support they need to recover.”

In February 2021, Congress met to provide a blueprint on assistance to small businesses with provisions under the American Rescue Plan. Members of Congress met with constituents to discover at local levels the impact of the pandemic and the effect it is having on businesses that may have been left out in early rounds of relief.

The Community Navigator Notice of Funding Opportunity will also be open to applications from nonprofit organizations, state, local, and tribal governments, SBA resource partners, and other organizations. Selected partners will engage in targeted outreach for small businesses in underserved communities to help small businesses get the resources and support they need to get back on track as the economy continues to recover from the COVID-19 pandemic.

“The SBA understands the importance of partnering with organizations as well as smaller, local institutions that are already embedded in the fabric of the Main Street business communities they serve,” added Natalie Madiera Cofield, assistant administrator for the Office of Women’s Business Ownership. “Community Navigators are the backbone of aiding underserved and underrepresented communities across the nation with recovery.”

Key in this initiative are partners and people in the community, serving as a two-way information stream, enabling enterprising business owners to receive the help needed from the SBA. Community Navigator Pilot will also provide counseling, networking, and the assistance needed during this time of economic recovery.

PHOTO CAPTIONS:

1. SBA Shifts Gears: COVID-19 business relief turns to aiding economic recovery of nation’s smallest businesses.

2. The U.S. Small Business Administration will shut down the Paycheck Protection Program on May 31 after providing more than $1 trillion in forgivable loans since March 2020.

3. After Gov. Asa Hutchinson recently announced the end of Arkansas' COVID-19 health emergency on May 30, businesses on Little Rock's Main Street Corridor are slowly reopening to the public again.

4. CityPost digital kiosks with seven-foot, interactive smart screens allow downtown Little Rock residents and visitors to learn about local restaurants, entertainment, upcoming events, and advertising deals. Under a 2018 city agreement, there are kiosks planned for the downtown area. Competitive grant awards will range from $1 million to $5 million for a two-year performance period. Applicants have until July 12, 2021, to submit their applications at grants.gov. Performance periods are projected to commence in September 2021. Those eligible to apply must meet and demonstrate abilities to support the requirements of this funding opportunity. For more information on the Community Navigators Initiative, please visit www.sba.gov/navigators.

In additional to the $100 million navigator program, the SBA and the non-profit Public Private Strategies Institute recently announced the launch a new regional webinar series, “Getting Back on Track: Help is Here,” to provide Main Street entrepreneurs with the information and resources they need to continue to recover from the COVID-19 pandemic.

The educational webinars will feature speakers from The White House, the SBA, Members of Congress, and small business leaders, and will provide updates on President Joe Biden’s $2.2 trillion American Rescue Plan. The webinar for SBA Region 6, which includes Arkansas, Louisiana, New Mexico, Oklahoma, and Texas, will be held on June 24.

“The ‘Getting Back on Track: Help is Here’ webinar series is an important outreach effort to help small businesses recover, rebuild and gain resiliency,” said Guzman. “Small businesses are beginning to see the light at the end of the tunnel as marketplaces and main streets reopen thanks to strong vaccination rates. We are empowering small businesses to reopen fully and safely by connecting them with helpful resources and tools, including the Biden-Administration’s tax credits that cover paid time-off for employees getting vaccinated. We all must double down on our efforts to help our beloved small businesses survive and get our economy back on track.”

“This webinar series is designed to reach the hardest-hit small business owners across the country with regionally focused conversations connecting them to local resources and to give them the steps they need to build back better,” said Rhett Buttle, Public Private Strategies Institute senior advisor. “The program will focus on three key areas: economic recovery and access to capital options, digital tools, and resources to allow small business owners to be vaccine leaders with their employees and communities.”

The new series builds on a successful national webinar series hosted by the SBA and Public Private Strategies Institute, highlighting the Biden-Harris Administration’s action to create additional access to the Paycheck Protection Program for America’s smallest businesses. That webinar series provided resources and information to more than 80,000 small business owners across the country.

To join one of the regional webinars and learn more about programs that will help small businesses get back on track, register at the following website: https://www.publicprivatestrategies.com/back-on-track?utm_medium=email&utm_source=govdelivery

PPP, EIDL outlays top $1 trillion

Both the Getting Back on Track and Community Navigator programs began this month nearly 14 months after the PPP program was unveiled on March 27, 2020 under the $2.2 trillion Coronavirus Aid, Relief and Economic Security (CARES) Act signed into law by former President Donald Trump. It will officially this week, two months after President Biden extended the program through May 31 or until remaining funds are exhausted.

