Used car market booming as prices continue to skyrocket in 2022

January 10-16, 2022

By Wesley Brown

Out of the chaos of COVID-19 in 2021 and the threat of rising inflation, one economic sector that is booming entering 2022 and poised to lift even higher is the once mocked used car industry.

Unlike the past stereotype of a fast-talking, cigar-smoking lot salesman, the used car vendor in 2022 is just as likely to be an online or remote technology expert that the car buyer will never see or interact with before a purchase is made. Much of the industry’s growth has come from traditional and online used car sellers that range from well-brands such as Car-Mart, AutoNation and CarMax to newer entries such as Carvana, Rodo, Vroom and Shift.

For example, Carvana first entered the used car market in Arkansas ahead of the pandemic in late 2019 when the e-commerce platform announced plans to locate an inspection and distribution center in West Memphis. In highlighting the company’s plan to invest $40 million to bring over 400 new jobs to Crittenden County, Gov. Asa Hutchinson raved about Carvana’s innovative technologies.

“Carvana is an upstart company that is changing the used car industry through technology and great customer service,” said Hutchinson. “That’s just the sort of business model we have sought in our recruiting efforts, and we’re pleased to see these high-paying jobs coming to the Delta.”

Since locating part of its operations in Arkansas, Carvana has begun offering next-day vehicle delivery services across the state, beginning in Little Rock in December 2020. As used car prices have continued to spike during the pandemic, Carvana has expanded its “New Way to Buy a Car” service in Hot Springs, Pine Bluff, Fayetteville and Fort Smith.

Founded as a Phoenix, Ariz.-based startup only a decade ago, Carvana is one of the early pioneers of online car buying, offering its patented 360-degree virtual vehicle tour where customers can view vehicles in high-definition photography, inside and out. According to company officials, customers today can shop more than 45,000 vehicles on Carvana.com, and finance, purchase, trade-in an existing vehicle, and schedule as-soon-as-next-day delivery or pick up at one of the company’s patented “car vending machines.”

During the company’s last Arkansas announcement on Sept. 17 for its new service in Fort Smith, Carvana said pandemic-isolated customers looking to trade in their vehicle, or sell a vehicle, can skip visiting the local dealership by simply entering their VIN or license plate number on Carvana.com. Depending on whether the customer is a buyer or seller, Carvana can pick up the vehicle and bring them a check as soon as the next day.

“As we expand our reach in Arkansas, we’re bringing our easy, convenient and transparent car buying experience to one of the largest cities in the state, ‘’ said Ernie Garcia, Carvana founder and CEO.

And as rental car rates began to spike as high as 1,000% in some areas during the pandemic, Carvana and Hertz also announced plans in late October to form a partnership to expand the online car dealer’s reach. Following a pilot project in September, Hertz said it will now utilize Carvana’s online transaction technology and logistics network to expand vehicle disposition channels.

The rental car industry – which buys and sells millions of vehicles annually – is an integral part of the used car market. Historically, Hertz has sold vehicles from its rental fleet through auctions, direct-to-dealer programs and its retail network of 68 Hertz car sales locations. Using Carvana’s technology and logistics network will allow a more efficient direct-to-consumer sales channel, giving Hertz the opportunity to reduce its reliance on wholesale disposition, company officials said.

“Our new partnership with Carvana will help Hertz provide a tech-enabled and scalable channel through the lifecycle of our fleet,” said Mark Fields, Hertz interim CEO. “This is another step toward the new Hertz – combining our brand strength and global fleet expertise with new technology and innovations to chart a dynamic, new course for the future of travel, mobility and the auto industry.”

“Carvana’s technology and infrastructure enable this partnership to bring online car buying experiences to more customers,” added Garcia. “Our nationwide first-party logistics network allows Hertz to expand its retail reach beyond its physical stores and into over 300 markets across the country.”

Rodo and Arkansas automotive ties

The huge growth in the used car market has also brought other new startup and technology firms into the competitive industry, including one with Wall Street and Arkansas ties. On Dec. 16, New York City-based Rodo Inc. announced plans to add used cars to its online marketplace. Founded in 2016 as “Honcker” by Nathan Hecht, the company was originally backed by New York-based IAC and Evolution VC Partners.

In late July, Rodo closed an $18 million Series B financing round led by Holman Enterprises and Evolution VC Partners. The round also includes participation from existing investor IAC along with Hollywood comedian Kevin Hart’s HartBeat Ventures and Arkansas’s auto industry veterans Mack McLarty, vice chairman of RML Automotive, and Franklin McLarty, chairman and CEO of McLarty Diversified Holdings and Ken Schnitzer, former Chairman of Park Place Automotive Group.

The latest round brings Rodo’s total funding to $45 million as the company prepares to scale its dealership network nationwide and invest in marketing and customer acquisition. As key investors in Rodo, the McLarty family brings their Arkansas automotive business roots going back to their first family dealership in Hope in 1921 to the online car selling trade.

