U.S. inflation jumps to highest level in nearly 40 years as nation’s economic growth stalls

December 20-26, 2021

By Wesley Brown

With less than one month left in 2021, the U.S. Labor Department spooked U.S. and global markets after reporting that inflation has risen to its highest level since global oil prices were spiraling out of control nearly 40 years ago.

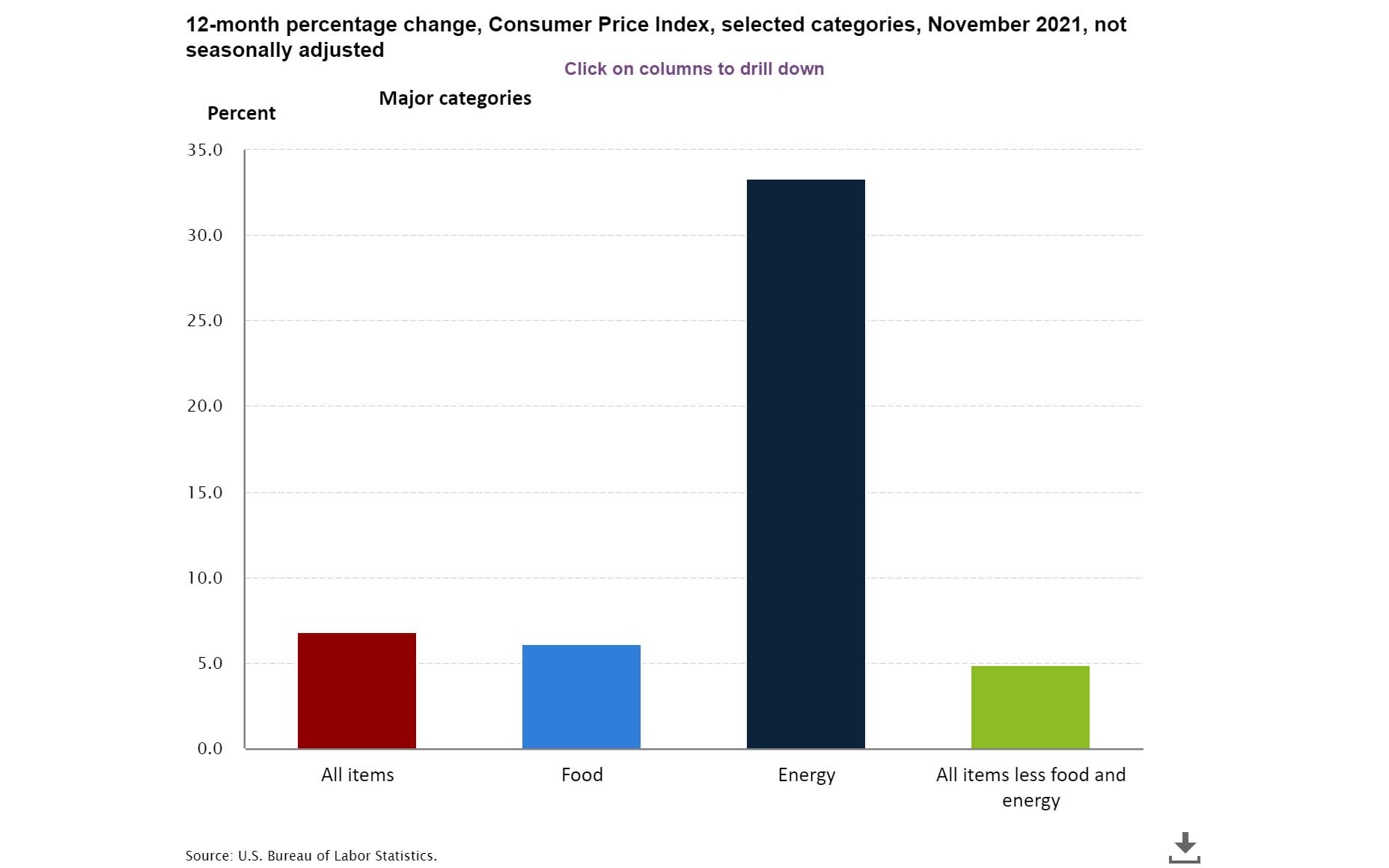

On Friday (Dec. 9,) the Labor Department’s Bureau of Labor Statistics (BLS) released its monthly Consumer Price Index for All Urban Consumers (CPI-U) report, showing that inflation increased 0.8% in November on a seasonally adjusted basis after rising 0.9% in October. Over the last 12 months, the “all items index” has spike 6.8% before seasonal adjustment, the largest 12-month increase since the period ending June 1982.

And although the Biden administration has highlighted the nation’s continued economic expansion, gross domestic product (GDP) only increased at an annual rate of 2.1% in the third quarter of 2021, well below 6.7% real GDP growth in the second quarter, according to the Nov. 24 estimate released by the Bureau of Economic Analysis (BEA). That stalled growth has also bled into the Midwest economy, which remains stuck in neutral as inflation pressures are causing labor shortages and supply chain bottlenecks and impacting overall consumer confidence.

Earlier this month, Creighton University’s Mid-America Business Conditions Index fell by nearly five percentage points to 60.2 from October’s strong 65.2. The highly watched economic indicator for the nine-state region stretching from Minnesota to Arkansas has remained above growth neutral for 18 of the last 19 months.

The Creighton Economic Forecasting Group has conducted the monthly survey of supply managers in nine states since 1994 to produce leading economic indicators of the Mid-America economy. States included in the survey are Arkansas, Iowa, Kansas, Minnesota, Missouri, Nebraska, North Dakota, Oklahoma and South Dakota.

