Congress’ three-phase COVID-19 relief package promises small businesses support

March 30 - April 5, 2020

By Daily Record Staff

Final $2 Trillion stimulus offers $1,250 check to most Americans, extra $350 billion in forgivable bridge loans to small business owners

As Arkansas economy deals with the devastating fallout from the rapid spread of COVID-19, President Donald Trump has signed into law the first two of at least three coronavirus relief bills to help small business stays afloat through the next several weeks or possibly months.

The first two bills, known respectively as the Coronavirus Preparedness and Response Supplemental Appropriations Act (HR 6074 and Families First Coronavirus Response Act (HR 6201), were intended as measures to help U.S. workers and small businesses. However, as details of the bills become clearer, some small business groups and advocates are calling on the Trump administration and Congress to do more to abate the possible collapse of the U.S. job market and economy.

For example, the Families First Coronavirus Response Act requires all small businesses with fewer than 500 employees to provide employees with 10 days of fully paid sick leave. It further requires all small businesses to provide up to 12 weeks of family leave at two-thirds pay.

The legislation, which was the second coronavirus relief bill approved by Congress on March 18, was intended as a measure to help workers dealing with the coronavirus pandemic, but larger businesses are exempted from the paid leave requirements. NFIB President Brad Close said although the new law will minimize the impact on the nation’s workforce, it will hurt the small business owners who employ most of them.

“We appreciate Congress’ efforts to lessen the impact of COVID-19 on American workers, small businesses, and our national economy, but imposing costly and unsustainable mandates on small businesses is not the answer,” said Close. “(S)mall businesses in every state are facing extremely low foot traffic, reduced revenues, and are struggling to remain afloat. Our members are telling us, in droves, that the additional mandates in this bill could be a devastating blow they cannot afford to shoulder.

Although Close and other small business owners and advocates are still absorbing details of the two bills, the initial Coronavirus Preparedness and Response Supplemental Appropriations Act provides $8.3 billion in emergency funding for federal agencies to respond to the coronavirus outbreak in fiscal 2020, which ends on Sept. 30. In the breakdown of the bill, Congress approved supplemental appropriations for the Department of Health and Human Services (HHS), the State Department, and the Small Business Administration to respond to the coronavirus outbreak.

The lion’s share of the first leg of funding allotted for mostly first, second and third quarters of the current fiscal year will be funneled through the U.S. Department of Health and Human Services, including funding for international relief and outreach. For small businesses owners in Arkansas and the U.S., most of the emergency spending funding, H.B. will come through the nation’s local SBA offices, including the Arkansas District office on Little Rock’s Riverfront Drive.

“The President took bold, decisive action to make our 30 million small businesses more resilient to Coronavirus-related economic disruptions. Small businesses are vital economic engines in every community and state, and they have helped make our economy the strongest in the world,” said SBA Administrator Jovita Carranza. “Our Agency will work directly with state Governors to provide targeted, low-interest disaster recovery loans to small businesses that have been severely impacted by the situation.

“Additionally, the SBA continues to assist small businesses with counseling and navigating their own preparedness plans through our network of 68 District Offices and numerous Resource Partners located around the country,” continued Carranza. “The SBA will continue to provide every small business with the most effective and customer-focused response possible during these times of uncertainty.”

Economic Injury Disaster Loans also offer up to $2 million in assistance for a small business. These loans can provide vital economic support to small businesses to help overcome the temporary loss of revenue they are experiencing, Arkansas SBA officials said.

Below is the process for accessing SBA’s Coronavirus (COVID-19) Disaster Relief Lending

The U.S. Small Business Administration is offering designated states and territories low-interest federal disaster loans for working capital to small businesses suffering substantial economic injury as a result of the Coronavirus (COVID-19). Upon a request received from a state’s or territory’s Governor, SBA will issue under its own authority, as provided by the Coronavirus Preparedness and Response Supplemental Appropriations Act that was recently signed by the President, an Economic Injury Disaster Loan declaration.

Any such Economic Injury Disaster Loan assistance declaration issued by the SBA makes loans available to small businesses and private, non-profit organizations in designated areas of a state or territory to help alleviate economic injury caused by the Coronavirus (COVID-19).

SBA’s Office of Disaster Assistance will coordinate with the state’s or territory’s Governor to submit the request for Economic Injury Disaster Loan assistance.

Once a declaration is made for designated areas within a state, the information on the application process for Economic Injury Disaster Loan assistance will be made available to all affected communities.

These loans may be used to pay fixed debts, payroll, accounts payable and other bills that can’t be paid because of the disaster’s impact. The interest rate is 3.75% for small businesses without credit available elsewhere; businesses with credit available elsewhere are not eligible. The interest rate for non-profits is 2.75%.

