Electric car market poised for breakout year as President Biden’s announces $2.2 billion American Jobs Plan

April 12-18, 2021

President’s Plan to rebuild nation’s highways and bridges includes $174 billion investment in clean cars

By Wesley Brown

The electric vehicle market is set to poised power it’s way into the American mainstream as the Biden administration lays out plans to build nationwide connected infrastructure that could make gas-powered cars a thing of the past.

Electric vehicles (EVs) will be a major disruptor for the US electric power sector, with the number of EVs in the US projected to increase from 1.5 million in 2020 to between 10 million and 35 million by 2030, according to a study released in June 2020 by economists at The Brattle Group. The highly cited report concludes that an investment in the range of $75–125 billion will be needed across the electric power sector supply chain by 2030 to serve 20 million EVs, including adding 1–2 million public chargers.

“While EVs and chargers are becoming more common in our everyday lives, the industry is really just seeing the tip of the iceberg when it comes to the impact that EVs will have on the grid,” commented Michael Hagerty, co-author of the 2020 study and senior analyst with the Boston-based global research and consulting firm. “System planners across the electricity supply chain need to better understand and prepare for the impacts of EVs, including the opportunities for EV participation in balancing the system.”

Similar studies by the U.S. Energy Information Administration and Deloitte note that the greatest concern for EV adoption in America is a lack of EV charging infrastructure. In a June 2020 report, the EIA said cumulative sales of plug-in electric vehicles, including battery electric vehicles and plug-in hybrid electric vehicles, reached 1.2 million worldwide in 2015. Still, PEVs account for less than 1% of vehicles in use globally.

Future developments in battery technology, policy, and consumer preference have important implications for future PEV adoption and serve as a great source of uncertainty in meeting future mobility demand. Deloitte’s study shows that China is expected to dominate the global EV market by 2030 with a 49% market share, while Europe and the U.S. will hold 27% and 14%, respectively.

Charging up Chinese Competition

In unveiling his new $2.2 billion American Jobs Plans, President Joe Biden’s broad infrastructure proposal to rebuild the nation’s aging highways, bridges, and U.S. transit system also included a $174 billion set aside to boost the nation’s fledgling EV market. Noting the U.S.’s small market share of plug-in electric vehicle (EV) sales, Biden said that scenario must change for the U.S. to “win the EV market.”

“The American Jobs Plan is the biggest increase in our federal non-defense research and development spending on record,” said Biden. “It’s going to boost America’s innovative edge in markets where global leadership is up for grabs — markets like battery technology, biotechnology, computer chips, clean energy, the competition with China in particular.”

Under Biden’s proposal that he is pushing Congress to enact by the summer, American consumers seeking to buy a new electric car made in the U.S. would receive point-of-sale rebates and tax incentives. The plan, which is part of Biden’s broader climate change initiative, would also establish grant and incentive programs for state and local governments and the private sector to build a national network of 500,000 EV chargers by 2030 while promoting strong labor, training, and installation standards.

Through the Environment Protection Agency and Department of Energy, the Biden administration would also replace 50,000 diesel transit vehicles and electrify at least 20% of the nation’s “yellow school bus fleet” with new electric buses. The goal, Biden said, is to put the U.S. on a path to 100% clean buses, while retooling the U.S. the American workforce is to operate and maintain “this 21st-century infrastructure.” The goal, he said, is to fully electrify all federal vehicle fleets, including the United States Postal Service.

“The federal government owns an enormous fleet of vehicles which are going to be transitioned to clean electric vehicles and hydrogen vehicles right here in the United States, by American workers with American products,” said the Democratic president.

Biden’s big EV plans come as the private sector is already ramping up efforts to develop a national network of charging stations for electric cars, SUVs, and trucks. One month ago, Entergy Corp., the parent company of Entergy Arkansas, joined five other top U.S. utilities to make plans for an EV network that stretches from west Texas eastward to Cleveland, Ohio, and the Washington, D.C. area.

