Nation’s hot housing market hits highest level in 14 years, fueled by low mortgage rates

September 28 - October 4, 2020

By Daily Record Staff

As the nation looks for good news amid the ongoing pandemic, robust home sales in Arkansas and across the U.S. have jumped to their highest level in more than 15 years as record low mortgage rates and soaring home values fuel the current economic rebound.

In recent month reports by the National Association of Realtors (NAR) and online rival Zillow Group Inc., home sales in every region of the country have climbed for third straight month after nearly all states shutdown after SARS CoV-2 was declared a global pandemic by the World Health Organization in early March.

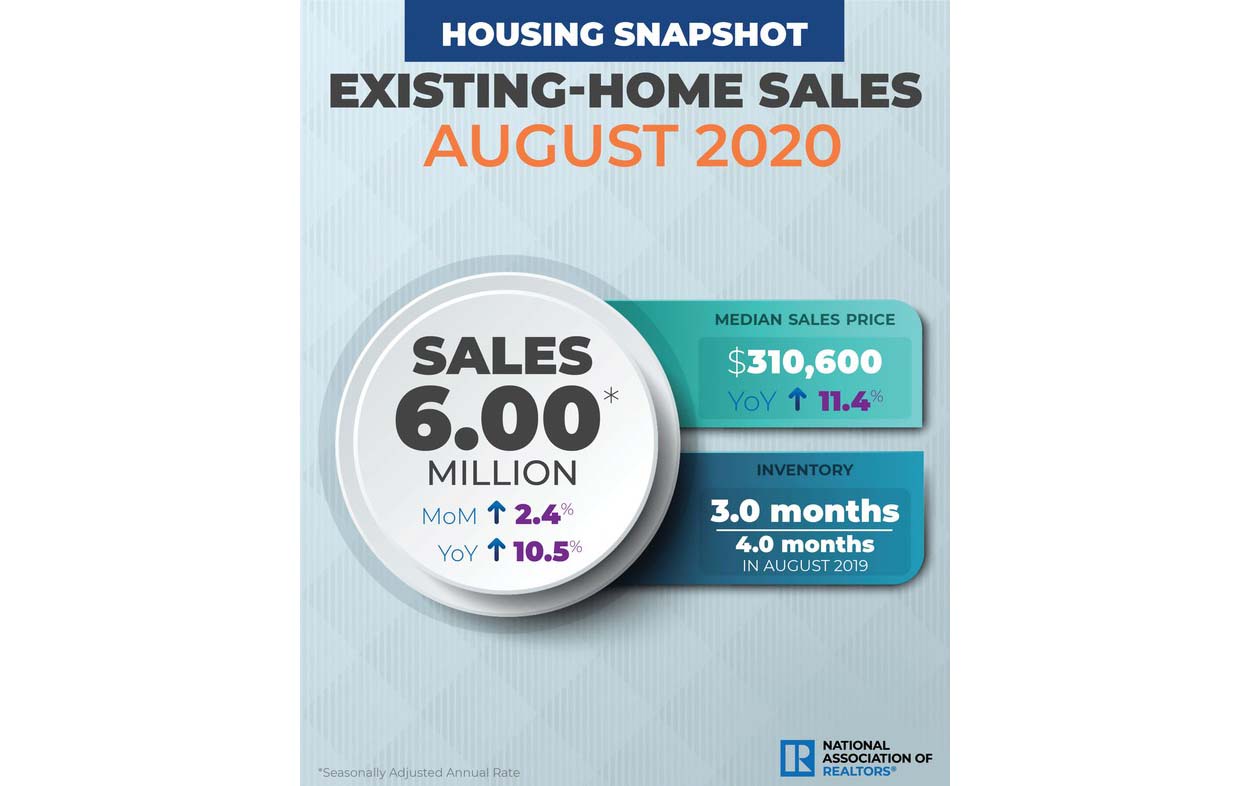

Still according to NAR most recently monthly housing snapshot on Sept. 22, existing-home sales continued to climb in August, marking three consecutive months of positive sales gains. Nationwide, total existing-home sales completed transactions that include single-family homes, townhomes, condominiums and co-ops, rose 2.4% from July to a seasonally adjusted annual rate of 6 million in August. Year-over-year home sales rose by 10.5% from 5.43 million in August 2019.

“Home sales continue to amaze, and there are plenty of buyers in the pipeline ready to enter the market,” said Lawrence Yun, chief economist for nation’s largest trade association representing more than 1.4 million members involved in all aspects of the residential and commercial real estate industries. “Further gains in sales are likely for the remainder of the year, with mortgage rates hovering around 3% and with continued job recovery.”

For those sellers in the market looking for an upgrade or extra cash, the median existing-home price for all housing types in August was $310,600, up 11.4% from $278,800 in August 2019 as prices rose in every region. August’s national price increase marks 102 straight months of year-over-year gains.

Total housing inventory at the end of August totaled 1.49 million units, down 0.7% from July and down 18.6% from one year ago (1.83 million). Unsold inventory sits at a 3.0-month supply at the current sales pace, down from 3.1 months in July and down from the 4.0-month figure recorded in August 2019.

Scarce inventory has been problematic for the past few years, according to Yun, an issue he says has worsened in the past month due to the dramatic surge in lumber prices and the dearth of lumber resulting from California wildfires.