The much ballyhooed PPP initiative was first launched on April 17, 2020 but was abruptly halted after U.S. banks approved nearly 1.7 million PPP loans totaling $342.3 billion in just two weeks, mostly to preferred customers and larger corporations with over $1 million in revenue.

According to one federal lawsuit filed against Bank of America, Wells Fargo, and other Wall Street financiers, however many SBA lenders processed larger loan amounts first because of profitable origination fees instead of complying with the CARES Act’s “first-come, first-served” application rules. According to a federal class action complaint, that method left more than 90% of the true “mom-and-pop” small businesses still in the SBA’s queue once funds were gone.

In March, The Department of Justice announced an update on criminal and civil enforcement efforts to combat COVID-19 related fraud, including schemes targeting the PPP, Economic Injury Disaster Loan (EIDL) program and Unemployment Insurance (UI) programs that offered up to $600 per week in expanded jobless benefits.

And the end of the first quarter, the DOJ has publicly charged 474 defendants with criminal offenses based on fraud schemes connected to the COVID-19 pandemic. These cases involve attempts to obtain over $569 million from the U.S. government and unsuspecting individuals through fraud and have been brought in 56 federal districts around the country. These cases reflect a degree of reach, coordination, and expertise that is critical for enforcement efforts against COVID-19 related fraud to have a meaningful impact and is also emblematic of the Justice Department’s response to criminal wrongdoing.

“The Department of Justice has led an historic enforcement initiative to detect and disrupt COVID-19 related fraud schemes,” said Attorney General Merrick B. Garland. “The impact of the department’s work to date sends a clear and unmistakable message to those who would exploit a national emergency to steal taxpayer-funded resources from vulnerable individuals and small businesses. We are committed to protecting the American people and the integrity of the critical lifelines provided for them by Congress, and we will continue to respond to this challenge.”

As noted by the Justice Department, the CARES Act also expanded COVID-19 eligibility to its former EIDL program, which originally provided low-interest, long-term loans to include larger businesses, cooperatives, employee-owned stock ownership plans, and Indian tribes with not more than 500 employees.

Although not as well-known as the SBA’s larger PPP that was flagship emergency relief plan under the CARES Act, the EIDL initial received more publicity due to a $10,000 grant that was provided to small business owners within days after COVID-19 was declared a global pandemic. In early May 2020, Congress approved another $384 billion in emergency CARES Act relief, including $320 billion appropriated for the PPP initiative and $20 billion for the EIDL program.

After Congress approved a second round $320 billion in funding for the PPP two days after Christmas, SBA granted dedicated access to Community Development Financial Institutions (CFIs), minority-owned banks, and fintech platforms as part of the agency’s ongoing efforts to reach underserved and minority-owned small businesses.