SBA offers loans with long-term repayments in order to keep payments affordable, up to a maximum of 30 years. Terms are determined on a case-by-case basis, based upon each borrower’s ability to repay.

SBA’s Economic Injury Disaster Loans are just one piece of the expanded focus of the federal government’s coordinated response, and the SBA is strongly committed to providing the most effective and customer-focused response possible.

As noted, the second part of the COVID-19 response legislation, H.B. 6201 or Families First Coronavirus Response Act, responds to the coronavirus outbreak by providing paid sick leave and free coronavirus testing, expanding food assistance and unemployment benefits, and requiring employers to provide additional protections for health care workers.

The final bill approved by Congress, which takes effect for most covered employers no later than 15 days after enactment and sunsets on Dec. 31, 2020, contains numerous provisions affecting small businesses and individuals. Here is an overview of the key elements, which generally apply to private employers with fewer than 500 employees:

Emergency Family Medical Leave (FML) Expansion Act: Temporarily expands the provisions under the Federal Family and Medical Leave Act specifically to address COVID-19-related absences.

Eligible employees, who have worked for their employer for 30 days, who qualify for leave under the expanded reasons for leave, would be paid by their employer after the first 10 days of leave at a rate of no less than two-thirds of their current rate of pay.

There is cap of $200 per day, up to a maximum $10,000, for up to 12 weeks in the benefit year.

Employees are permitted to take but employers cannot require the use of any other paid time off during their leave.

Employees covered under a multi-employer bargaining agreement are addressed separately in the legislation.

Some exemptions apply for employers of health care workers.

Payroll Credit for Required Paid Family Leave: This refundable tax credit is designed to reimburse 100 percent of wages paid by the employer under the new Emergency FML expansion for each calendar quarter.

The tax credit is allowed against the employer portion of the tax-imposed Social Security rate of 6.2 percent and the Medicare rate of 1.45 percent.

The amount is capped for each employee at $200 per day and $10,000 for all calendar quarters.

If the credit exceeds the employer’s total liability of the employer portion of Social Security and Medicare in any calendar quarter, the excess credit is refundable to the employer.

Specific rules apply that prevent a double tax benefit.

Emergency Paid Sick Leave (PSL) Act: Employers are required to provide paid sick time, available for immediate use, to each employee requiring such time for specific reasons associated with the COVID-19 pandemic, including quarantines, currently seeking a diagnosis due to symptoms, or caring for an individual who is under quarantine or for a child whose school/care is closed due to COVID-19.

Provide up to 80 hours of paid sick leave (PSL) to eligible full-time employees and pro-rate part-time employee paid sick time based on the average number of hours regularly scheduled in a two-week period.

The calculation and caps for compensation vary dependent on the reason for leave with a maximum of $511 per day if the employee is the individual directly impacted and up to $200 per day if it is for care of someone else. Aggregate caps exist as well.

Employees may not be required to use other available paid time off before using paid sick time under this Act.

Employees covered under a multi-employer bargaining agreement are addressed separately in the legislation.

Some exemptions apply for employers of health care workers.

Employers will be required to post a notice of employee rights; the U.S. Secretary of Labor will provide a model notice within seven days of enactment.

Paid sick time provided under this Act is not preempted by other federal, state, or local law.

Payroll Credit for Required Paid Sick Leave (PSL): This refundable tax credit is designed to reimburse 100 percent of wages paid by the employer under the new Emergency PSL for each calendar quarter.

The tax credit is allowed against the employer portion of the tax imposed Social Security rate of 6.2 percent and the Medicare rate of 1.45 percent.

The amount is capped at the maximums of $511 or $200 per day, depending on the reason.

If the credit exceeds the employer’s total liability of the employer portion of Social Security and Medicare in any calendar quarter, the excess credit is refundable to the employer.

Specific rules apply that prevent a double tax benefit.

Other General Provisions:

Emergency Unemployment Insurance Stabilization and Access Act of 2020: The bill provides $1 billion in emergency grants to states for activities related to facilitating unemployment insurance benefits, under certain conditions.

$500 million will be used to provide immediate additional funding to all states for staffing, technology, systems, and other administrative costs, provided certain requirements are met.

The remaining $500 million would be set aside in reserve for emergency grants to states which experienced at least a 10 percent increase in unemployment. Those states would be eligible to receive an additional grant, if certain conditions are met.

The U.S. Secretary of Labor will also work with states that want to implement work-sharing programs.

Coverage of Testing for COVID-19: Diagnostic testing and provider visits related to COVID-19 testing, including office visits, urgent care visits, and emergency room visits, must be provided without any co-pays, coinsurance, or deductibles.

Additionally, no prior authorizations may be required for testing.

These provisions would apply to any health insurance plans, including individual and group health plans, Medicare, and Medicaid.

