Low-income renters hardest hit during pandemic as Arkansas lawmakers seek compromise on new eviction standards

March 29 - April 4, 2021

By Daily Record Staff

As Arkansas lawmakers continue to debate the issue of renters’ rights in Arkansas, a new national report shows rent affordability has continued to surge during the ongoing pandemic.

According to Zillow’s February Market Report Home released on March 19, while home sales and appreciation soared over the course of the pandemic, rents have largely flatlined nationally during the pandemic and have fallen significantly in several expensive markets.

Although home sales and appreciation soared over the course of the pandemic, rent growth slowed, seemingly a boost for rent affordability. However, it was often the more-expensive areas of metros that softened the most, providing little respite for renters in lower-priced areas, the monthly Zillow report noted.

“While the pandemic has cut into demand for rental housing, that has only translated into declining rents in expensive markets, and most acutely at the top-end of those markets,” said Zillow senior economist Jeff Tucker. “This past year saw widespread adoption of work-from-home policies, especially for higher-income renters who previously paid top dollar for proximity to their workplace. Demand for these rentals took a hit as many leapt into homeownership, while the flow of new renters entering these sub-markets dried up, at least temporarily.”

In the New York metro area, for example, rents in wealthier neighborhoods are down 11.6% year over year, but they are up 1.8% in the least-expensive areas. In Atlanta, like many other more-affordable metros where rent has risen since last February, the increases have been biggest in the least-expensive ZIP codes, putting added financial pressures on vulnerable renters.

Rents across the U.S. are showing real signs of recovery. Typical rents grew substantially monthly for the second month in a row, posting 0.4% gains after a 0.5% rise in January, lending credence to the idea that rents have bottomed out and are on an upward swing. Still, rents are up just 0.5% year over year, well behind the 3.7% annual pace they were growing in February 2020, illustrating the long road ahead to a full pre-pandemic recovery.

The typical U.S. home value rose 1.1% in February to $272,446, maintaining the lightning-fast speed of month-over-month growth seen in both January and December. This is the fastest monthly appreciation in Zillow records reaching back to 1996, and still above the previous high of 1% set in the summer of 2005.

Annual home value growth across the U.S. jumped from 9.1% in January to 9.9% in February, the highest yearly appreciation since April of 2006 and an increase of $24,473 for the typical U.S. home.

For-sale housing inventory remains lower than a year earlier, as it did throughout 2020 largely due to a fast pace of sales. Inventory fell 8% from January and is down 30.3% year over year.

“Home price appreciation kept up its breakneck pace in February, as a wave of early-bird shoppers competed furiously over a very limited inventory offering,” said Tucker. “Monthly price growth accelerated further in most large metros in February, suggesting that buyers still have a lot of gas in the tank to keep pushing prices higher.”

Mortgage rates listed by third-party lenders on Zillow rose from a monthly low of 2.58% on February 10 to 2.98% as the month ended. While the streak of record-low rates may be over, rates remain incredibly low by historical standards -- mortgage rates ended February 2020 at 3.91%. Zillow’s real-time mortgage rates are based on thousands of custom mortgage quotes submitted daily to anonymous borrowers on the Zillow Group Mortgages site by third-party lenders and reflect recent changes in the market.

Arkansas lawmakers consider renters’ rights bills

In Arkansas, House Bill 1563 has apparently stalled temporarily after a House committee last week gave a do-pass recommendation for legislation that would require landlords to meet minimum rental housing standards. HB1563, which also creates a simple eviction procedure guaranteeing a hearing to both landlord and tenant, was approved by the House Insurance & Commerce Committee nearly two weeks ago with the caveat that it be amended for a second time.

According to Lynn Foster, a retired UA Little Rock Law School professor, Arkansas is the only state in the U.S. where renters essentially do not have any rights and can go to jail for not paying rent. Under current Arkansas law, the landlord of a tenant who is one day late on rent may order the tenant to vacate the premises within 10 days. If the tenant fails to do so, they are guilty of a separate misdemeanor offense for each day they fail to vacate the premises following the expiration of the 10-day notice and must pay a fine of up to $25 per day or offense.

Among many things, HB1563 would have required all residential rental properties to be structurally sound and have working locks, plumbing, electricity and heat, along with a few other basic living standards. Similar bills have failed to pass the several past legislative sessions due to opposition from the Arkansas Realtors Association.

Likewise, HB 1563 remains on the House calendar with no apparent date for a full House vote. If eventually approved by the House, sponsor Rep. Jimmy Gazaway, R-Paragould, must also garner support for his controversial legislation in the Senate after lawmakers return this week from spring break.

Foster also said HB 1769, a companion bill to HB1563, is set to be heard by the House Judiciary Committee on March 30. That legislation by Rep. Nicole Clowney, D-Fayetteville, would repeal Arkansas’s current statute criminalizing the eviction process. It was filed on March 18 and has also been assigned to the House Insurance panel.