Electric Highways

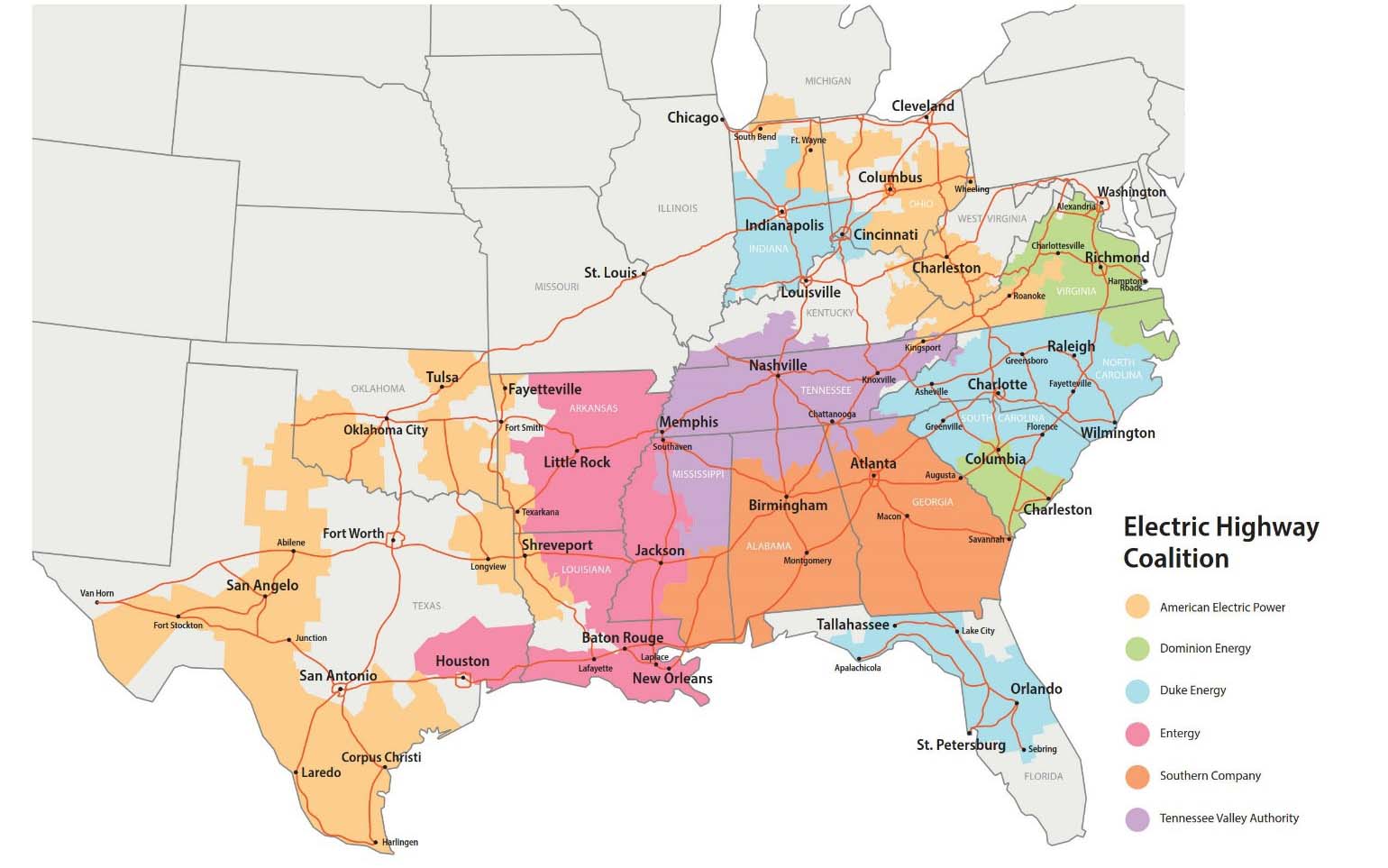

The Electric Highway Coalition – made up of Entergy, American Electric Power, Dominion Energy, Duke Energy, Southern Company, and the Tennessee Valley Authority – would enable electric vehicle drivers seamless travel across major regions of the country through a network of direct current fast chargers for electric vehicles (EV). The companies said on March 2 that they are each taking steps to provide EV charging solutions within their service territories.

“At Entergy, we are taking an integrated approach toward a carbon-free future that includes working with industry peers and customers to electrify other sectors of the economy like transportation and the maritime industry,” said Entergy Chairman and CEO Leo Denault. “Initiatives like this proposed regional EV charging corridor will help lower transportation emissions and provide community benefits for all our stakeholders.”

Entergy said the utility coalition will provide drivers with effective, efficient, and convenient charging options that enable long-distance electric travel. Sites along major highway routes with easy highway access and amenities for travelers are being considered as coalition members work to determine final charging station locations. Charging stations will provide DC fast chargers that can get drivers back on the road in approximately 20 to 30 minutes.

Similarly, Oklahoma City-based Oklahoma Gas and Energy (OGE) and Joplin, Mo-based Liberty Partners, both announced on March 16 they were a smaller collaborative of regional energy companies to build a network of Midwest electric vehicle (EV) charging stations by the end of 2022. Both OGE and Liberty have operations in the far northwest corner of Arkansas. That partnership includes participation from Liberty, Ameren Illinois, Ameren Missouri, Consumers Energy, DTE Energy, Duke-Indiana, Evergy, MidAmerican, and OGE.

Closer to home, Entergy Arkansas and California-based Adopt a Charger earlier in late January developed a new “Charge Up! Arkansas’’ partnership to raise the awareness of the benefits of electric vehicles and encouraging ecotourism across the state. Adopt a Charger is a national nonprofit organization focused on accelerating the widespread adoption of plug-in electric vehicles by broadening available charging infrastructure.

Through a grant from Entergy Corp.’s Environmental Initiatives Fund, the California nonprofit announced a plan to install electric vehicle charging stations at up to 10 locations across Arkansas. All sites will offer “fee-free” charging to drivers to incentivize electric vehicle owners to plug in, said Kitty Adams, executive director of Adopt a Charger.