“Over recent months, we have seen lumber prices surge dramatically,” Yun said. “This has already led to an increase in the cost of multifamily housing and an even higher increase for single-family homes.”

Although Zillow’s proprietary month report only includes the middle price tier of homes, pressure from this summer’s housing inventory shortage still has caused U.S. home values to rise sharply by 0.7% to $256,663 in August, the biggest month-over-month increase in nearly seven years. Zillow’s August report shows that home value growth accelerated last month in 48 of the 50 largest markets and was relatively constant in the other two: Birmingham, Ala. and Richmond, Va.

Year over year, home values are up 5.1% in August, the largest annual rise since March 2019. Markets with the highest year-over-year increases in home values were Phoenix (10.5%), San Jose (10.3%) and Seattle (9.2%). The smallest year-over-year gains in home values among major metros were seen in Chicago (1.9%), New York (2.3%) and San Francisco (2.7%).

“American home shoppers faced an historic shortage of listings to choose from this summer, and that scarcity is now reflected in rapidly appreciating home values after a sluggish start to the home shopping season this spring,” said Zillow economist Jeff Tucker. “Builders are racing to catch up with demand, and rising prices should encourage more potential sellers to come off the sidelines and list. Still, the shortage of inventory should keep housing markets unusually tilted in sellers’ favor this autumn.”

Homes flying off the market

Nationwide, demand continues to outpace supply. Homes continue to fly off the market at a record pace and inventory is contracting, according to the most recent Zillow weekly housing market data. Listings’ typical time on the market was 14 days, as of the week ending Sept. 12. That is 14 days faster than the year before, said the nation’s largest online real estate broker

Looking ahead, Zillow forecasts that upward price pressure seems likely to continue at least through the fall, thanks to the large inventory deficit. Purchase demand is holding steady at high levels, reflected in strong pending sales data, perhaps due to delayed purchases from earlier this spring and summer. Given that the housing market typically begins to cool off by late August, this stable volume of sales looks even more impressive: pending sales were up a whopping 23.3% year over year in the week ending Sept. 12.

In addition, Zillow also notes that the Federal Reserve expects to keep interest rates near zero through at least 2023, and allow periods of higher inflation, to revive the economy. According to Freddie Mac, the average commitment rate for a 30-year, conventional, fixed-rate mortgage fell to a record low at 2.86% on Sept. 10, down from 2.94% in August. That is ninth record low since March and the lowest level since the federal mortgage servicer began the national survey 50 years ago.

“This news reinforces the Federal Reserve’s commitment to keeping credit flowing using a broad policy toolkit that included purchases of mortgage-backed securities this year,” said the Seattle-based real estate analytics firm. “In that context there is little reason to expect mortgage rates to rise significantly any time soon, which should help keep buyers active.

At NAR, Yun also says the need for housing will grow even further, especially in areas that are attractive to those who can work from home. As highlighted in influential real estate trade group’s August study, remote work opportunities are likely to become a growing part of the nation’s workforce culture. Yun said he believes this reality will endure, even after a coronavirus vaccine is available.

“Housing demand is robust, but supply is not, and this imbalance will inevitably harm affordability and hinder ownership opportunities,” he said. “To assure broad gains in homeownership, more new homes need to be constructed.”

Properties typically remained on the market for 22 days in August, seasonally equal to the number of days in July and down from 31 days in August 2019. Sixty-nine percent of homes sold in August 2020 were on the market for less than a month.

Also, in August, first-time buyers were responsible for 33% of sales in August, down from 34% in July 2020, but up from 31% in August 2019. NAR’s 2019 Profile of Home Buyers and Sellers – released in late 20194 – revealed that the annual share of first-time buyers was 33%.

Individual investors or second-home buyers, who account for many cash sales, purchased 14% of homes in August, a small change from July’s figure of 15% and equal to the August 2019 rate of 14%. All-cash sales accounted for 18% of transactions in August, up from 16% in July 2020 and down from 19% in August 2019.

Distressed sales – foreclosures and short sales – represented less than 1% of sales in August, equal to July’s percentage, but down from 2% in August 2019.

“The past few months have shown how valuable real estate is in the country, both to our nation’s economy and to individuals who have been given an opportunity to rethink their location and redesign their lifestyle,” said NAR President Vince Malta, broker at Malta & Co., Inc., in San Francisco, Calif.

In Arkansas, the hot housing market is also following the national trend as 43% of all existing home sales in August occurred in the South region, which includes Arkansas and 15 others states that stretch from Oklahoma and Texas to Maryland and Delaware. Existing-home sales in the South rose 0.8% to an annual rate of 2.60 million in August, up 13.0% from the same time one year ago. The median price in the South was $269,200, a 12.3% increase from a year ago.

The Arkansas Realtors Association, which includes the Little Rock Realtors Association and 27 other independent local realtor boards and associations and serves as the state arm of Washington, D.C.-based NAR, recently held its annual state convention and trade show virtually on Sept 14-16.

PHOTO CAPTIONS: (Photos provided)

1. Homeowners in Arkansas are benefitting from robust housing sales amid pandemic. Record low mortgage rates fell below 3% nationwide, according to the National Association of Realtors.