Additionally, federal funding will be provided for uninsured individuals to receive reimbursement for COVID-19 testing and related services.

Close said the NFIB, which has state chapters in Arkansas and all other remaining U.S. states, is also closely watching the ongoing conversations surrounding the next phase of $1.8 trillion-plus coronavirus relief package. That bill, known as Coronavirus Aid, Relief, and Economic Security Act or the CARES Act, is tied up in the Senate on a $500 billion discretionary fund held by the U.S. Treasury that opponents fear will be used to bailout the airline industry and other selected sectors.

That bill would send a $1,200 check to most Americans, bolster the unemployment insurance system, and disburse a broad range of emergency funds to help reinforce hospitals and other areas. Another $350 billion is also targeted for small businesses to prevent more layoffs by offering forgivable bridge loans and additional funding for grants and technical assistance.

“Small business owners need relief now, and we look forward to continuing to work with Congress and the administration in this next phase to find a workable solution moving forward,” said the NFIB chief executive.

In additional to the two emergency bills, the Treasury Department and IRS have extended the due date for Federal income tax payments. The deadline has been extended from April 15, 2020 to July 15, 2020 and applies for payments due of up to $10 million for corporations and up to $1 million for individuals – regardless of filing status – and other unincorporated entities.

Associated interest, additions to tax, and penalties for late payment will also be suspended until July 15, 2020. Taxpayers are not required to file any documentation in order to take advantage of this delay, and no interest or penalties will be assessed in connection with this extension.

This is an expansion of the relief previously announced on March 18, 2020, and only applies to federal income tax and other association tax payments otherwise due April 15, 2020, not state tax payments of any other type of federal tax.