Meanwhile, other similar utility collaboratives and initiatives are sprouting up every day across the U.S. For example, California technology startup FreeWire announced in January that it had received a $50 million Series C investment from several venture capital groups to expand the production capacity of its Boost Charger device to meet unprecedented customer demand and accelerate international market growth. To date, FreeWire said it has deployed over 200 battery-integrated chargers with Fortune 100 companies, commercial customers, fleets, retail locations, and gas stations.

Tesla effect

On the consumer-facing end, fast-growing Tesla is expected to face stiffer competition from rival automakers in the U.S. and globally in the upcoming years. On Tuesday (April 6), General Motors announced that Chevrolet will introduce a Silverado electric pickup truck that will be built at the company’s Factory ZERO assembly plant in Detroit and Hamtramck, Michigan. Reuss also confirmed the recently revealed GMC’s Hummer EV sports utility vehicle will be built at Factory ZERO.

Companywide, GM plans to deliver more than 1 million electric vehicles globally by 2025 and said it hopes to surpass Tesla’s EV market leadership in North America. To achieve that goal, the Detroit automaker announced in January it was investing $2.2 billion in its Detroit-Hamtramck assembly plant to produce a variety of all-electric trucks and SUVs.

In October 2020, GM renamed the plant Factory ZERO to advance the company’s EV strategy. The 4.5 million square feet factory is the company’s largest-ever GM manufacturing facility. As the factory retools for EV manufacturing, the plant’s paint and body shops and general assembly area are receiving comprehensive upgrades, including new machines, conveyors, controls and tooling. Production of the GMC Hummer EV pickup will begin later this year, company officials said.

Ford Motor Co. has also jumped full-fledged into investing in electric vehicles. Company President and CEO Jim said on Feb. 4 that Ford will now invest at least $22 billion in electrification through 2025, nearly twice what the company had previously committed to EVs. He said the company is “all in and will not cede ground to anyone” in developing and delivering connected electric vehicles and services in mainstream areas of strength for Ford: pickups, commercial vans, and SUVs.

“We are accelerating all our plans – breaking constraints, increasing battery capacity, improving costs and getting more electric vehicles into our product cycle plan,” Farley said. “People are responding to what Ford is doing today, not someday.”

Part of that investment includes Ford’s first European-built, volume all-electric passenger vehicle that will be built at Ford’s retooled EV facility in Valencia, Spain by 2023, with the potential for a second all-electric vehicle under consideration. By mid-2026, 100% of Ford’s passenger vehicle range in Europe will be zero-emissions capable, all-electric or plug-in hybrid, moving to all-electric by 2030.

Ford customers in the U.S. in the fourth quarter of 2020 began taking delivery of the all-electric Mustang Mach-E; the Bronco Sport, ahead of the summer return of the revamped Bronco; and the 2021 F-150 pickup.

“The transformation of Ford is happening and so is our leadership of the EV revolution and development of autonomous driving,” said Farley.

Still, Tesla maintains a big head start with Biden’s infrastructure plan looming in the future, a Wall Street investment analyst said in a research note on Wednesday (March 7). According to a Bloomberg News story, Morgan Stanley’s Tesla Inc. can disproportionately benefit from the U.S. infrastructure package, and investors in the auto sector risk losing out if they don’t own the stock.

“It will likely be complicated by a labyrinth of national and local laws that will present advantages and disadvantages to various automakers, depending on the year that you choose to analyze,” wrote Morgan Stanley analyst Adam Jonas, according to Bloomberg. Yet over the long term, “auto investors face greater risk not owning Tesla shares in their portfolio than owning Tesla shares in their portfolio.”

In the first quarter of 2021, Tesla said it produced just over 180,338 vehicles and delivered nearly 184,800 vehicles. That compares favorably to production of 179,575 and 180,700 deliveries in the fourth quarter of 2020, according to the company’s financial statements. The Palo Alto, Calif.-based electric car giant reported record revenues of $31.5 billion in 2020, up 28% from a year ago. It also reported its first yearly profit of $721 million amid the ongoing pandemic.

“We are encouraged by the strong reception of the Model Y in China and are quickly progressing to full production capacity,” Tesla said in a statement. “The new Model S and Model X have also been exceptionally well received, with the new equipment installed and tested in Q1 and we are in the early stages of ramping production.”

Outside the U.S., Tesla’s Model was also the global leader in EV sales, followed by the Volkswagen Group, the Renault-Nissan-Mitsubishi alliance, Hyundai Motor, and BMW, according to EV Sales Blog.

PHOTO CAPTIONS:

1. & 2. Electric vehicle (EV) sales forecasted to jump to 35 million by 2030.

3. GM Executive Vice President Global Manufacturing Gerald Johnson (left) talks with U.S. Senator Debbie Stabenow, D-Mich., at the company's new Factory ZERO, the company's largest-ever manufacturing plant for EV vehicles.

4. General Motors President Mark Reuss announced April 6 that Chevrolet will manufacture a new Silverado electric pickup truck at the company’s Factory ZERO assembly plant in Detroit and Hamtramck, Mich.