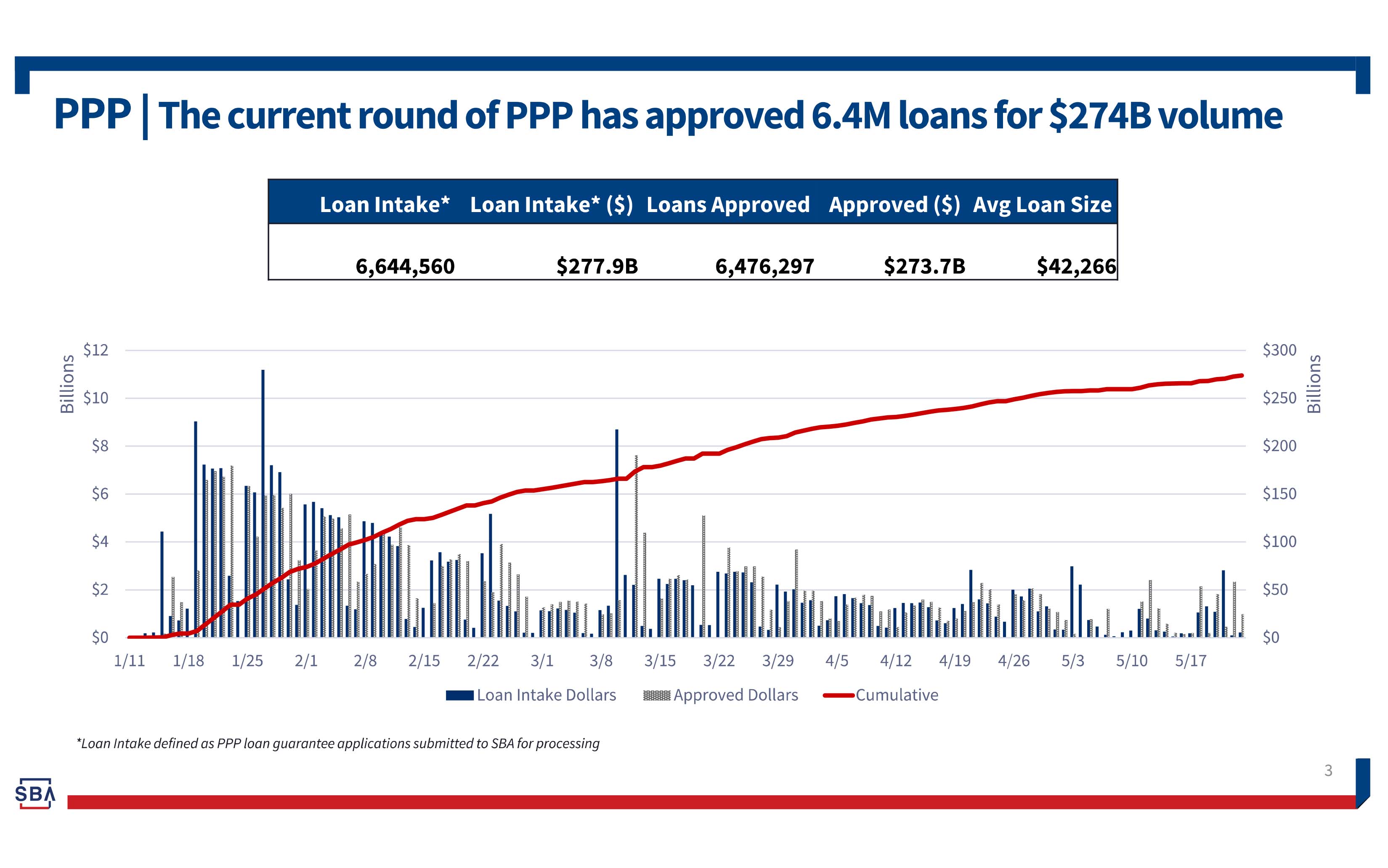

Another $284 billion was approved through the Biden administration’s second draw PPP loan as the SBA has shifted origination of PPP and Emergency Injury Disaster loans through Community Development Finance Institutions, microlenders and minority-owned banks. Following the change in administration after President Biden took office in the January, the SBA has mostly focused on first and second draw loans for employers with fewer than 300 workers.

In addition, SBA offices in all 50 states have unveiled targeted programs such as the Shuttered Venue Operators grant and the Restaurant Revitalization Fund to aid frontline industries impacted by the COVID-19 pandemic. The $28.6 billion restaurant established under Biden’s rescue plan also set aside an initial $5 billion for applicants with gross receipts not more than $500,000.

“If our nation’s food and beverage industry is going to fully recover, we must ensure as many of the hardest-hit businesses get the economic aid they need,” said Guzman. “We are committed to creating easy to navigate programs and removing barriers that have kept many of our nation’s smallest businesses from accessing these crucial economic lifelines.

Through the RRF’s application deadline on May 24, the program has received more than 303,000 applications representing over $69 billion in requested funds, and nearly 38,000 applicants have been approved for more than $6 billion. Of the overall submitted applications, 57% came from women, veterans, and socially and economically disadvantaged business owners, SBA data shows.

“The numbers speak to the commitment SBA made to educating owners and operators through their work with the Association, our state partners, and other industry support organizations,” said Tom Bené, President & CEO of the National Restaurant Association.

“The funds that have already been distributed will help accelerate the recovery of thousands of restaurants and bring much-needed capital to communities across the country,” said Bene, whose organization reported last week that 90,000 eating and drinking place establishments remain completely closed either permanently or long-term due to the ongoing pandemic.

Altogether, 11,618,144 PPP loans totaling $795.9 billion have been approved by the SBA since the emergency loan program has been extended three times by Congress since the pandemic started 14 months ago. Just over $274 billion of the PPP “second draw” loans have been expended in 2021 mostly to true mom-and-pop small business owners.

The smaller EIDL loan program that provided a second-round of targeted advance payments and emergency loans to struggling small businesses impacted by COVID-19 has disbursed an additional $205 billion since April 2020. Altogether, the nation’s signature COVID-19 financial assistance and small business bailout program has handed out just over $1 trillion as of May 24, while $279.4 billion of loans have been forgiven, according to the SBA’s latest data report.

In Arkansas, the SBA has handed out 93,959 PPP loans totaling more than $4.9 billion since the program began in early 2020. The average PPP loan in Arkansas totaled $51,710 to companies with seven employees.