Today, the elder McLarty and first chief of staff for former President Bill Clinton is vice chairman of RML Automotive Holdings, a $1.8 billion operation consisting of 25 automotive dealerships across the South Central, Southeast and Midwest regions of the country. Founded by former BET founder Robert Johnson and McLarty in 2007, the company today has offices in downtown Little Rock and Washington, D.C.

As head of the McLarty family’s investment portfolio at MDH, Franklin is one of the McLarty siblings who recently expanded into car finance and insurance as an initial public officer for vehicle protection planning provider Olive.com and its affiliate PayLink Direct. According to Wall Street analysts, the IPO for the combined business is valued at nearly $960 million, including debt.

Although Rodo originally focused on selling and leasing new cars on Rodo.com and the Rodo app, the New York startup said used cars will now be available from local dealers across the U.S. – a competitive differentiator that lets shoppers find and buy the vehicles they want, with no hidden fees or price haggling. Unlike Carvana, Rodo does not buy or maintain expensive fleets or inventory; instead, buyers shop the inventories of more than 1,200 dealerships in its partner network.

With tighter inventories caused by a diminished supply of microchips needed for new cars, consumer demand for previously owned vehicles is skyrocketing, said Hecht. Unlike Carvana’s next-day offering, Rodo touts itself as the only remote dealership where a consumer can instantly lease or purchase a new or used car with same-day delivery service.

“While we’ve been focused on new cars, we knew the time was right to offer used cars on the Rodo marketplace. Given the challenging conditions squeezing the automobile market, consumers are looking for greater choice. This expansion meets that demand,” said the Rodo chief executive.

But online and remote car dealers are not the only benefactors of the booming used car market. Rogers-based America’s Car-Mart Inc. on Nov. 17 reported record second quarter revenues of $288 million on profits of $22.9 million or $2.22 per share. Today, the Arkansas used car chain operates dealerships in 12 states and is one of the largest publicly held automotive retailers in the U.S. focused exclusively on the “integrated auto sales and finance” segment of the used car market.

“We continue to see solid productivity improvement and market share gains in an operating environment with historic supply and demand imbalances. Unit sales were up almost 6%, the average retail sales price was up 21% and interest income was up 39%, resulting in top line growth of 29% for the quarter. We believe productivity would have been even better had availability of vehicles at lower price points been at more normal levels,” said Car-Mart President and CEO Jeff Williams.

“The investments we are making in our inventory procurement area have allowed us to consistently offer better quality vehicles to our customers and keep our dealerships sufficiently stocked during this difficult supply period,” continued Williams. “We anticipate ongoing and continuous improvements in this crucial area of our business with the ultimate goal being to increase the amount of field time allocated to operational efficiencies, unit volume productivity and growing customer counts.”

Danger ahead in 2022

And that customer demand shows no signs of slowing. According to the recent market study by Technavio, the used car market within the overall U.S. automobile industry is expected to increase by 3.91 million units from 2020 to 2025, with an accelerated annual growth rate of 1.98%.

In the near-term, the Bureau of Labor Statistics’s highly watched Consumer Price Index for November shows the nation’s inflation benchmark rose 6.8% for the 12 months ending November, the largest 12-month increase in nearly 40 years. The monthly CPI index for used cars and trucks rose 2.5%, the same increase as in October. The index for new vehicles rose 1.1% in November after a 1.4% spike in the previous month.

November was also the strongest month on record for all segments of the used medium and heavy truck market and incoming December data shows the throttle is firmly to the floor, according to analysts from J.D. Power Valuation Services. Buyers continue to pay retail pricing at auctions, to the point where trucks regularly bring higher pricing at auction than retail.

The danger in the rising used car prices is that “what goes up, must come down,” according to a new report by consulting giant KPMG. A recent research note by Gary Silberg, a KPMG partner and the firm’s global automotive lead, said the massive supply and demand gap has disrupted global auto markets, especially for used cars.

“The prices of used cars in the U.S. have risen by more than 40%, the result of reduced output by U.S. auto plants,” wrote Silberg. “Consumers and businesses that would normally buy new have piled into the used car market, driving up prices at four times the pace of new-car prices. When the supply/demand situation normalizes, we can expect used car prices to come back to earth. How this happens—how far and how quickly prices change—will have profound impact on the new-car market and on players across the auto industry.”

When that happens, Silberg said the used car market could collapse. “The millions of customers and businesses that are forced to buy used cars today will go back to buying new ones. Used car demand would normalize and the relationship to new-car prices would be restored,” said the KPMG analyst. “That would imply a drop in used car prices of about 30% below where they are today. However, the fall could be somewhat less if inflation persists. The decline could be sudden or slow and will depend on how quickly supply and demand come back into equilibrium.”

Closer to home, some Arkansans will get some relief from higher used car prices, mainly due to Act 1013 approved by the Arkansas General Assembly during the 2021 legislation session. Under the new law sponsored by Rep. John Payton, R-Wilburn, a used car dealer, if the sale of the new or used motor vehicle, trailer, or semitrailer is less than $4,000, no tax shall be due. Gov. Hutchinson had originally wanted the tax to cover used cars between $4,000 and $10,000.