According to House Speaker Matthew Shepherd, R-El Dorado, the 93rd General Assembly’s original adjournment date will now be extended to April 30, giving lawmakers extra time to approve a renters’ rights bill before the end of the session. Foster said Gazaway and Rep. Spencer Hawks, R-Conway, are discussing possible compromises between HB1563 and HB1769. Gazaway, an attorney is a Northeast Arkansas property owner, and Hawks is a real estate broker in Faulkner County.

“These discussions are underway. That is why Rep. Gazaway did not run his bill this week,” Foster said ahead of the legislature spring break recess. “We will support any bill that will create a meaningful implied warranty of habitability comparable to the law in all other states.

According to Foster, hundreds of cases are filed each year by prosecutors booting renters out of their apartments. Tenants, often unaware of the criminal nature of the proceedings, may unwittingly find themselves later prosecuted for failure to appear, and be subject to large criminal fines, she said.

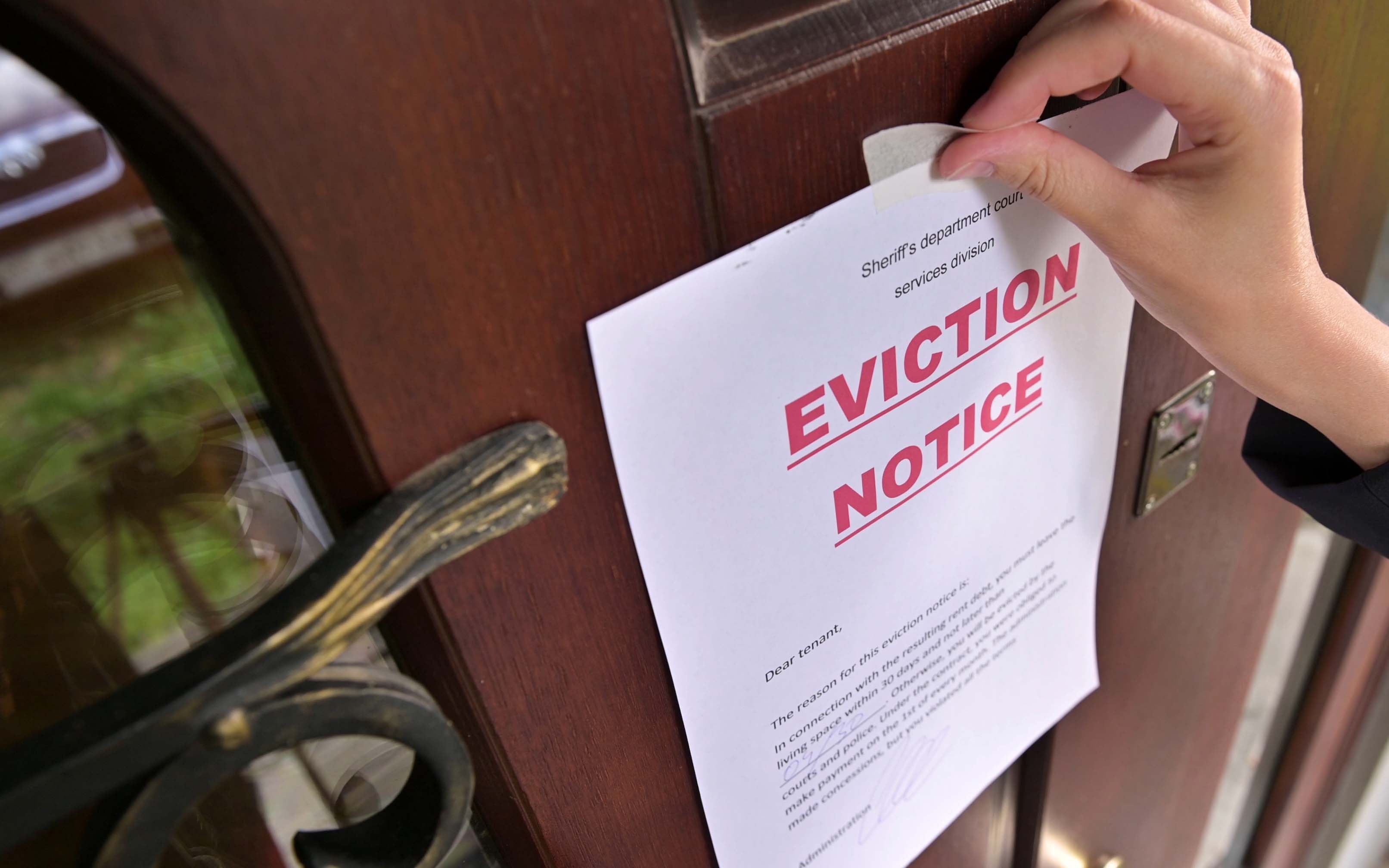

PHOTO CAPTION:

The Arkansas Legislature is debating House Bill 1563 and other legislation that would require landlords to meet minimum rental housing standards.