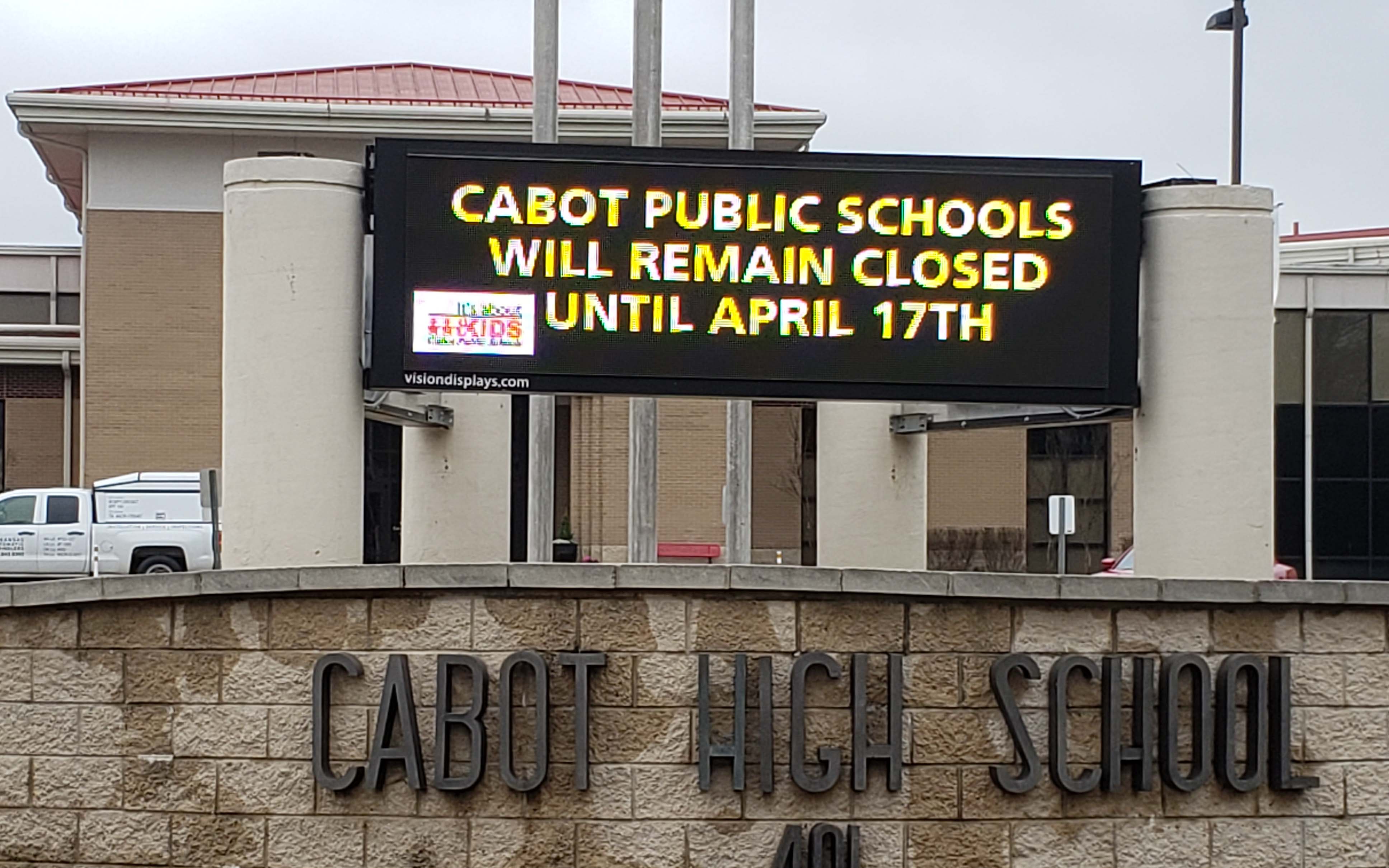

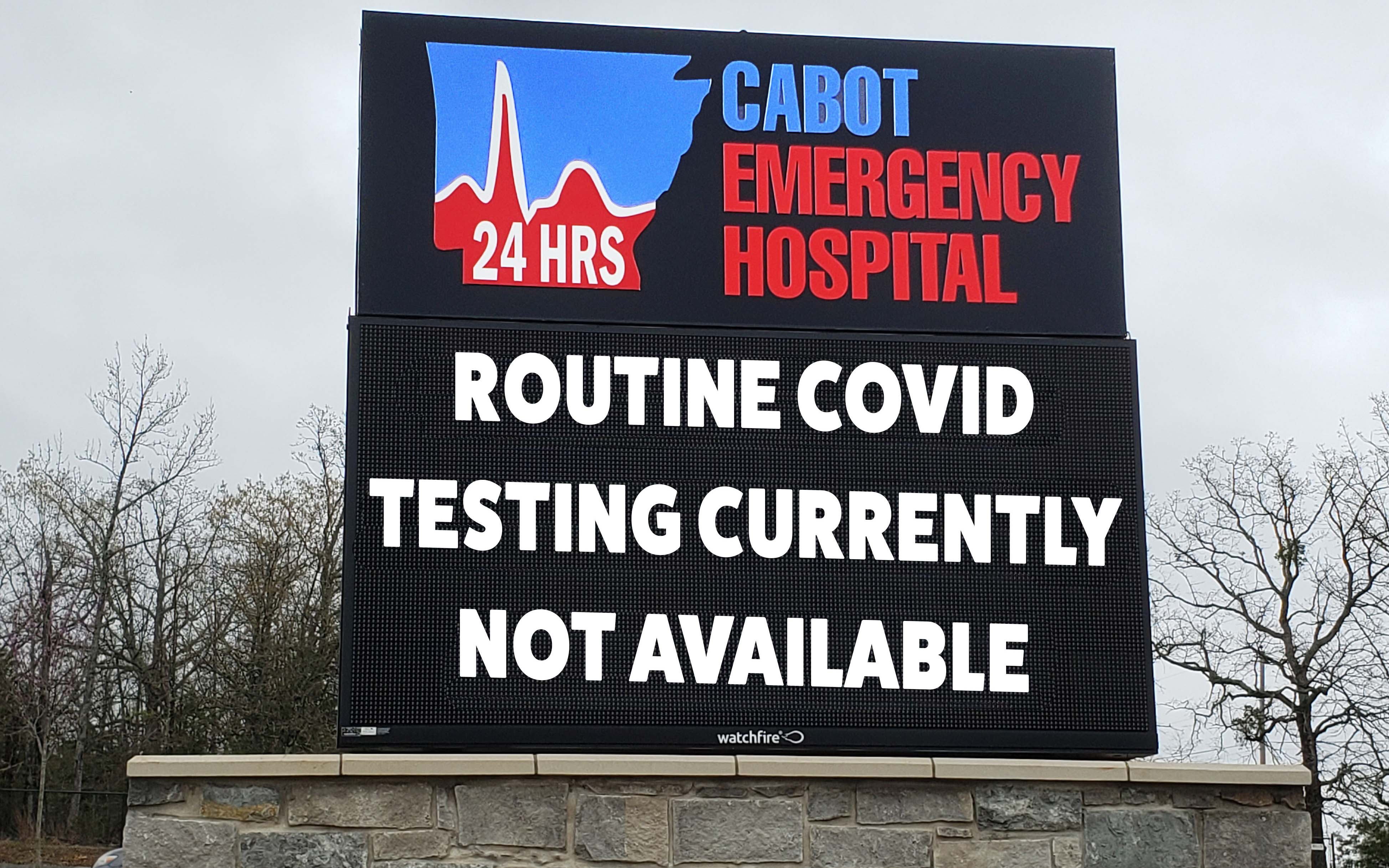

PHOTO CAPTIONS: (Photos by Karen Dunphy)

SIGNS OF TIME - Federal coronavirus stimulus promises local help.