Nation’s burgeoning student loan bubble nears $1.6 trillion despite pandemic payment pause

November 15-21, 2021

By Wesley Brown

One of President Joe Biden’s major agenda items that has received scant attention during the fight over the $1.75 trillion Build Back Better program and other economic priorities is the administration’s ongoing efforts to revamp the nation’s student loan program.

Yet since taking office, the Biden administration through the U.S. Department of Education has not only reversed nearly all the agency’s former policies under former President Donald Trump but has also taken aim at ending the nation’s growing student loan debt crisis, which now stands at a whopping $1.58 trillion.

According to the New York Federal Reserve’s quarterly report on U.S. household debt and credit, total household debt increased by $286 billion (1.9%) to $15.24 trillion in the third quarter of 2021. The total debt balance is now $1.1 trillion higher than at the end of 2019. It is also $890 billion higher than in third quarter 2020, and $2.57 trillion higher, in nominal terms, than the $12.68 trillion peak seen in 2008.

Of that amount, mortgage balances—the largest component of household debt—rose by $230 billion and stood at $10.67 trillion at the end of September. Credit card balances increased by $17 billion, the same size increase as in the second quarter. Auto loan balances increased by $28 billion in the third quarter. while student loan balances grew by $14 billion, coinciding with the academic borrowing year.

According to the New York Fed, about 5.3% of aggregate student debt was 90+ days delinquent or in default in the third quarter. The lower level of student debt delinquency reflects the U.S. Department of Education’s (USDE) decision to report the current status on loans eligible for CARES Act forbearances.

The rising student loan debt and lower delinquencies stem mostly from the Biden’s administration’s policy to delay and suspend student loan payment since the COVID-19 pandemic began in March 2020. On Oct. 6, the USDE announced a final extension of the pause on student loan repayment, interest, and collections until January 31, 2022.

Education Department Secretary Miguel Cardona said the administration believes this additional time and a definitive end date will allow borrowers to plan for the resumption of payments and reduce the risk of delinquency and defaults after restart. The USDE said it will continue its work to transition borrowers smoothly back into repayment, including by improving student loan servicing.

“The payment pause has been a lifeline that allowed millions of Americans to focus on their families, health, and finances instead of student loans during the national emergency,” said USDE Secretary Miguel Cardona. “As our nation’s economy continues to recover from a deep hole, this final extension will give students and borrowers the time they need to plan for restart and ensure a smooth pathway back to repayment. It is the Department’s priority to support students and borrowers during this transition and ensure they have the resources they need to access affordable, high quality higher education.”

Last month, USDE officials began notifying student loan borrowers in Arkansas and other states about this final extension with upcoming plans to release information about how to plan for payment restart as the end of the pause approaches. For 20 months now, no payments have been due, and interest has not been accruing on the loans during the forbearance period.

At the same time, the Biden Administration has quietly instituted several federal programs through the USDE that have wiped out more than $11.5 billion in loan payments for over 580,000 borrowers since President Biden and Vice President Kamala Harris entered the White House in January.

The Biden administration also hired Richard Cordray to lead the Education Department’s Office of Federal Student Aid, which manages the nation’s $1.6 trillion student loan portfolio. Cordray previously served as the director of the independent Consumer Financial Protection Bureau, the federal watchdog agency created by Dodd-Frank Act following the 2008 financial crisis to regulate the banks, payday lenders, and debt collectors.

Cordray resigned from CFPB in November 2017 after the Trump administration stripped the bureau of its regulatory bureau’s regulatory and enforcement powers to discipline banks and other financial rogues. In leading FSA, the Biden administration has charged Cordray to end the USDE relationships with unsavory student loan debt collectors and provide borrowers with more support.

“It is critical that students and student loan borrowers can depend on the Department of Education for help paying for college, support in repaying loans, and strong oversight of postsecondary institutions,” Cardona said in a statement announcing Cordray’s selection in May. “Cordray has a strong track record as a dedicated public servant who can tackle big challenges and get results.”