The forecasting group’s overall index, referred to as the Business Conditions Index, ranges between 0 and 100. An index greater than 50 indicates an expansionary economy over the course of the next three to six months. To U.S. economist Ernie Goss, director of Creighton University’s Economic Forecasting Group, said that monthly survey results indicate “the region is adding manufacturing activity at a positive pace, and that regional growth will remain solid.”

“In terms of supply chain disruptions and bottlenecks, approximately one-half of supply managers expect delays to worsen with only one in four anticipating improvements,” Goss said, noting that Midwest firms are reporting that transportation bottlenecks in trucking and rail were key factors accounting for supply chain disruptions.

According to the Creighton University forecasting group, the regional employment index remained significantly above growth neutral for November but dropped to 61.1 from 66.1 in October. “Despite healthy growth over the past year, compared to its pre-pandemic level, U.S. Bureau of Labor Statistics manufacturing employment data indicate that the region has lost 20,000 jobs, or 1.4%,” said Goss.

In other areas of the nine-state economy, the wholesale inflation gauge for the month declined to an elevated 92.9 from October’s 96.5.

“Creighton’s monthly survey is tracking the highest and most consistent inflationary pressures in more than a quarter of a century of conducting the survey,” said Goss. “According to the U.S. Bureau of Labor Statistics, commodity prices are up approximately 22.6% over the last 12 months with fuels expanding by 57.5%, farm products advancing by 18.5%, and metal products soaring by 45.5%.”

Looking ahead six months, economic optimism, as captured by the November Business Confidence Index climbed to a weak 46.2 from October’s 37.0 which was its lowest level since the onset of COVID-19 in March 2020. The regional inventory index, reflecting levels of raw materials and supplies, sank to 52 from 64.4 in October.

Despite supply chain bottlenecks, regional export numbers were positive for the month. The new export orders index advanced to 56.7 from October’s 53.3, while port delays sank the import reading to 50.1 from 57.9 in October. Other survey components of the November Business Conditions Index were new orders rising to 57.4 from 50.0 in October; the production or sales index falling to 53.7 from 70.4 in October; and the index reading for the speed of deliveries of raw materials and supplies climbed to 76.8 from October’s 75.0.

Meanwhile, the November Business Conditions Index for Arkansas declined to 54.6 from 59.0 in October. Components from the November survey of supply managers were new orders at 56.4, production or sales at 51.3, delivery lead time at 73.5, inventories at 38.6, and employment at 53.1. According to U.S. Bureau of Labor Statistics, Arkansas’s seasonally adjusted manufacturing employment was down by almost 1,000 jobs, or 0.6%, compared to its pre-pandemic level.

“Job gains for the state’s durable goods producers were more than offset by losses for the state’s nondurable goods manufacturers,” said Goss.

Despite the U.S. economy facing uncertainty due to the long-term impact of the pandemic and other factors like skyrocketing inflation, the stock market appears to be thriving and has continued to surge in 2021, according to a new report by Finbold, a London-based financial blog.

According to data acquired by Finbold, in the first three quarters of 2021, the U.S. stock market value hit $48.57 trillion, growing 19.22% compared to 2020’s full year valuation of $40.74 trillion. Therefore, the market added $7.83 trillion in capital this year alone.

In 2019, the valuation stood at $33.9 trillion while in 2018 the market had a value of $30.45 trillion. Over the last decade, the valuation has steadily surged 160.15% between 2012 and 2022. The report also highlights some of the implications of the growing stock market valuation in relation to investor confidence.

“With investors pumping more money into the stock market, it points to confidence in the stability of future investments. In this case, investors are more likely to purchase stocks if they are convinced their shares will increase in value,” wrote Finbold analyst Justinas Baltrusaitis. “However, if there is a reason to believe that shares will perform poorly, more investors will be looking to sell.”

The report also warned that confidence in the market shows that investors are still hoping to reap big in future despite the existence of other alternatives like cryptocurrencies. However, the valuation does not necessarily point to a bullish future, especially with the continued uncertainty around the economy.

“Currently, as the economy continues to recover from the pandemic, the threat of the new Covid-19 variant should make investors approach the market with caution,” explained Justinas Baltrusaitis.

Meanwhile, the BLS report that the noted increased in the CPI’s monthly all items index was the result of broad increases in most component indexes, similar to October. The indexes for gasoline, shelter, food, used cars and trucks, and new vehicles were among the larger contributors. For example, the energy index rose 3.5% in November as the gasoline index increased 6.1%.

In other areas affecting most consumers, the food index increased 0.7% as the indicator for food at home rose 0.8%. The index for all items less food and energy rose 0.5% in November following a 0.6% jump in October. Along with shelter, used cars and trucks, and new vehicles, the indexes for household furnishings and operations, apparel, and airline fares were among those that increased. The indexes for auto insurance, recreation, and communication were month the few indexes that declined in November.

As noted, the all items index for November jumped 6.8% from a year ago, even higher than 12-month spike of 6.2% in the previous month. The index for all items less food and energy rose 4.9% over the last 12 months, while the energy index rose a whopping 33.3% over the last year compared to a 6.1% gain for the food index. These changes are the largest 12-month increases in at least 13 years in the respective series, BLS officials said.

PHOTO CAPTION:

Through November, the Creighton University’s Mid-America Business Conditions Index fell by nearly five percentage points to 60.2 from October’s strong 65.2. The highly watched economic indicator for the nine-state region stretching from Minnesota to Arkansas is tracking the highest and most consistent inflationary pressures in more than a quarter of a century.