COVID-19 Surveys Say: Consumers, businesses still wary of reopening economy too soon

May 11-17, 2020

By Daily Record Staff

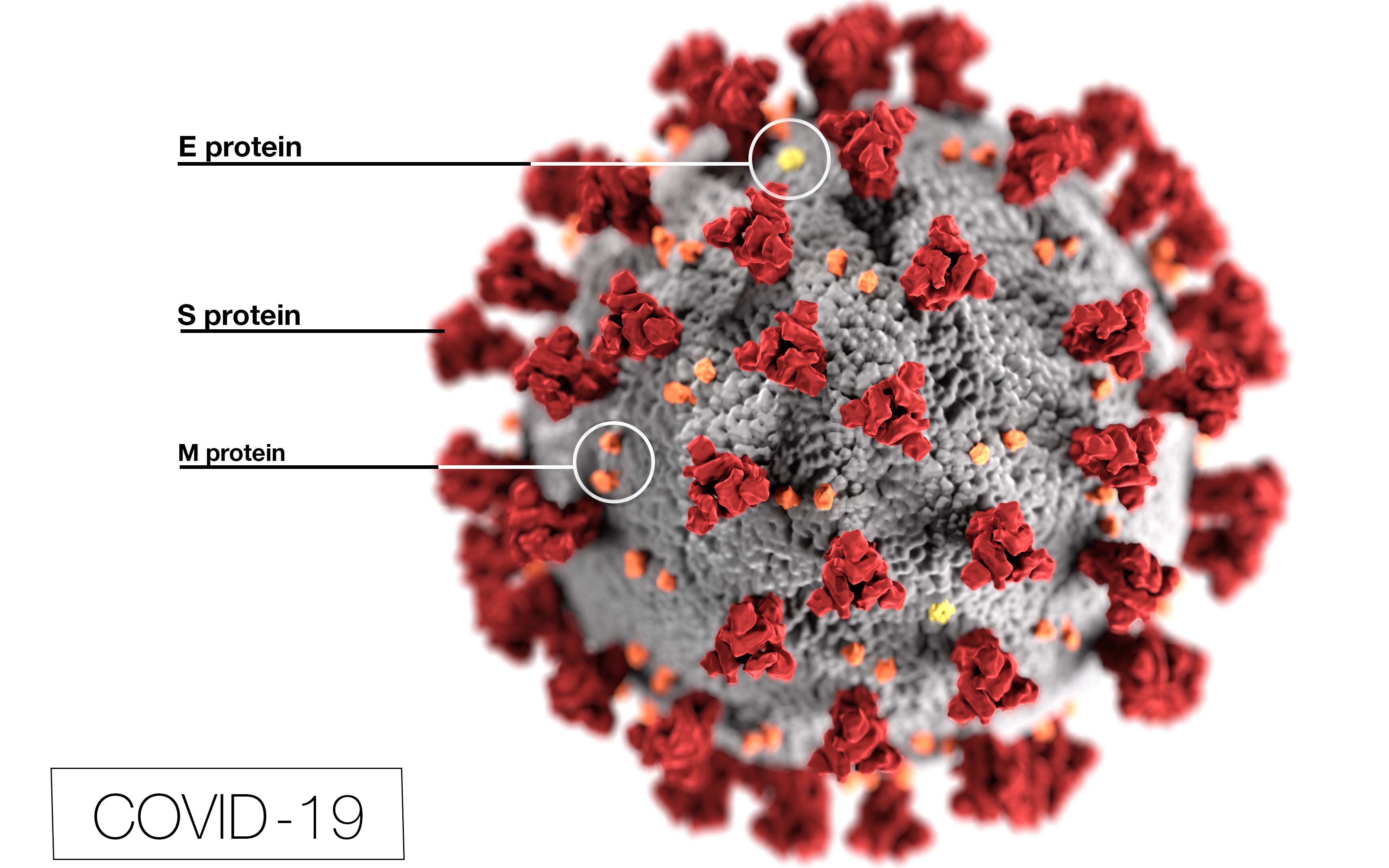

A plethora of recent consumer and business-related COVID-19 surveys and polls show most of the nation is still nervous about the lingering effects of the highly contagious virus known scientifically as SARS-CoV-2.

Findings from an IBM’s Institute for Business Value (IBV) survey of U.S. consumers on May 1 reveals shifting personal behavior and preferences resulting from the COVID-19 pandemic.

The study polled more than 25,000 U.S. adults in the month of April to understand how COVID-19 has affected their perspectives on several issues, including retail spending, transportation, future attendance at events in large venues, and returning to work.

Many respondents also expressed changes in the way they will shop and spend their money, including an increased willingness to use contactless payment technologies when shopping, alongside a reluctance and hesitation to make large purchases such as a new car due to personal financial concerns resulting from the pandemic.

“The study provides further evidence that COVID-19 is permanently altering U.S. consumer behavior. There are (also) long term implications of the new consumer behaviors for industries like retail, transportation, and travel among others,” said Jesus Mantas, senior managing partner for IMB Services. “These organizations need to quickly adapt their business models to serve the new consumer behaviors in order to survive and thrive,”

Concerning the workplace, the IBM study noted the forced shift to operating as a largely remote workforce led to nearly 40% of respondents to indicate they feel strongly that their employer should provide employee opt-in remote work options when returning to normal operations. More than 75% indicate they would like to continue to work remotely at least occasionally, while more than half – 54% – would like this to be their primary way of working.