Besides extending the USDE’s pandemic forbearance program until 2022, the Biden’s American Rescue Plan also defers taxes on all federal student loan forgiveness programs through 2025. This allows students who are pursuing an annulment of their debt through the Public Service Loan Forgiveness Program or other options to reduce their balance owed to the government and not owe taxes on the amount dropped as if it were income, officials said.

President Biden’s economic recovery legislation package under the Build Back Better Act doesn’t include student loan forgiveness and has dropped earlier provisions for free community college. However, the budget proposal does call on Congress to invest nearly $103 billion in Department of Education programs, a 41% increase over the fiscal year 2021 appropriation to support students’ success.

The fiscal year 2022 budget proposal would be the largest increase to the Pell Grant ever, hiking the maximum amount by $550 for more than 5 million students enrolled in public and private, non-profit colleges, including so-called “Dreamers,” or children of undocumented immigrants that live and attend school in the U.S.

Meanwhile, the USDE released its official cohort student loan default rates on Sept. 27, which shows the percentage of student loan defaulters has declined dramatically. For the current three-year tracking period, new data shows that the national cohort default rate is 7.3%, which is 28% below the 10.1% default rate before the pandemic began in March 2020.

However, Tony Williams, executive director of the Arkansas Student Loan Authority (ASLA) in Little Rock, told The Daily Record that most every school in the state and country had a decrease in their student loan default rate in the previous three-year tracking period from October 2017 to September 2020.

“The primary reason for the decrease was due to the COVID forbearance instated in March of 2020. Borrowers in the 2018 cohort who were delinquent in March 2020 and on the path to default were able to avoid default when all federally held student loans were brought current with the forbearance,” said Williams. “The standard three-year cohort tracking period was cut short by six months providing relief to borrowers and a slight reprieve for schools and their default rates.”

In the current tracking period from October 2018 through September 2021, Williams added that the new USDE data may not have any recorded defaults since these borrowers have been in forbearance for 22 months of their 36-month tracking period. “There will simply not be enough time in a repayment status for these borrowers to default. To be clear, these borrowers may default after the cohort tracking period, but it will not be reflected in the 2019 national cohort default rate or the school’s cohort default rate,” he said.

In Arkansas’ last USDE ranking in October 2019, just months before the COVID-19 pandemic began, ALSA reported that the student loan default rates for Arkansas students attending 70 colleges and universities had declined for the sixth consecutive year and was just 0.3 percentage points off the national average at 10.4%.

In 2021, Williams said USDE has stopped publishing default rates for each individual state “so we no longer know Arkansas’s ranking amongst all of the states.” Before 2020, Arkansas student loan cohort default rate improved from 19% in 2013 to 10.4% in 2019 under the ASLA’s watch.

Statewide, Arkansas’ 351,000 college tuition borrowers carried an average of $26,579 in student loan debt at the end of 2019, USDE data shows. That total is slightly below $26,999 in the previous year and less than the $32,731 average balance held by the other 44.7 million Americans still paying off their college debt.

ASLA’s data compiled by the USDE shows nearly $639 million in federal student loans that originated in Arkansas during the 2018-2019 academic year. That was down 1.1% from $649.6 million in loan originations in the previous year and well above the $435.7 million handed out to student borrowers a decade ago. The highest level of federal student loan origination in the last decade occurred during the period between 2009 and 2016. Federal student loan origination topped out at $701.3 million in the 2011-2012 academic year, followed by $679.7 million and $675.5 million the 2010-2011 and 2013-2014 academic years, respectively.

By far, college-goers attending the University of Arkansas at Fayetteville received the largest portion of federal student loan proceeds in the pre-pandemic years, when $108.5 million was handed out to enrollees at the state’s flagship university in 2019, which enrolled nearly 28,000 students that year.

In the northeast corner of the state, Arkansas State University in Jonesboro received the second-largest share of federal student loans at $90.2 million in the 2018-2019 academic year. The University of Central Arkansas and the University of Arkansas at Little Rock were listed at third and fourth, respectively, with student loan volume of $51.7 million and $48.9 million.