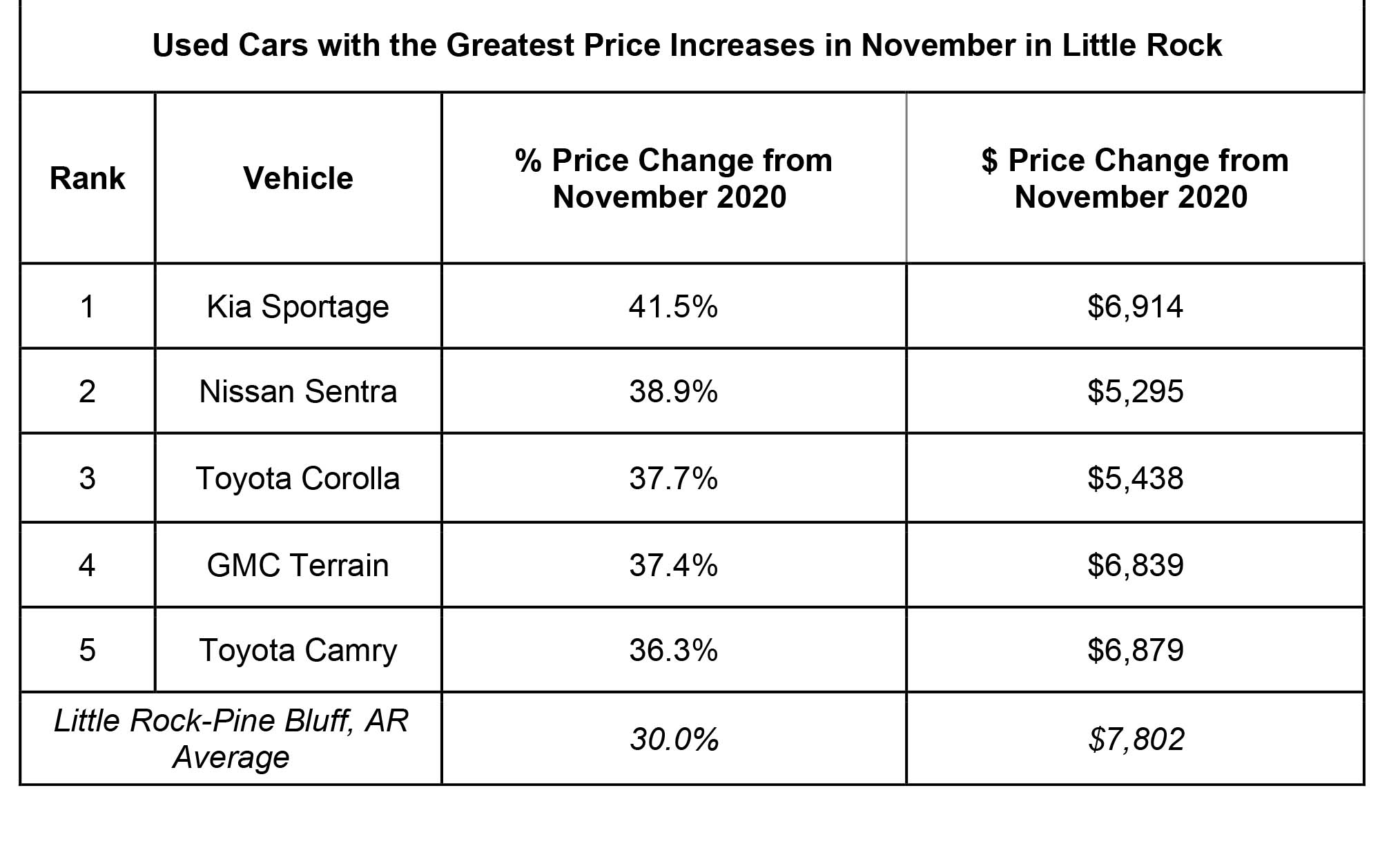

In the fiscal year ended July 2021, the state collected $298.4 million in revenue from the tax on used vehicle sales. After analyzing 1.9 million used car sales in November, iSeeCars found that used car prices increased 30% or $7,802 in Little Rock over last year in the wake of the microchip shortage. Nationally, used car prices have increased 27.9%, or $6,939 compared to last year.

According to the state Department of Finance and Administration, the average price for used vehicles purchased at an Arkansas car dealer in fiscal 2021 was $13,437.

PHOTO CAPTIONS:

1. Sticker Shock: Once maligned used car industry now booming. The nation’s Consumer Price Index for used cars jumped 42% from December 2019 to October 2021, making car prices a major contributor in the biggest inflation spike for the U.S. economy in three decades.

2. After analyzing 1.9 million used car sales in November, iSeeCars found that used car prices increased 30% or $7,802 in Little Rock over the last year in the wake of the microchip shortage. Nationally, used car prices have increased 27.9%, or $6,939 compared to last year.

3. (Information provided by iSeeCars)