Another WebMD poll shows that many consumers are also concerned about COVID-19 testing, including one in 10 people surveyed who believe they may have had COVID-19 within the past 30 days. Of that total, only 7% received a test that could have confirmed their suspicions, according to a new poll from WebMD. Among the 7% who were tested, about two-thirds were positive for COVID-19, and one-third were negative.

“The survey demonstrates the need to ramp up diagnostic testing, along with antibody testing, to fully understand the scope of the disease,” said Dr. John Whyte, WebMD’s chief medical officer. He said the new numbers can help guide policy decisions as officials determine about how and when to relax social distancing guidelines.

More than 6,300 responded to WebMD’s online reader poll conducted April 20-21 which asked about symptoms and experiences with COVID-19 testing. Of the respondents who said they were not tested, 39% said they did not meet the testing criteria, 28% said they did not think they needed one, and 25% said that testing was not available in their area. Additionally, 16% said they did not get tested because they were concerned about going to a clinic.

Among those who said they had symptoms, the most common included cough, loss of sense of smell or taste, body aches, diarrhea, headache, sore throat, and fatigue. A significant percentage reported shortness of breath and fever. Nearly two-thirds described the symptoms as mild, 33% as moderate, and 6% as severe.

The WebMD poll findings also underscored the ongoing difficulties people have had getting tested and the ability to determine actual disease prevalence in the U.S. A separate reader poll of 1,451 U.S. physicians conducted by Medscape found that 80% believe the actual numbers of people infected with Covid-19 are higher than official reports. About 20% said they believe the figure is between 3% and 4%.

The confirmed case count from the Centers for Disease Control and Prevention (CDC) is at 0.2% of the population nationwide and 1.2% of the New York State population, but only 5% of U.S. physicians said they thought the official numbers were accurate. Most physicians, 75%, said they did not practice in a known hot spot.

The reader polls mirror the results of recent studies, which show that infection with SARS-CoV-2, the coronavirus that causes COVID-19, may be higher than reported. One recent study from the Los Angeles County Department of Public Health found that the number of residents infected with the virus in that county is 28 to 55 times higher than the 8,000 cases that were confirmed when the study was done in early April. The study results have not yet been peer-reviewed.

In the business sector, a May 5 survey was conducted by Indianapolis-based Sales Xceleration Inc. to see how their sales organizations are functioning through the uncharted territory of COVID-19. The results confirmed that nine out of 10 said they had been overwhelmingly impacted by the virus, including 77.14% of the survey respondents that were small to mid-size businesses under $100 million in annual revenues.

Other key findings showed that nearly 55% of survey respondents do not have a plan-ahead strategy or plan to create one for their post COVID-19 sales efforts. Another 47.17% have either executed sales layoffs/furloughs or plan to in the near term, while 34.9% adjusted quotas or compensation plans for sales reps. About 24% have not adjusted compensation plans despite sales being significantly impacted.

Additionally, the survey revealed a list of biggest challenges companies are facing during this crisis. Key themes emerged from the data, including loss of revenue, sales pipeline standstill, travel restrictions, and inability to gain facetime with business prospects. Other top issues were employee safety, supply chain gridlocks, staff struggles, and time and resources to focus on creating a viable re-entry strategy.

“The COVID-19 pandemic has hit the small to mid-sized business community hard,” said Mark Thacker, president of the Indianapolis-based sales consulting firm.

Meanwhile, another COVID-19 poll conducted last week shows millennials are more likely to report being new to remote work; less productive than usual; and feeling a decreased employer connectivity than typical when compared to their Generation X and baby boomer colleagues.

These are among the findings of a survey on how people are coping the coronavirus crisis from global health and wellness company Vitality Group of Chicago. More than 109,000 responses have logged on to take the ongoing survey.

“As employers navigate this unprecedented global health and economic crisis, wholly new work methods are required for organizations and their people,” said Tal Gilbert, CEO of Vitality USA. “These ongoing polls shed light on how people in diverse contexts are coping. This enable us to help employers continuously adapt to keep their people healthy, productive and connected even though many are working apart.”

Finally, a new business index released by the Society for Human Resource Management (SHRM) and Oxford Economics examines COVID-19’s impact on U.S. business operations and workforce decisions. Initial findings by the nation’s largest HR group show how businesses are curbing costs, when businesses expect employees to return to work, and which industries are faring better or worse than others.

“While federal and state governments are seemingly doing all they can to support U.S. businesses, SHRM research shows one third of U.S. employers are still laying off workers and will continue to do so in the weeks and months ahead,” said SHRM President and CEO Johnny Taylor. “The looming April jobs report will surely reflect this as well. However, there is some sense of optimism from employers about when they expect to bring at least some of those furloughed and laid off employees back to work.”

The initial COVID-19 Business Index highlights include:

Fifty-two percent of U.S. employers have either changed employee hours, furloughed or laid off workers to reduce costs.

One third of U.S. employers are either still laying off workers or may do so in the future.

Sixty-four percent of salaried and 49 percent of hourly employees are now working from home most of the time, compared to 3 and 2 percent on in January.

Nearly all, or 99% of U.S. employers expect furloughed salaried workers to return to work within six months.