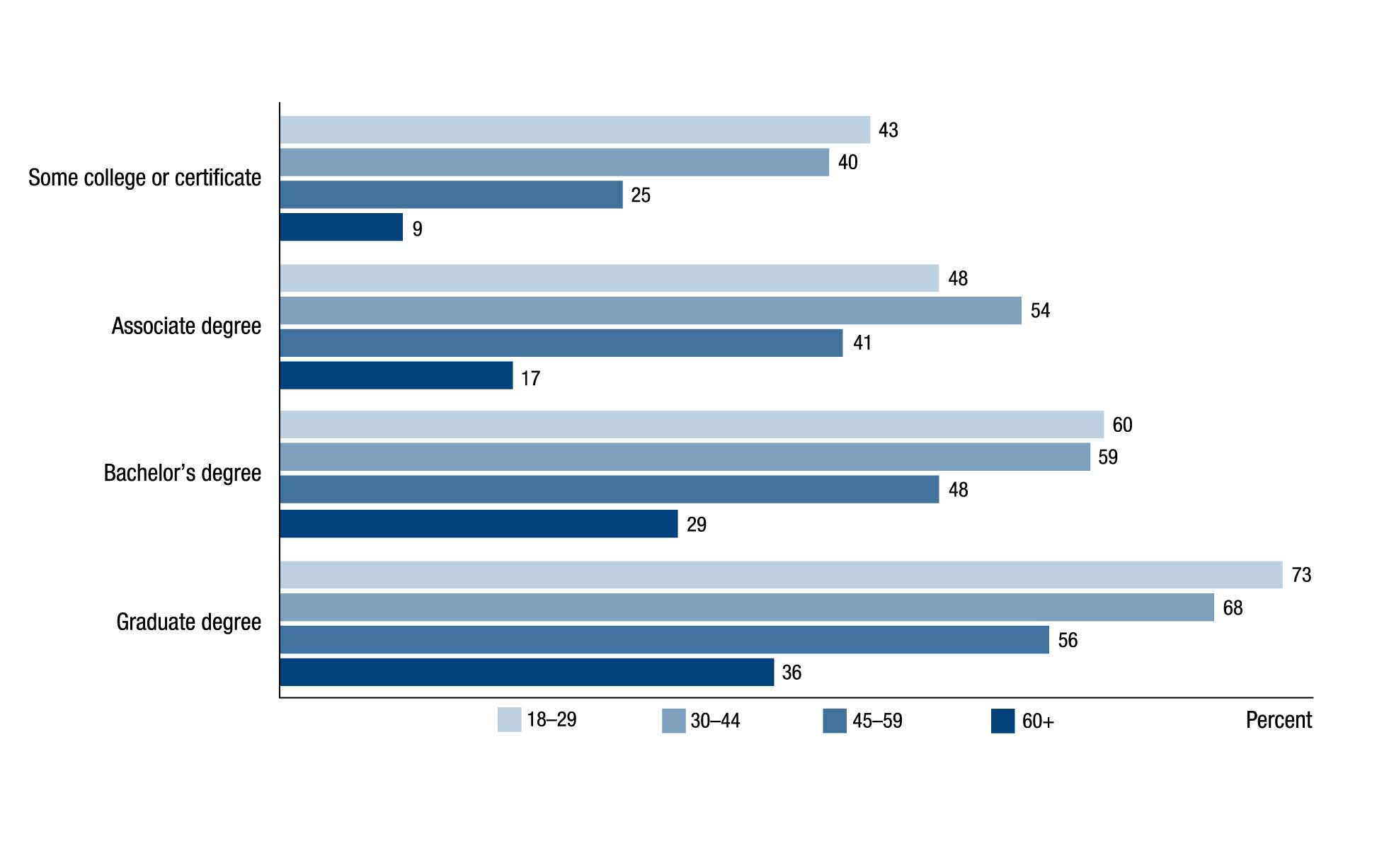

PHOTO CAPTION:

1. Acquired student loan debt for own education, including repaid (by age and highest degree completed)

2. Student Loan Bubblee: The nation's 3Q student loan debt has grown to more than $1.6 trillion, up $14 billion.